Key Takeaways:

- Sarepta Therapeutics faces challenges after the third patient death related to its gene therapy, leading to a 16% drop in shares.

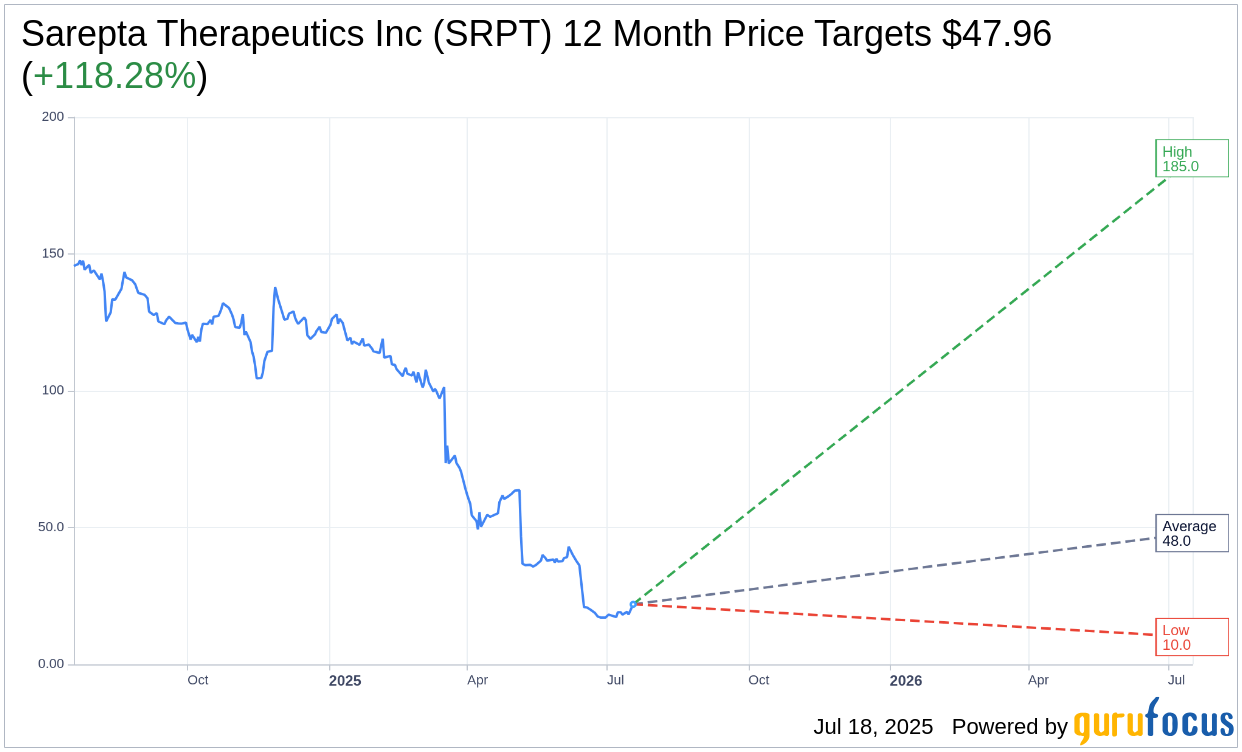

- Wall Street remains optimistic, with analysts setting a high target that suggests potential growth.

- GuruFocus estimates significant upside potential, indicating a fair valuation of Sarepta's stock.

Sarepta Therapeutics (SRPT, Financial) is currently navigating a challenging period amidst increased scrutiny following a series of unfortunate events linked to its gene therapy programs. The recent death of a third patient associated with its limb-girdle muscular dystrophy treatment has added to the company's woes. Previously, two fatalities connected to its Duchenne muscular dystrophy treatment prompted a suspension of trials and an initiative to cut its workforce, aiming to save $400 million annually. Consequently, the company's shares plunged 16% in premarket trading, raising concerns among investors.

Wall Street Analysts' Outlook

Despite recent setbacks, Wall Street analysts project a promising recovery for Sarepta Therapeutics Inc (SRPT, Financial). With 24 analysts contributing one-year price targets, the average target sits at $47.96, with optimistic estimates reaching as high as $185.00, and more conservative views at a low of $10.00. This average target suggests a potential upside of 118.28% from the current trading price of $21.97. For a more detailed analysis, investors can explore the Sarepta Therapeutics Inc (SRPT) Forecast page.

The consensus from 27 brokerage firms also reflects a favorable stance, with an average recommendation of 2.3, indicating an "Outperform" status. This recommendation is based on a scale from 1 to 5, where 1 represents a "Strong Buy" and 5 signifies a "Sell".

GuruFocus's Valuation Insights

According to GuruFocus estimates, the one-year projected GF Value for Sarepta Therapeutics Inc (SRPT, Financial) stands at $216.81. This estimation suggests a remarkable upside of 886.85% from the current price of $21.97. The GF Value represents GuruFocus' best guess of the fair value at which the stock should trade, derived from historical trading multiples, past business performance, and future growth estimates. For more comprehensive insights, visit the Sarepta Therapeutics Inc (SRPT) Summary page.

In summary, while Sarepta Therapeutics faces operational challenges and investor apprehension, the analyst forecasts and GuruFocus metrics suggest substantial potential for recovery and growth, providing informed investors with opportunities for long-term gains.