During the second quarter, BayCom Corp (BCML, Financial) recorded a net interest margin of 3.77%, a slight decrease from the previous quarter's 3.83%, but an improvement over the 3.69% recorded in the same period last year. The company's tangible book value per share rose to $26.46 from $25.98 at the end of the previous quarter.

Additionally, BCML's common equity tier 1 capital ratio increased to 17.35% from 17.23% in the prior quarter, indicating a strengthened capital position. The company attributes its continued positive financial performance to new lending activities and an increase in deposits.

Despite the challenging economic landscape, BCML remains upbeat about its financial health. The company is diligently managing operating expenses, maintaining strict credit standards, and closely observing the quality of new loans. BCML is also committed to its strategy of share buybacks and dividend payouts to enhance long-term value for clients and shareholders.

Wall Street Analysts Forecast

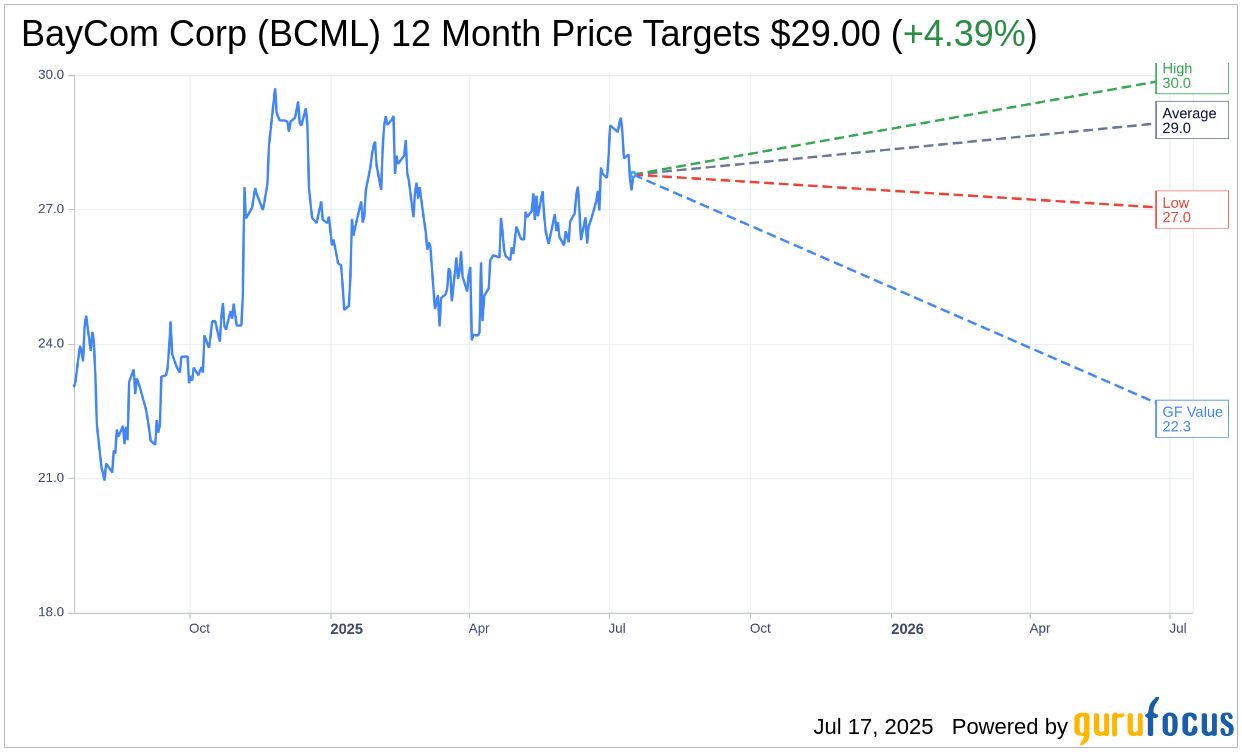

Based on the one-year price targets offered by 3 analysts, the average target price for BayCom Corp (BCML, Financial) is $29.00 with a high estimate of $30.00 and a low estimate of $27.00. The average target implies an upside of 4.39% from the current price of $27.78. More detailed estimate data can be found on the BayCom Corp (BCML) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, BayCom Corp's (BCML, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for BayCom Corp (BCML, Financial) in one year is $22.33, suggesting a downside of 19.62% from the current price of $27.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the BayCom Corp (BCML) Summary page.