Key Points:

- Interactive Brokers (IBKR, Financial) increases commission revenue by 27% in Q2 2025.

- The company adds 250,000 new accounts following a successful stock split.

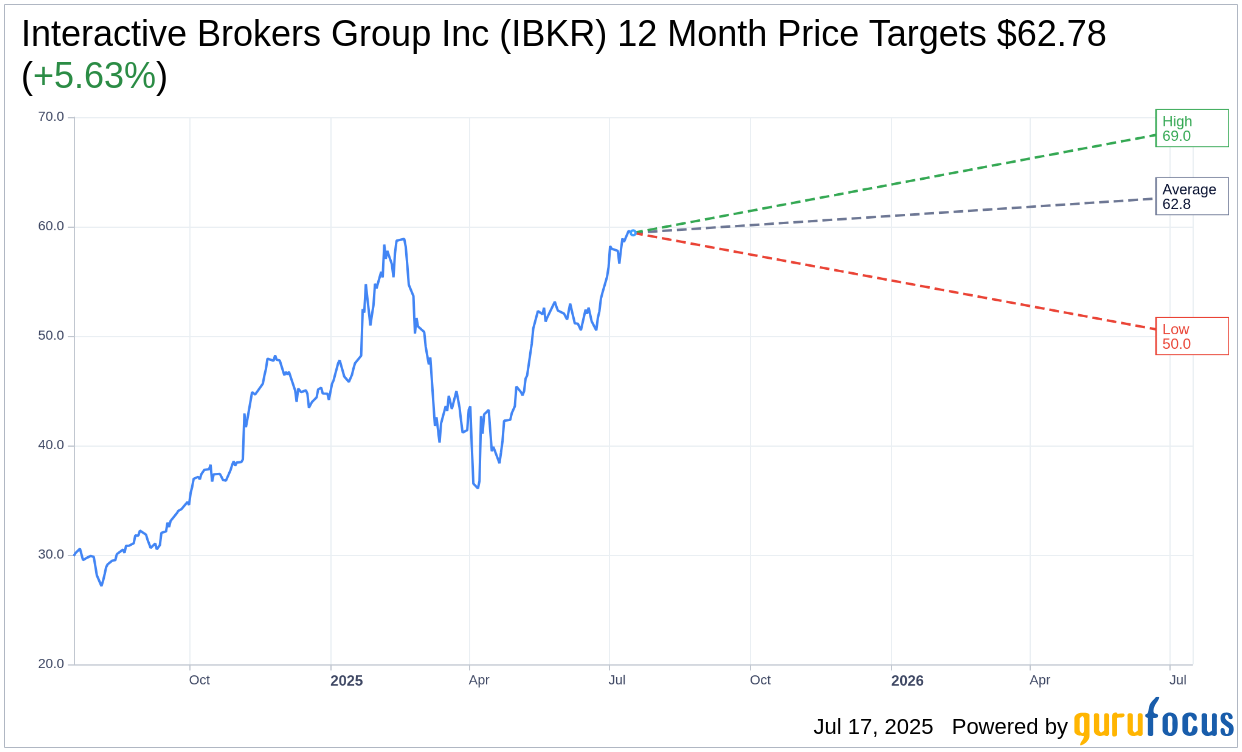

- Analysts forecast a modest upside for IBKR stock with an average target price of $62.78.

Interactive Brokers Sees Robust Growth in Q2 2025

Interactive Brokers (IBKR) demonstrated strong financial performance in the second quarter of 2025. The company reported a 27% year-over-year increase in commission revenue, reaching an impressive $516 million. This achievement came despite a mid-quarter reduction in SEC fee rates, highlighting the company's operational resilience and strategic acumen. Overnight trading volumes also witnessed a remarkable surge of 170%, further bolstering the company's revenue streams.

The quarter was notable for the addition of 250,000 new accounts, marking significant growth in the company's customer base. A four-for-one stock split was also successfully executed, making shares more accessible to a broader range of investors.

Wall Street Analysts' Projections

Nine Wall Street analysts have provided a one-year price target for Interactive Brokers Group Inc (IBKR, Financial), with the average estimate set at $62.78. Price targets span from a high of $69.00 to a low of $50.00. Considering the current share price of $59.43, this average target suggests a potential upside of 5.63%. For more in-depth analysis, visit the Interactive Brokers Group Inc (IBKR) Forecast page.

Brokerage Recommendations and GF Value Estimate

The consensus recommendation from 10 brokerage firms positions Interactive Brokers (IBKR, Financial) at an average rating of 1.9, signifying an "Outperform" status. This rating is derived from a scale where 1 indicates a Strong Buy and 5 denotes a Sell.

According to GuruFocus' GF Value analysis, the estimated fair value of Interactive Brokers Group Inc (IBKR, Financial) in one year is projected at $6.85. This suggests a potential downside of 88.47% from its present trading price of $59.43. The GF Value metric evaluates the fair trading value of a stock based on historical trading multiples, business growth in the past, and future performance estimates. For additional insights and data, please consult the Interactive Brokers Group Inc (IBKR) Summary page.