BrainStorm Cell Therapeutics (BCLI, Financial) has announced that its common stock will be removed from the Nasdaq Capital Market due to non-compliance with the exchange's minimum shareholder equity requirements, specifically Nasdaq Listing Rule 5550(b)(1). As a result, trading of BCLI on Nasdaq is set to be halted when the market opens on July 18.

The company has already arranged for its shares to be listed on the OTCQB Venture Market, which is managed by the OTC Markets Group, a U.S.-based trading platform. BrainStorm expects trading under the current ticker, BCLI, to commence on OTCQB on or shortly after July 18. This transition aims to maintain a platform for investors following the Nasdaq delisting.

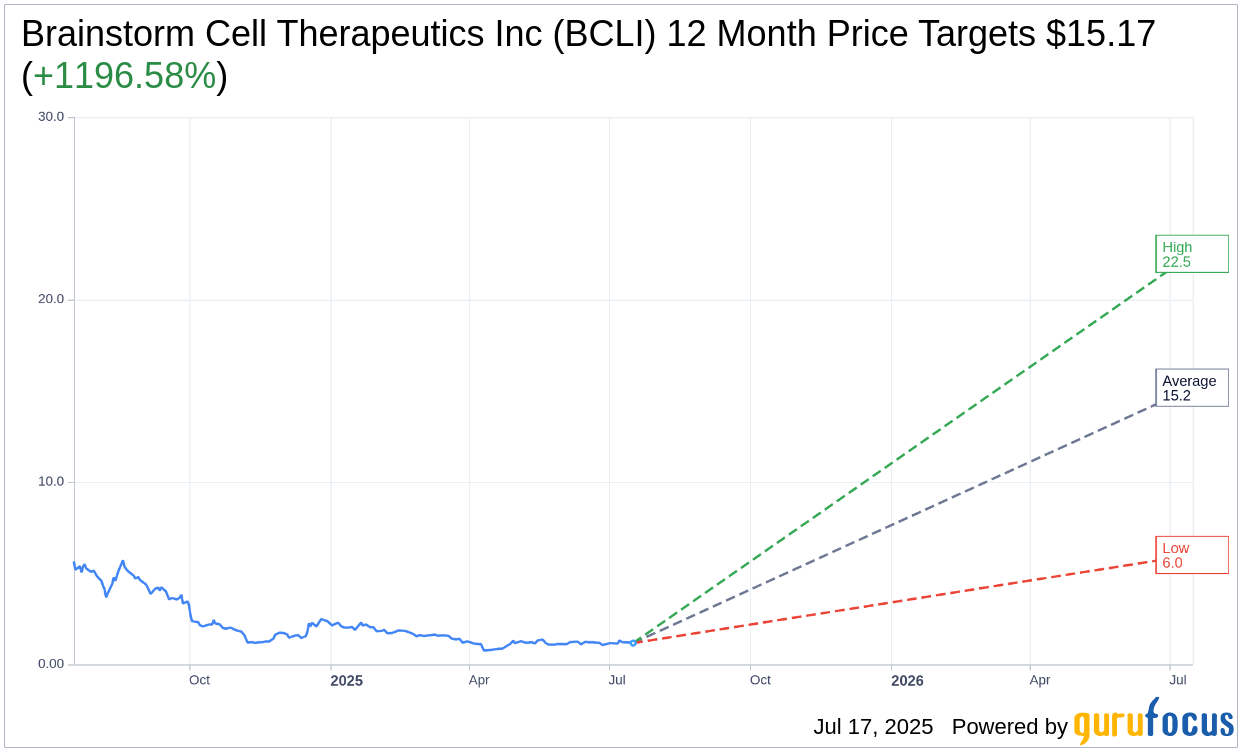

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Brainstorm Cell Therapeutics Inc (BCLI, Financial) is $15.17 with a high estimate of $22.51 and a low estimate of $6.00. The average target implies an upside of 1,196.58% from the current price of $1.17. More detailed estimate data can be found on the Brainstorm Cell Therapeutics Inc (BCLI) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Brainstorm Cell Therapeutics Inc's (BCLI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BCLI Key Business Developments

Release Date: May 19, 2025

- Phase 3b Trial Initiation: FDA clearance received to initiate pivotal Phase 3b trial for NurOwn.

- Manufacturing and Site Selection: Initial manufacturing at Tel Aviv Sourasky Medical Center; technology transfer to Pluri for additional facilities.

- Clinical Trial Agreements: Negotiations with approximately 15 leading clinical centers in the U.S. for Phase 3b trial sites.

- Trial Design: Phase 3b trial includes a 24-week double-blind period followed by a 24-week open-label extension.

- Primary Endpoint: Change from baseline to week 24 in ALSFRS-R total score.

- Biomarker Analysis: NurOwn associated with reduction in neuroinflammatory and neurodegenerative biomarkers.

- Genetic Substudy: UNC13A genotype may influence response to NurOwn therapy.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The U.S. FDA has cleared Brainstorm Cell Therapeutics Inc (BCLI, Financial) to initiate a pivotal Phase 3b trial for NurOwn, marking a significant milestone in their ALS treatment development.

- The trial design has been agreed upon with the FDA under a special protocol assessment (SPA), which de-risks the regulatory pathway for NurOwn.

- Brainstorm Cell Therapeutics Inc (BCLI) has secured a leading U.S. clinical site that has passed FDA inspection, enhancing their operational readiness for the upcoming trial.

- The company is actively engaged in negotiations with approximately 15 leading clinical centers across the United States for the Phase 3b trial, indicating strong interest from the ALS research community.

- Brainstorm Cell Therapeutics Inc (BCLI) is pursuing multiple funding avenues, including a promising $15 million non-dilutive grant, to ensure the timely commencement of the trial.

Negative Points

- The company faces significant financial constraints, which are common in the biotech industry, and securing proper funding is essential to commence the trial.

- The initiation and successful execution of the clinical trial demand a robust and sustainable cash flow, which is currently a challenge for Brainstorm Cell Therapeutics Inc (BCLI).

- The company has not yet signed clinical trial agreements (CTAs) with the clinical centers, which could delay the trial's start.

- The manufacturing capacity at the Tel Aviv facility is limited, and the company is still in the process of expanding its manufacturing footprint to the United States.

- The exosome program, while promising, is still in the preclinical stage and requires strategic partnerships to advance towards clinical development.