Key Points:

- Granite Construction, in partnership with Obayashi Corporation, secures a significant $158 million contract for Guam Defense System.

- Current analyst consensus rates the stock as a "Hold" with potential upside and downside estimates creating varied forecasts.

- GuruFocus metrics suggest a potential downside in the GF Value estimate compared to current trading levels.

Granite Construction (GVA, Financial), in partnership with Obayashi Corporation, has clinched a $158 million task order from the Naval Facilities Engineering Command. The contract involves constructing the Missile Defense Agency's Guam Defense System, aimed at bolstering air and missile defenses. This project is anticipated to impact Granite's third-quarter capital positively.

Wall Street Analysts Forecast

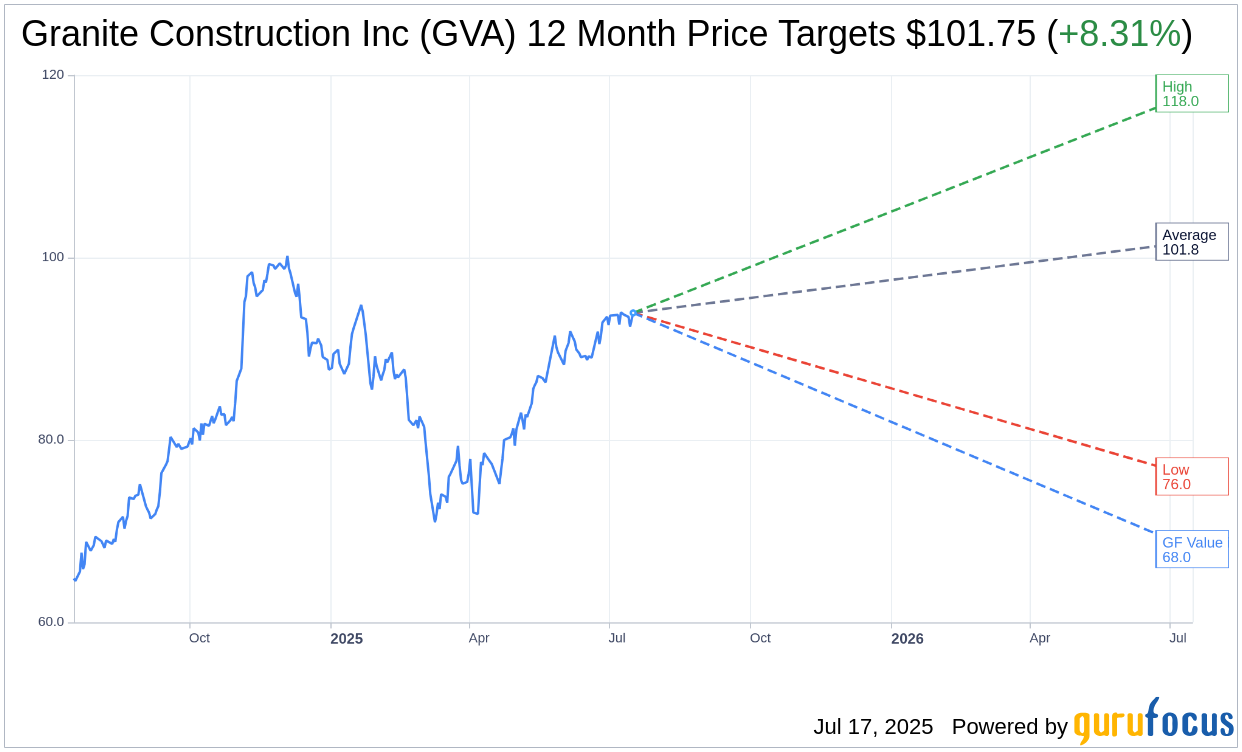

According to the forecasts from four analysts, the average one-year price target for Granite Construction Inc (GVA, Financial) stands at $101.75, with projections ranging between a high of $118.00 and a low of $76.00. This average target indicates a potential upside of 8.31% from its current trading price of $93.94. For more detailed estimations, visit the Granite Construction Inc (GVA) Forecast page.

Consensus from three brokerage firms currently places Granite Construction Inc's (GVA, Financial) average brokerage recommendation at 2.7, which translates to a "Hold" status. This rating scale ranges from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell.

GuruFocus's projection estimates the GF Value for Granite Construction Inc (GVA, Financial) at $68.03 in one year, suggesting a potential downside of 27.58% from the current price of $93.94. The GF Value is derived from historical trading multiples, past business growth, and forecasted future business performance. For a comprehensive analysis, consult the Granite Construction Inc (GVA) Summary page.