Bank of America has boosted its price target for Goldman Sachs (GS, Financial) from $775 to $782 while maintaining its Buy rating for the company's shares. This decision comes on the heels of Goldman Sachs reporting a core earnings per share (EPS) of $10.91 for the second quarter, significantly surpassing both BofA's and market expectations. The firm anticipates further upward potential in its 2026 EPS projections and return on tangible common equity forecasts for Goldman Sachs.

Wall Street Analysts Forecast

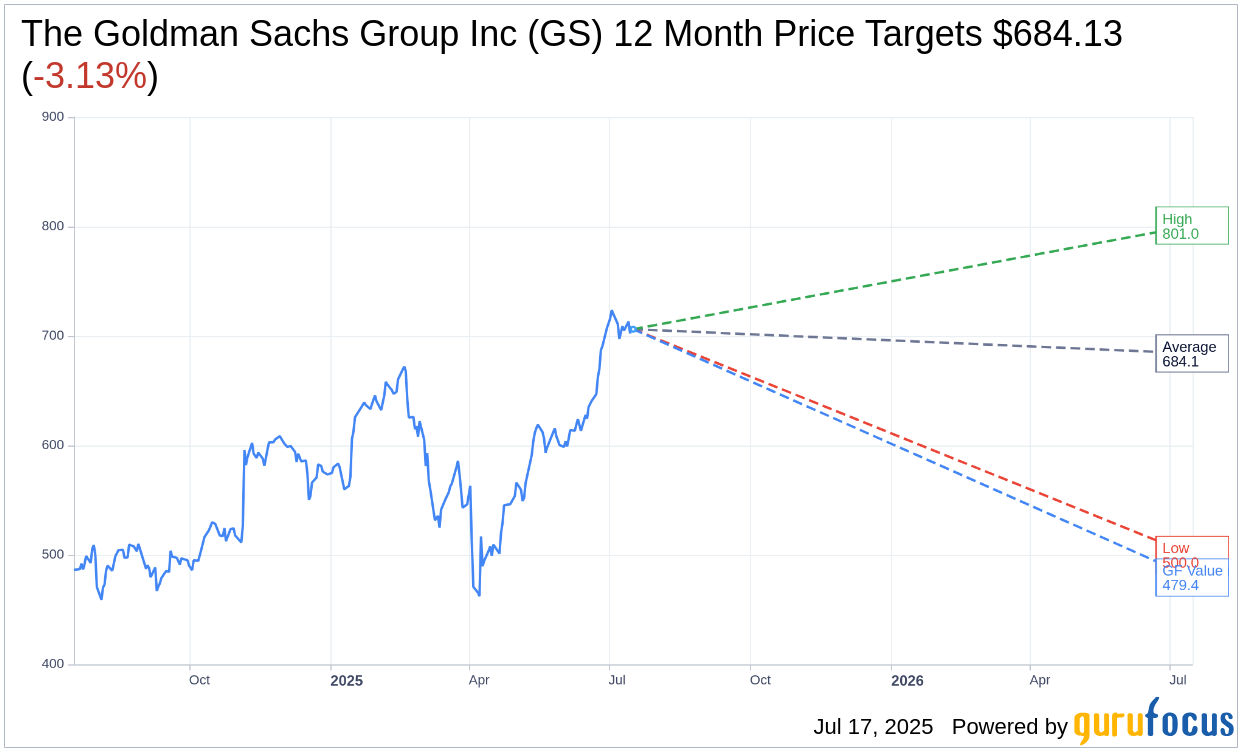

Based on the one-year price targets offered by 17 analysts, the average target price for The Goldman Sachs Group Inc (GS, Financial) is $684.13 with a high estimate of $801.00 and a low estimate of $500.00. The average target implies an downside of 3.13% from the current price of $706.28. More detailed estimate data can be found on the The Goldman Sachs Group Inc (GS) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, The Goldman Sachs Group Inc's (GS, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Goldman Sachs Group Inc (GS, Financial) in one year is $479.39, suggesting a downside of 32.12% from the current price of $706.275. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Goldman Sachs Group Inc (GS) Summary page.

GS Key Business Developments

Release Date: July 16, 2025

- Net Revenues: $14.6 billion for the second quarter.

- Earnings Per Share (EPS): $10.91.

- Return on Equity (ROE): 12.8% for the quarter, 14.8% for the first half of the year.

- Global Banking and Markets Revenues: $10.1 billion for the quarter.

- Advisory Revenues: $1.2 billion, up 71% year-over-year.

- Equity Underwriting Revenues: $428 million, flat year-over-year.

- Debt Underwriting Revenues: $589 million, down 5% year-over-year.

- FICC Net Revenues: $3.5 billion, up 9% year-over-year.

- Equities Net Revenues: $4.3 billion, a record for the quarter.

- Asset and Wealth Management Revenues: $3.8 billion.

- Management and Other Fees: $2.8 billion, up 11% year-over-year.

- Private Banking and Lending Revenues: $789 million, up 12% year-over-year.

- Total Assets Under Supervision: $3.3 trillion, a record high.

- Alternative Assets Under Supervision: $355 billion.

- Net Interest Income: $3.1 billion for the second quarter.

- Total Loan Portfolio: $217 billion at quarter-end.

- Operating Expenses: $9.2 billion for the quarter.

- Effective Tax Rate: 20.2% for the first half of 2025.

- Capital Returned to Shareholders: $4 billion, including $957 million in dividends and $3 billion in stock repurchases.

- Common Equity Tier 1 Ratio: 14.5% at the end of the second quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Goldman Sachs Group Inc (GS, Financial) reported strong financial performance in Q2 2025 with net revenues of $14.6 billion and earnings per share of $10.91.

- The company's Investment Banking division saw a 30% year-over-year increase in announced M&A volumes, indicating a resilient dealmaking environment.

- Asset and Wealth Management achieved record client assets of $1.7 trillion, with continued momentum in alternatives and long-term fee-based net inflows.

- The firm set a new record for total assets under supervision at $3.3 trillion, marking the 30th consecutive quarter of long-term fee-based net inflows.

- The Board approved a 33% increase in the quarterly dividend, reflecting confidence in the firm's financial durability and commitment to returning capital to shareholders.

Negative Points

- Despite strong performance, there is ongoing uncertainty in industries sensitive to trade policy, which could impact future results.

- The company faces challenges in the harvesting environment for private equity-type portfolio assets, which may affect future returns.

- Geopolitical concerns, particularly in the Middle East, and unresolved trade agreements pose risks to the global economic outlook.

- The firm is navigating a complex regulatory environment, with ongoing discussions around capital requirements and stress testing transparency.

- There is a need for more transparency in the capital process, which currently lacks clarity and affects strategic planning.