Morgan Stanley has revised its price target for PepsiCo (PEP, Financial), increasing it to $165 from the previous $153, while maintaining an Equal Weight rating on the company's shares. Analysts noted that PepsiCo made significant progress in the second quarter following a fiscal year forecast adjustment after the first quarter. The company’s enhanced productivity is providing better clarity on earnings, although there are challenges such as subdued revenue growth and ongoing difficulties in the U.S. market. Despite these hurdles and a recent uptick in the stock, the firm's rating remains unchanged at Equal Weight.

Wall Street Analysts Forecast

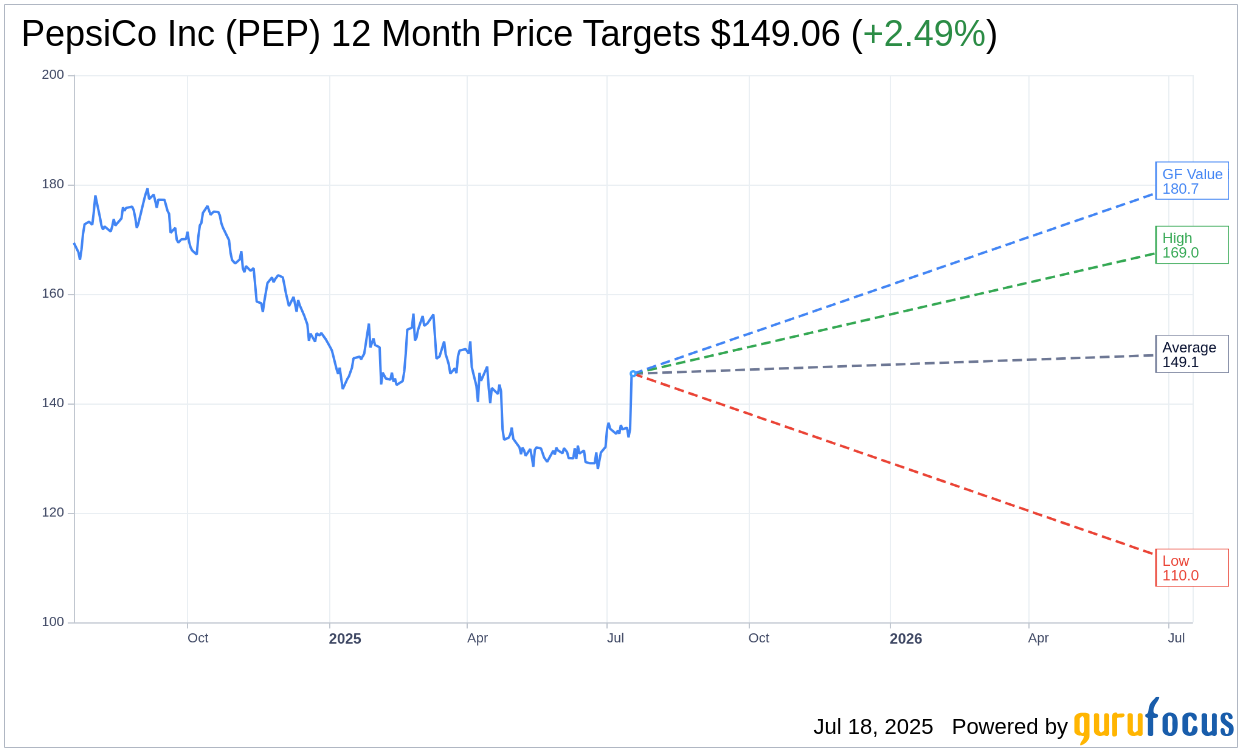

Based on the one-year price targets offered by 21 analysts, the average target price for PepsiCo Inc (PEP, Financial) is $149.06 with a high estimate of $169.00 and a low estimate of $110.00. The average target implies an upside of 2.49% from the current price of $145.44. More detailed estimate data can be found on the PepsiCo Inc (PEP) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, PepsiCo Inc's (PEP, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for PepsiCo Inc (PEP, Financial) in one year is $180.74, suggesting a upside of 24.27% from the current price of $145.44. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the PepsiCo Inc (PEP) Summary page.

PEP Key Business Developments

Release Date: July 17, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- PepsiCo Inc (PEP, Financial) is implementing accelerated productivity initiatives, expecting to deliver about 70% more productivity in the second half of the year.

- The company is focusing on integrating its North American businesses to create efficiency and cost reduction opportunities.

- PepsiCo Inc (PEP) is investing in technology, AI, and data to optimize cost structures and improve productivity.

- The international segment is performing well, with strong growth in Latin America, parts of Europe, and India.

- The company is expanding its permissible snack portfolio, which has grown to over $2 billion, and is seeing increased consumer engagement.

Negative Points

- Growth in North America is moderating, prompting the need to rightsize the asset footprint.

- There are challenges in the Chinese market, with softer consumer demand post-Chinese New Year.

- The company faces potential risks from tariffs, which could impact financial performance.

- PepsiCo Inc (PEP) is still working to improve performance in certain subsegments, such as potato chips.

- The company acknowledges the need for careful balancing of asset reduction to ensure future growth potential is not compromised.