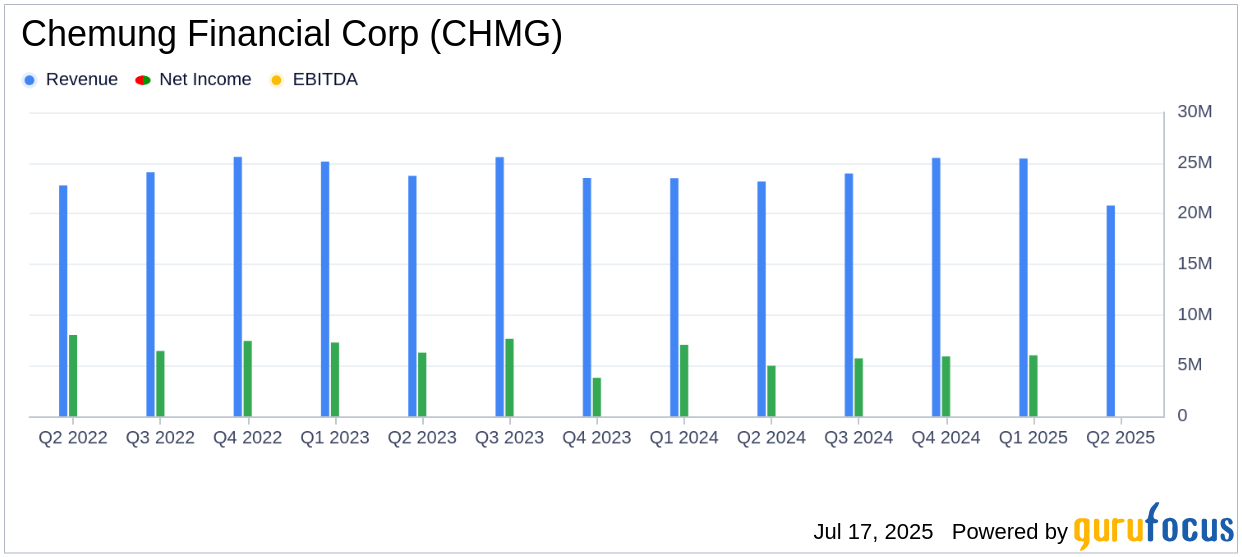

On July 17, 2025, Chemung Financial Corp (CHMG, Financial) released its 8-K filing for the second quarter of 2025, reporting a net loss of $6.5 million, or $1.35 per share. This result contrasts sharply with the analyst estimate of a $0.52 loss per share. The company had previously reported a net income of $6.0 million, or $1.26 per share, in the first quarter of 2025, and $5.0 million, or $1.05 per share, in the second quarter of 2024.

Company Overview

Chemung Financial Corp is a bank holding firm that, through its subsidiaries, offers a range of financial services. These include demand, savings, and time deposits, commercial, residential, and consumer loans, letters of credit, wealth management services, employee benefit plans, insurance products, mutual funds, and brokerage services. The company's primary revenue comes from its Core Banking segment, which focuses on attracting deposits and originating various types of loans.

Performance and Challenges

The second quarter of 2025 was marked by significant strategic actions, including the issuance of $45.0 million in subordinated debt and the sale of a substantial portion of the securities portfolio. These moves were part of a transformational balance sheet repositioning aimed at strengthening regulatory capital and improving commercial real estate concentration ratios. However, these actions resulted in a realized pre-tax loss of $17.5 million from the securities sale, contributing to the overall net loss for the quarter.

The Corporation executed two major components of a transformational balance sheet repositioning in the second quarter by issuing subordinated debt and selling a significant portion of our securities portfolio," said Anders M. Tomson, President and CEO of Chemung Financial Corporation.

Financial Achievements

Despite the net loss, Chemung Financial Corp reported a non-GAAP net income of $6.3 million, or $1.31 per share, excluding one-time items. The net interest margin improved to 3.05%, up from 2.96% in the previous quarter, driven by changes in the composition of interest-earning assets. This improvement is crucial for banks as it indicates better profitability from core operations.

Key Financial Metrics

Net interest income for the quarter increased by 5.0% to $20.8 million, compared to $19.8 million in the previous quarter. This was primarily due to higher interest income from loans and interest-earning deposits. However, the company faced challenges with a decrease in interest income from taxable securities and an increase in interest expense on borrowed funds.

| Metric | Q2 2025 | Q1 2025 | Q2 2024 |

|---|---|---|---|

| Net Interest Income | $20.8 million | $19.8 million | $17.8 million |

| Net Interest Margin | 3.05% | 2.96% | 2.66% |

| Non-GAAP Net Income | $6.3 million | N/A | N/A |

Analysis and Outlook

The strategic repositioning of Chemung Financial Corp's balance sheet is a double-edged sword. While it strengthens the company's capital position and prepares it for future growth, the immediate financial impact has been negative. The company's ability to manage its interest expenses and optimize its asset portfolio will be critical in the coming quarters. The increase in net interest margin is a positive sign, indicating potential for improved profitability.

Overall, Chemung Financial Corp's second quarter results highlight the challenges and opportunities of strategic financial management in the banking sector. The company's focus on repositioning its balance sheet and enhancing its capital structure is a forward-looking approach that may yield benefits in the long term, despite the current financial setbacks.

Explore the complete 8-K earnings release (here) from Chemung Financial Corp for further details.