Key Highlights:

- Bank of America's revised price target for Microsoft (MSFT, Financial): $585.

- Strong growth potential driven by Azure and Office adoption.

- Wall Street's consensus suggests potential upside for MSFT shares.

Bank of America has revised its price target for Microsoft Corporation (MSFT), boosting it to $585 from a previous $515 while maintaining a "Buy" rating. This upward revision is based on robust Azure performance and the increasing adoption of Office products, which are expected to fuel remarkable growth. These positive projections come alongside stable revenue forecasts for fiscal years 2025 and 2026.

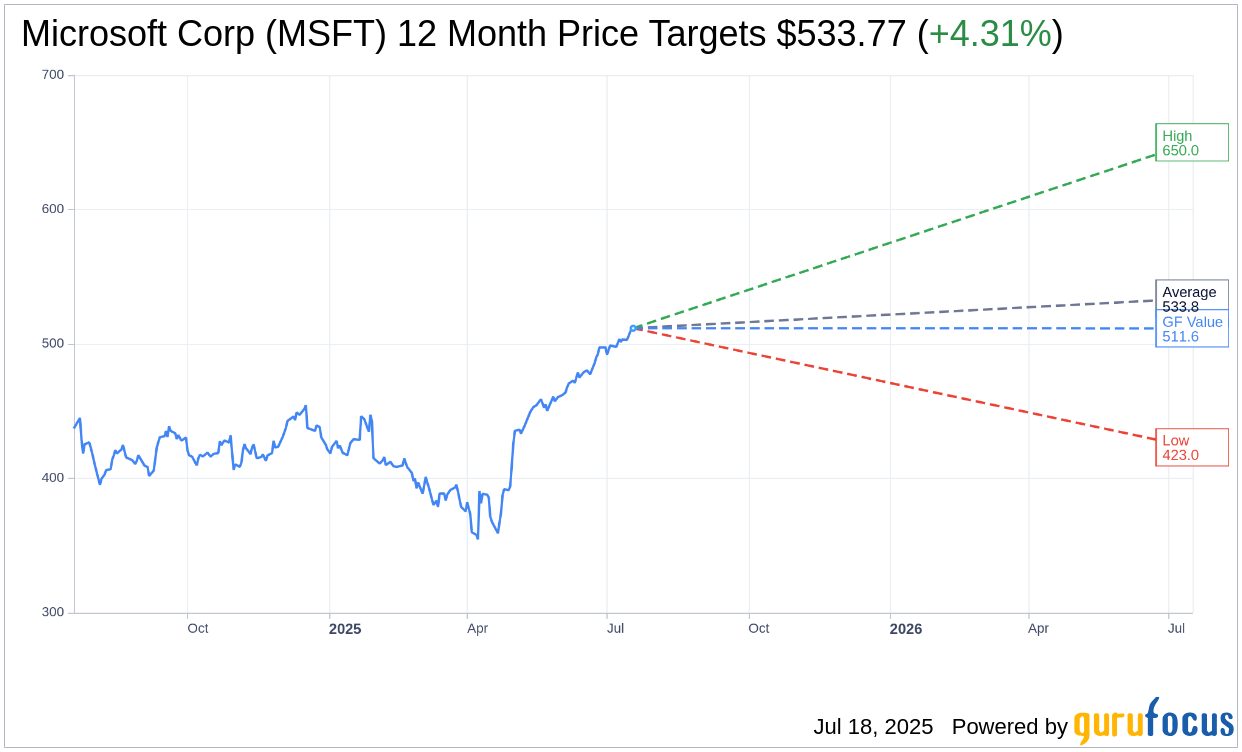

Wall Street Analysts Forecast

Analyzing the one-year price targets provided by 50 analysts, Microsoft Corp (MSFT, Financial) has an average target price set at $533.77. The highest estimate reaches $650.00, while the lowest sits at $423.00. This average target suggests a potential upside of 4.31% from the current trading price of $511.70. Investors can explore more detailed estimates on the Microsoft Corp (MSFT) Forecast page.

Brokerage Recommendations and GF Value

The consensus recommendation from 62 brokerage firms places Microsoft Corp's (MSFT, Financial) average brokerage rating at 1.7, indicating an "Outperform" status. This rating scale ranges from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

GuruFocus estimates suggest that the GF Value for Microsoft Corp (MSFT, Financial) in one year is $511.57. This figure implies a slight downside of 0.03% from the current price of $511.70. The GF Value is a proprietary measure of a stock's fair value, calculated from historical trading multiples, past business growth, and future performance estimates. For further details, visit the Microsoft Corp (MSFT) Summary page.