- Union Pacific (UNP, Financial) eyes significant mergers with CSX Corporation (CSX) or Norfolk Southern (NSC).

- Potential coast-to-coast railroad could reshape U.S. freight logistics.

- Bank of America raises CSX rating amidst merger considerations.

Union Pacific Corporation (UNP) is reportedly exploring the acquisition of either CSX Corporation (CSX) or Norfolk Southern (NSC). This strategic move aims to create the first coast-to-coast railroad in America, potentially revolutionizing freight logistics and enhancing competitiveness across the industry. The merger talks have already prompted Bank of America to upgrade CSX's rating, reflecting the significant implications of such a merger.

Wall Street Analysts' Expectations

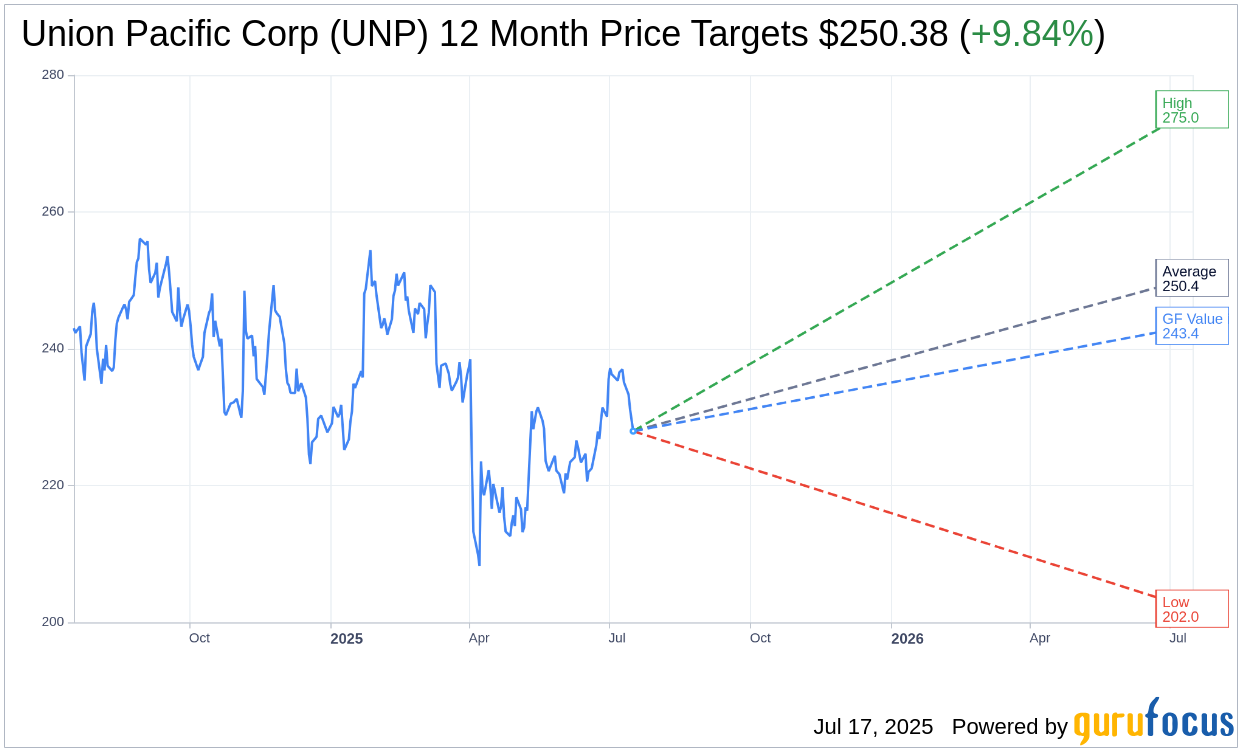

Analyst forecasts reveal that Union Pacific Corp (UNP, Financial) has an average one-year price target of $250.38, with projections ranging between a high of $275.00 and a low of $202.00. This average target indicates a potential upside of 9.84% from the current stock price of $227.95. For additional insights, visit the Union Pacific Corp (UNP) Forecast page.

Union Pacific Corp (UNP, Financial) currently holds an "Outperform" status according to the consensus recommendation from 31 brokerage firms, reflected in an average brokerage recommendation of 2.2. This rating is part of a scale where 1 represents a Strong Buy, and 5 signifies a Sell.

GuruFocus estimates predict that the GF Value for Union Pacific Corp (UNP, Financial) will be $243.37 in one year. This suggests a 6.76% potential upside from its current price of $227.95. The GF Value is a calculation of the fair value for the stock, based on historical trading multiples, past business growth, and projected future performance. More comprehensive data is available on the Union Pacific Corp (UNP) Summary page.