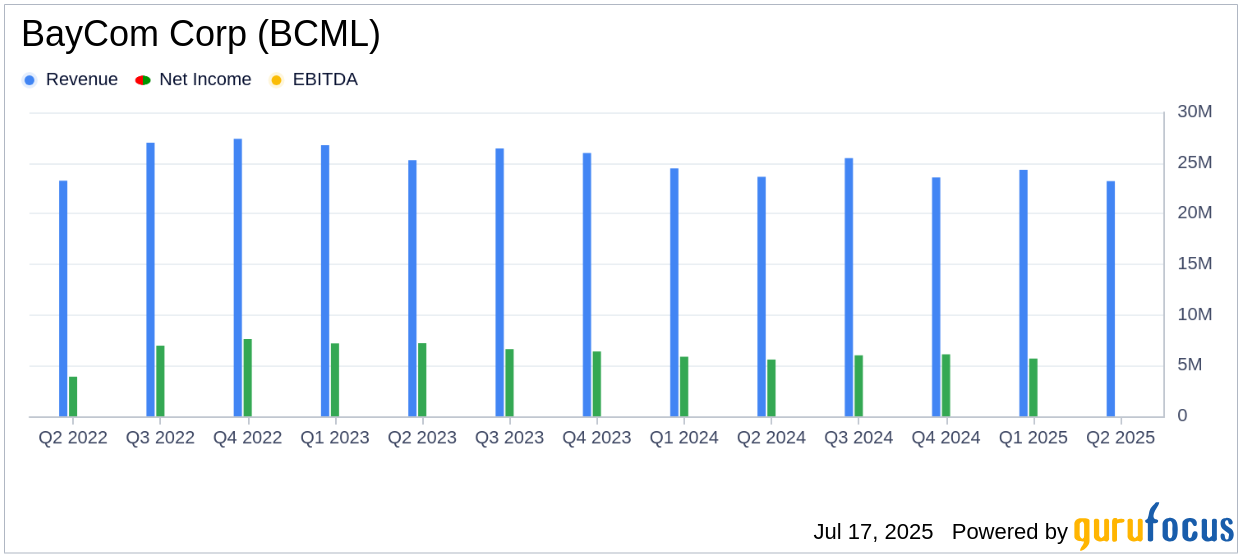

On July 17, 2025, BayCom Corp (BCML, Financial) released its 8-K filing announcing its second-quarter earnings for 2025. The company reported earnings of $6.4 million, or $0.58 per diluted common share, exceeding the analyst estimate of $0.55 per share. This marks an improvement from the previous quarter's earnings of $5.7 million, or $0.51 per share, and the $5.6 million, or $0.50 per share, reported in the same quarter last year.

Company Overview

BayCom Corp is a bank holding company for United Business Bank, offering a comprehensive range of financial services to businesses, professionals, and individuals. The company operates through full-service branches and a loan production office, targeting small to medium-sized businesses, real estate professionals, and nonprofit entities. Its offerings include deposit products, loans, online banking, and cash management services.

Performance and Challenges

BayCom Corp's performance in the second quarter of 2025 highlights its resilience and strategic growth. The company achieved a net income increase of 11.6% compared to the previous quarter, driven by a decrease in credit loss provisions and an increase in net interest income. However, challenges such as rising nonperforming loans, which totaled $16.4 million or 0.82% of total loans, pose potential risks. The increase in nonperforming loans from the prior quarter was primarily due to new commercial real estate loans being placed on non-accrual.

Financial Achievements

BayCom Corp's financial achievements are noteworthy, particularly in the banking industry. The company's net interest income rose by $280,000 to $23.2 million, reflecting increased interest income on loans and fed funds sold. The annualized net interest margin was 3.77%, slightly down from the previous quarter but up from the same quarter last year. These metrics are crucial for banks as they indicate the company's ability to manage interest rate spreads effectively.

Key Financial Metrics

BayCom Corp's income statement reveals a $662,000 increase in net income compared to the first quarter of 2025, primarily due to a decrease in credit loss provisions and noninterest expenses. The balance sheet shows total assets steady at $2.6 billion, with loans net of deferred fees totaling $2.0 billion. The allowance for credit losses was $18.7 million, or 0.93% of total loans, indicating a cautious approach to potential credit risks.

| Metric | Q2 2025 | Q1 2025 | Q2 2024 |

|---|---|---|---|

| Net Income | $6.4 million | $5.7 million | $5.6 million |

| Earnings Per Share | $0.58 | $0.51 | $0.50 |

| Net Interest Income | $23.2 million | $22.9 million | $22.3 million |

| Nonperforming Loans | $16.4 million | $10.0 million | $16.1 million |

Analysis and Commentary

BayCom Corp's strategic focus on lending activity and deposit growth has contributed to its positive financial results. The company's President and CEO, George Guarini, noted,

Our financial results for the second quarter of 2025 continued a positive trend, supported by new lending activity and deposit growth. In addition, our key financial metrics remain strong and show continued improvement."Despite the positive outlook, Guarini expressed caution regarding potential economic challenges, emphasizing the importance of maintaining strong credit discipline and managing operating expenses.

Overall, BayCom Corp's second-quarter performance demonstrates its ability to navigate a challenging economic environment while achieving growth in key financial metrics. The company's strategic initiatives and focus on long-term value creation for shareholders position it well for future success.

Explore the complete 8-K earnings release (here) from BayCom Corp for further details.