- BHP reports record copper production but foresees a decline due to Escondida's lower grades.

- The Jansen potash project faces delays and potential cost overruns.

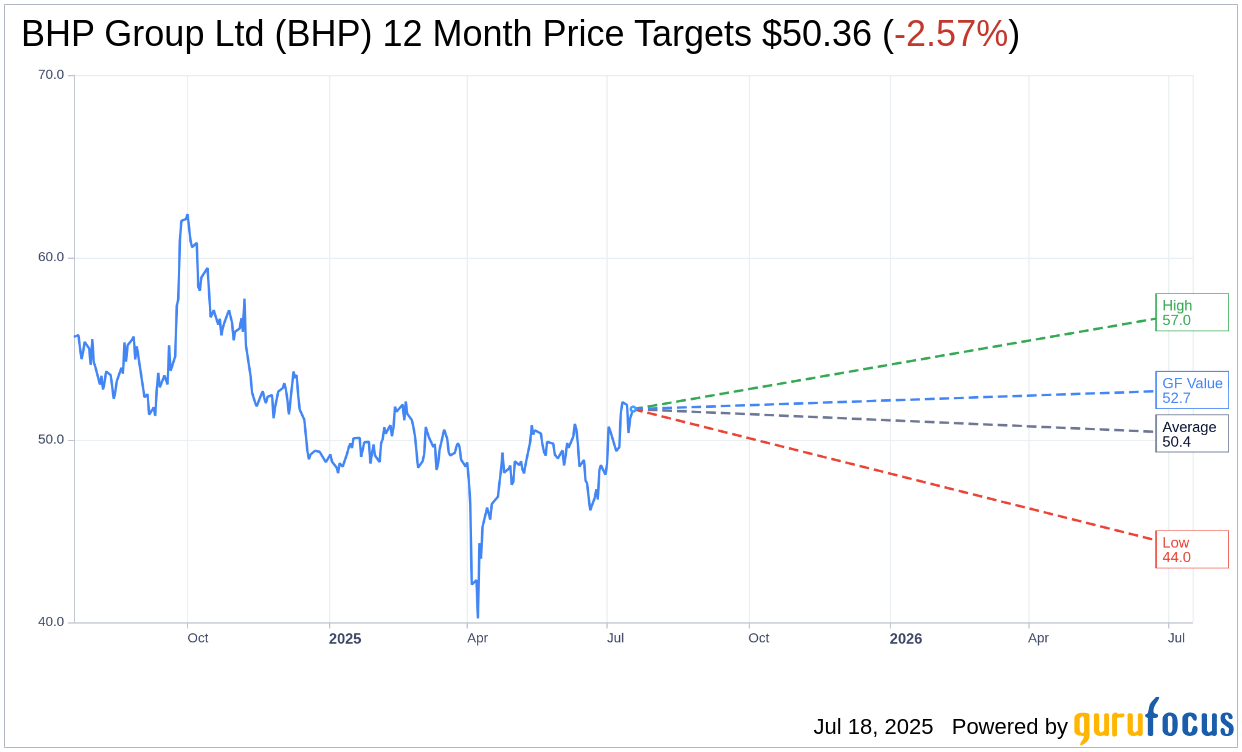

- Analysts suggest a "Hold" status with potential upside as per GF Value forecasts.

BHP Group's Copper Production Insights

BHP (BHP, Financial) has announced an extraordinary achievement in copper production, hitting an unprecedented annual figure of over 2 million metric tonnes. However, investors should brace for anticipated declines in production, with figures expected to fall between 1.8 million and 2.0 million tonnes for FY 2026. This projected decrease is largely attributed to declining grades at the Escondida mine, which is a pivotal asset for the company.

On another front, BHP is also tackling challenges with its Jansen potash project. This venture is expected to face delays alongside increased costs that could reach up to $7.4 billion. These potential financial impacts provide key considerations for investors evaluating BHP's future growth prospects.

Analyst Price Targets for BHP

According to insights from five seasoned analysts, BHP Group Ltd (BHP, Financial) is projected to reach an average price target of $50.36 over the next year. The projections range from a high of $57.00 to a low of $44.00, suggesting a potential downside of 2.57% from the current market price of $51.69. For a more comprehensive view of these estimates, visit the BHP Group Ltd (BHP) Forecast page.

Brokerage Firm Recommendations

The consensus recommendation, derived from seven prominent brokerage firms, places BHP Group Ltd at an average rating of 2.7, which translates to a "Hold" status on their rating scale. This scale ranges from 1, indicating a Strong Buy, to 5, which signifies Sell. Investors should consider this moderate positioning when making portfolio decisions concerning BHP.

Evaluating BHP's GF Value

In an assessment by GuruFocus, the projected GF Value for BHP Group Ltd (BHP, Financial) stands at $52.74 in one year. This suggests a potential upside of 2.03% from the current stock price of $51.69. The GF Value is a proprietary metric from GuruFocus, formulated to estimate the fair trading value based on historical trading multiples, past business growth, and future performance estimates. Further insights are available on the BHP Group Ltd (BHP) Summary page.