UBS has slightly lowered its price target for Quest Diagnostics (DGX, Financial) from $176 to $175 while maintaining a Neutral rating on the stock. This minor adjustment reflects a cautious approach by the firm as it assesses the company's market position and future prospects.

Wall Street Analysts Forecast

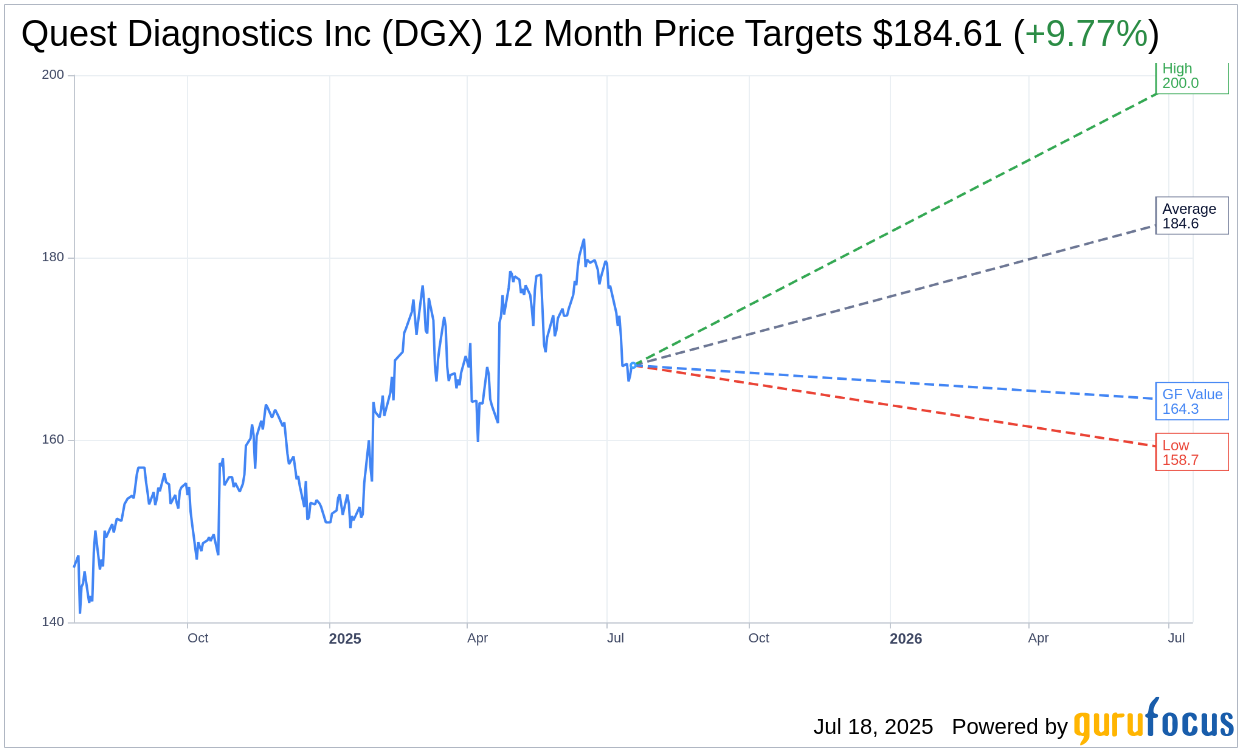

Based on the one-year price targets offered by 16 analysts, the average target price for Quest Diagnostics Inc (DGX, Financial) is $184.61 with a high estimate of $200.00 and a low estimate of $158.69. The average target implies an upside of 9.77% from the current price of $168.18. More detailed estimate data can be found on the Quest Diagnostics Inc (DGX) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Quest Diagnostics Inc's (DGX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Quest Diagnostics Inc (DGX, Financial) in one year is $164.26, suggesting a downside of 2.33% from the current price of $168.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Quest Diagnostics Inc (DGX) Summary page.

DGX Key Business Developments

Release Date: April 22, 2025

- Consolidated Revenue: $2.65 billion, up 12.1% year-over-year.

- Organic Revenue Growth: 2.4% increase.

- Diagnostic Information Services Revenue: Up 12.7% compared to the prior year.

- Total Volume Growth: Increased 12.4% versus the first quarter of 2024.

- Organic Volume Change: Down 0.9%.

- Revenue per Requisition: Up 0.3% year-over-year; organic basis up 3.6%.

- Reported Operating Income: $346 million or 13% of revenues.

- Adjusted Operating Income: $406 million or 15.3% of revenues.

- Reported EPS: $1.94, compared to $1.72 a year ago.

- Adjusted EPS: $2.21, compared to $2.04 the prior year.

- Cash from Operations: $314 million, compared to $154 million in the prior year.

- Full Year 2025 Revenue Guidance: Expected between $10.7 billion and $10.85 billion.

- Full Year 2025 Reported EPS Guidance: Expected to be in the range of $8.62 to $8.87.

- Full Year 2025 Adjusted EPS Guidance: Expected to remain in the range of $9.55 to $9.80.

- Full Year 2025 Cash from Operations Guidance: Approximately $1.5 billion.

- Full Year 2025 Capital Expenditures Guidance: Approximately $500 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Quest Diagnostics Inc (DGX, Financial) reported strong revenue growth of approximately 12% in the first quarter, with nearly 2.5% in organic growth.

- The company reaffirmed its revenue and adjusted EPS guidance for the full year 2025, indicating confidence in its financial outlook.

- Quest Diagnostics Inc (DGX) expanded its use of automation, robotics, and AI to improve quality, customer and employee experiences, and productivity.

- The company was named as the first independent national lab to be selected to the Optum Health Preferred Lab Network, enhancing its reputation and partnerships.

- Quest Diagnostics Inc (DGX) saw impressive uptake of its novel PFAS forever chemicals test, demonstrating successful innovation and market adoption.

Negative Points

- Organic volume growth was down by 0.9%, impacted by weather and one less day in the quarter compared to the prior year.

- Higher interest expenses impacted EPS in the first quarter, with reported EPS at $1.94 compared to $1.72 a year ago.

- The company faces potential challenges from tariffs, although it believes the impact is manageable under current regulations.

- There are ongoing labor strikes at LifeLabs in British Columbia, which could impact operations and financial performance.

- Quest Diagnostics Inc (DGX) continues to face challenges in the health system pricing landscape, which remains the most difficult area to manage.