Key Takeaways:

- Perplexity AI, now valued at $18 billion, challenges Google with recent funding, aided by Nvidia.

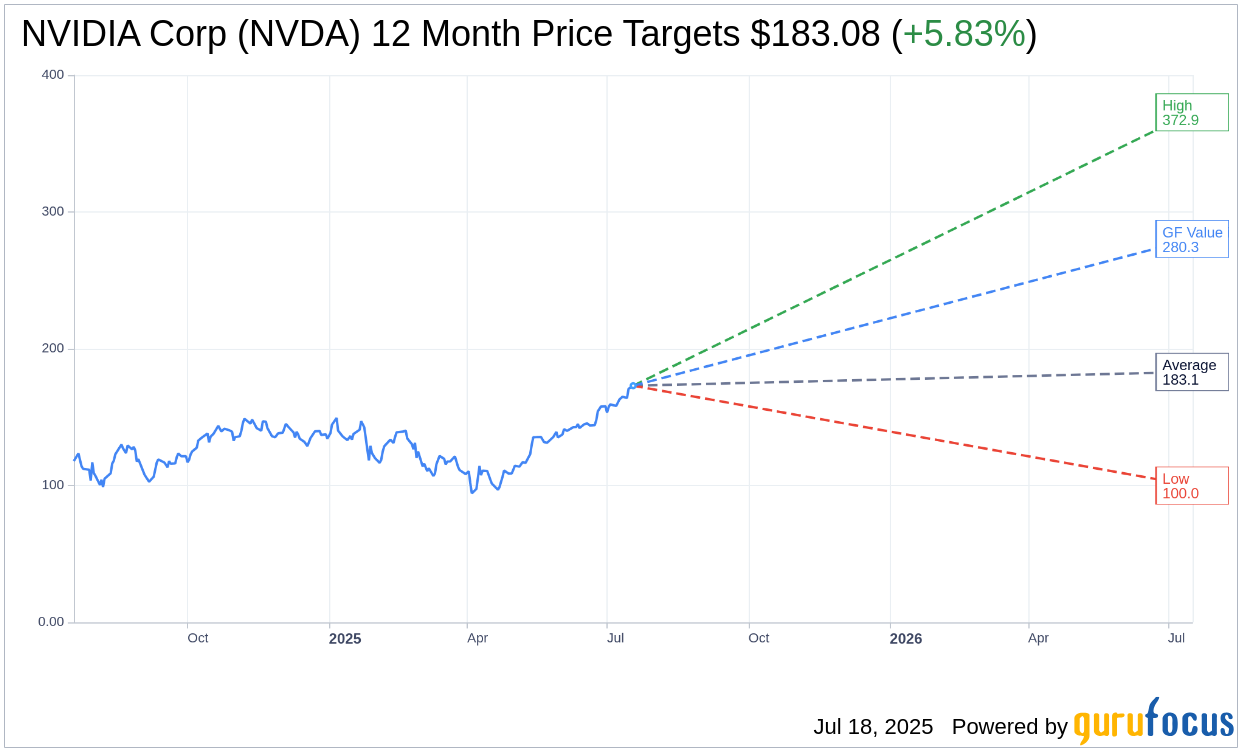

- Nvidia's one-year average target price indicates a potential upside of 5.83%.

- GuruFocus' GF Value estimate suggests a significant upside of 62.03% for Nvidia.

Perplexity AI Gains Momentum with Nvidia's Backing

Perplexity AI has successfully attracted an additional $100 million in funding, boosting its valuation to an impressive $18 billion. This leap from a previous $14 billion valuation strengthens its competitive stance against industry giant Google (GOOG). Nvidia (NVDA, Financial) plays a pivotal role in this progress, underscoring the tech startup's potential in the market.

Wall Street Analysts' Insights on Nvidia

Examining the consensus from 53 analysts, Nvidia Corp (NVDA, Financial) holds an average one-year price target of $183.08. This figure, amidst a high of $372.87 and a low of $100, indicates a potential upside of 5.83% from Nvidia's current trading price of $173.00. Additional insights into these predictions are available on the NVIDIA Corp (NVDA) Forecast page.

Nvidia's Competitive Outlook

Nvidia's strategic positioning is further affirmed by its "Outperform" average rating of 1.8, sourced from assessments by 66 brokerage firms. The ratings spectrum ranges from 1, representing a Strong Buy, to 5, denoting a Sell.

Long-Term Value Projection with GF Value

Looking ahead, GuruFocus estimates Nvidia Corp's (NVDA, Financial) one-year GF Value at $280.31, which suggests a considerable upside of 62.03% from its present price of $173.00. This GF Value represents GuruFocus' calculated fair value based on historical trading multiples, past growth trajectories, and future business performance projections. To delve deeper into these evaluations, visit the NVIDIA Corp (NVDA) Summary page.