Summary:

- Meta Platforms (META, Financial) is bolstering its AI division with top talent from Apple.

- Analysts provide a positive outlook on META with varied price targets.

- GuruFocus estimates suggest potential overvaluation of META stock.

Meta Platforms (META) has strategically advanced its artificial intelligence prowess by enlisting the expertise of two former Apple researchers, Mark Lee and Tom Gunter. This recruitment is part of Meta's broader initiative, led by CEO Mark Zuckerberg, to fortify its Superintelligence Labs team. Their addition comes shortly after their former supervisor from Apple joined Meta, signaling a robust emphasis on cultivating AI innovation.

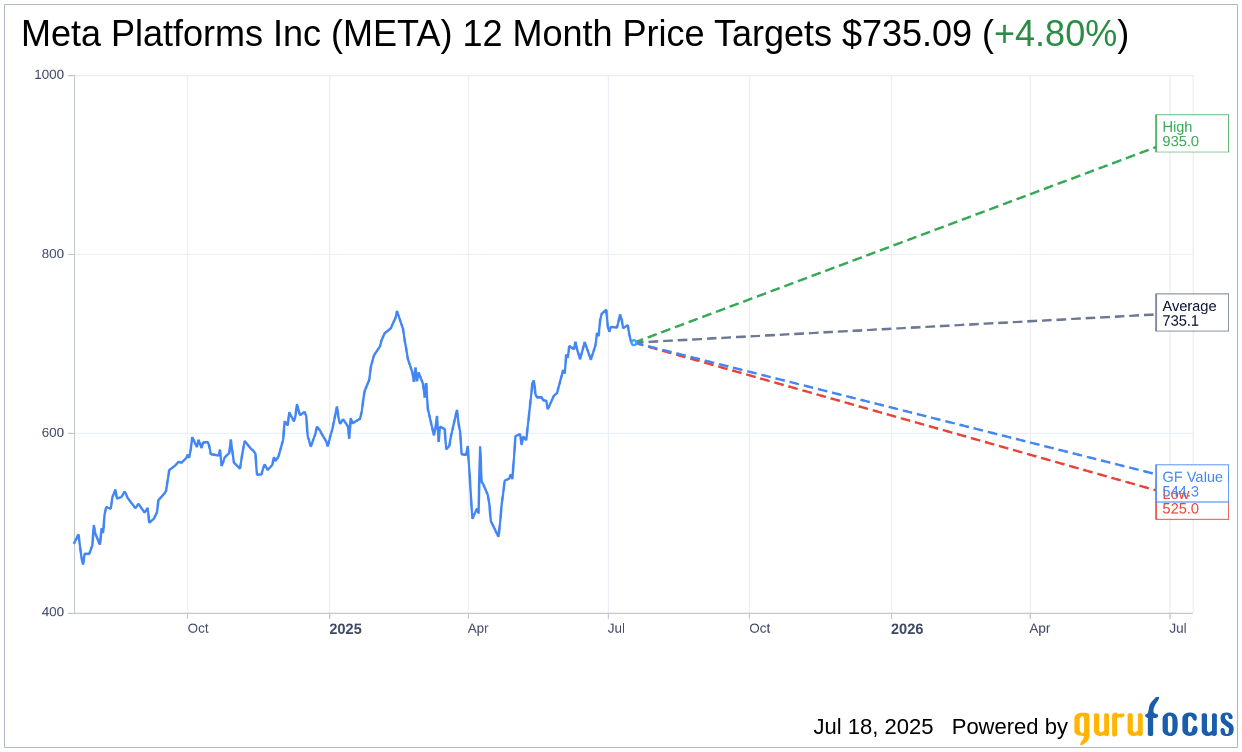

Wall Street Analysts' Forecast

According to insights from 61 analysts, the average one-year price target for Meta Platforms Inc (META, Financial) stands at $737.46. The projections range from a high of $935.00 to a low of $525.00, reflecting a possible 5.14% upside from the current price of $701.41. For more comprehensive data, visit the Meta Platforms Inc (META) Forecast page.

Brokerage Recommendations

With a consensus from 71 brokerage firms, Meta Platforms Inc (META, Financial) holds an average recommendation score of 1.8, suggesting an "Outperform" status. The recommendation scale is from 1, indicating a Strong Buy, to 5, indicating Sell.

GF Value Estimate

GuruFocus estimates project the GF Value for Meta Platforms Inc (META, Financial) to be $544.27 in one year, which indicates a potential downside of 22.4% from its current trading price of $701.41. The GF Value provides an estimation of the fair value at which the stock should be traded, incorporating historical multiples, past growth, and future business performance forecasts. For more detailed information, visit the Meta Platforms Inc (META) Summary page.