Key Takeaways:

- GameSquare (GAME, Financial) stock plunged by nearly 30% following a new share offering announcement.

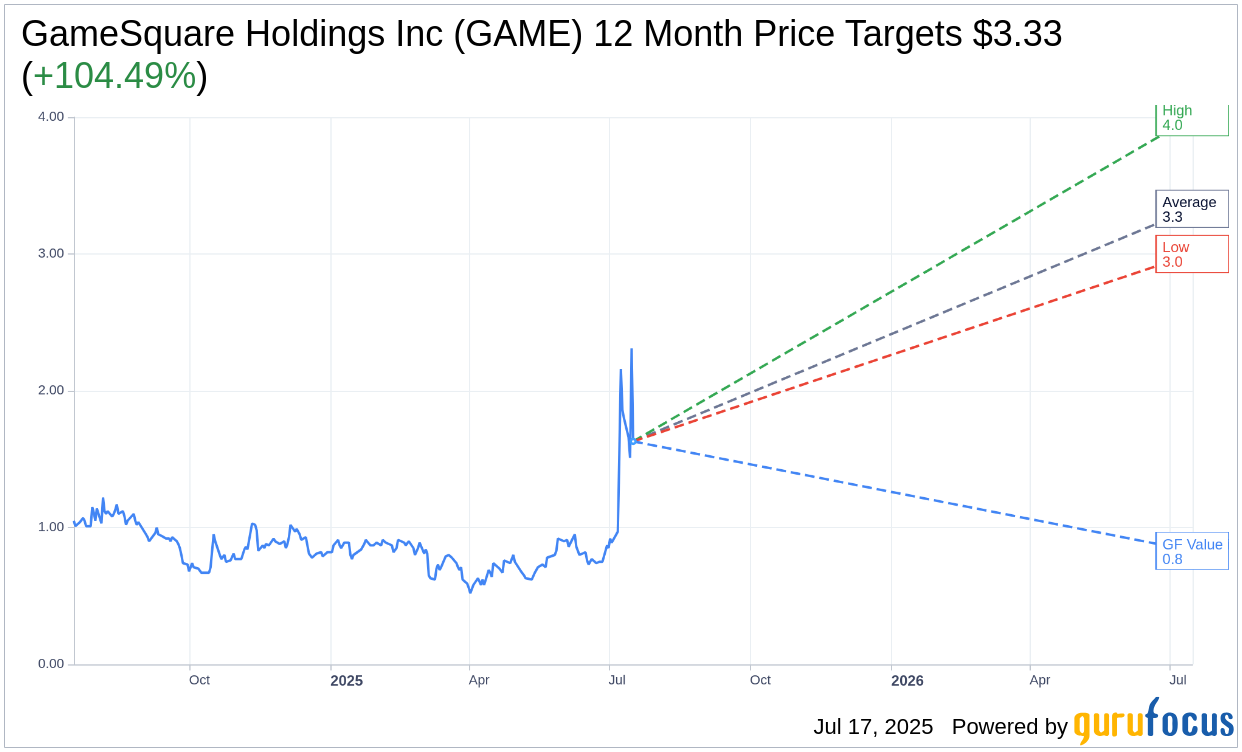

- Analysts predict an average potential upside of 104.49% based on a one-year target price.

- GuruFocus’ GF Value estimates a potential downside of 49.08% from the current stock price.

GameSquare Stock Reaction to Public Offering

GameSquare (GAME) witnessed a sharp decline of nearly 30% in its stock price subsequent to the announcement of a public offering. The company plans to issue 46.67 million shares priced at $1.50 each, intending to raise approximately $70 million. The capital will primarily be allocated to bolster its Ethereum holdings, as part of a strategic partnership with Dialectic.

Analyst Price Target Projections

According to projections by three analysts, GameSquare Holdings Inc (GAME, Financial) has an average one-year price target of $3.33. The highest estimate stands at $4.00, while the lowest is $3.00. This average target suggests a significant potential upside of 104.49% from the current market price of $1.63. For more detailed forecast data, visit the GameSquare Holdings Inc (GAME) Forecast page.

Brokerage Recommendations

The average brokerage recommendation for GameSquare Holdings Inc (GAME, Financial), based on consensus from two brokerage firms, is currently 2.0. This is indicative of an "Outperform" status. The rating scale employed ranges from 1 to 5, with 1 representing a Strong Buy, and 5 indicating a Sell.

GF Value Estimate

According to GuruFocus estimates, the one-year GF Value for GameSquare Holdings Inc (GAME, Financial) is projected to be $0.83. This suggests a potential downside of 49.08% from the current price of $1.6301. The GF Value represents GuruFocus' assessment of the fair price at which the stock should trade, based on historical trading multiples, past business growth, and future performance projections. Visit the GameSquare Holdings Inc (GAME) Summary page for more comprehensive data.