Lake Street has increased its price target for DiaMedica Therapeutics (DMAC, Financial) shares from $11 to $14 while maintaining a Buy rating. This adjustment follows the release of interim results from Part 1a of the Phase 2 study involving DM199, a treatment aimed at addressing preeclampsia. The firm views these findings as significantly enhancing the potential success of DM199 for this condition.

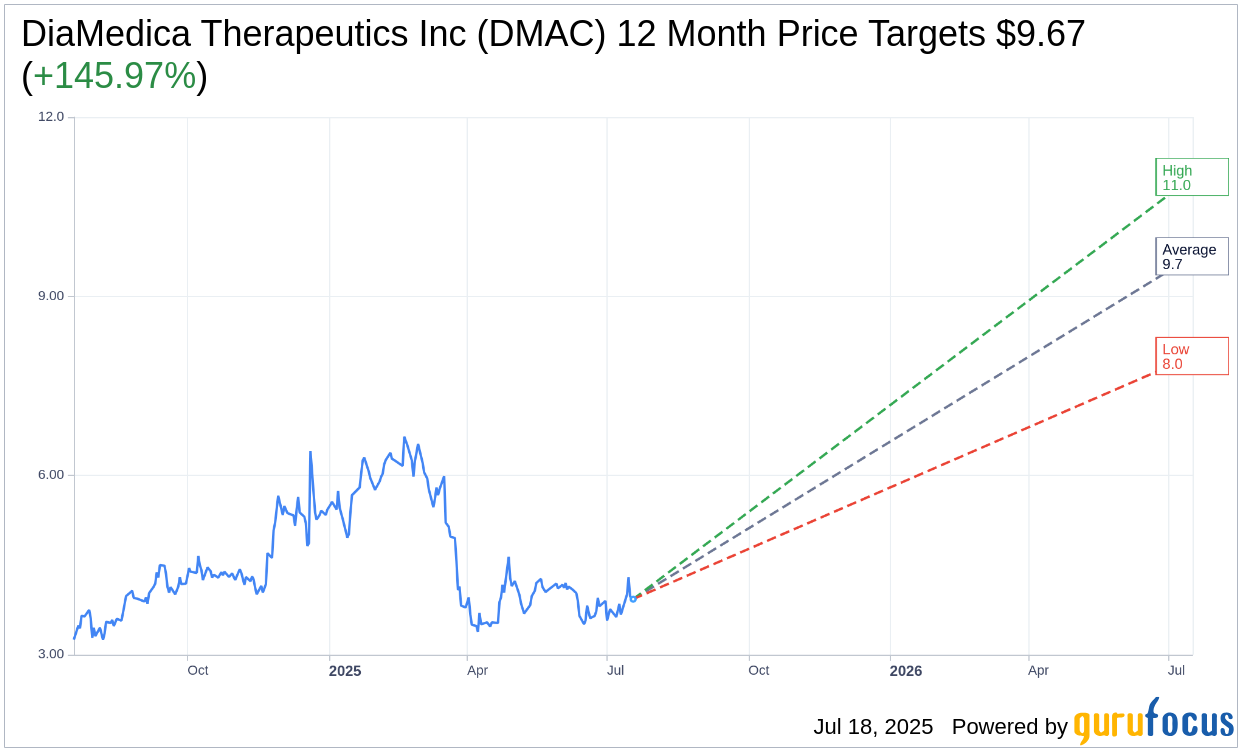

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for DiaMedica Therapeutics Inc (DMAC, Financial) is $9.67 with a high estimate of $11.00 and a low estimate of $8.00. The average target implies an upside of 145.97% from the current price of $3.93. More detailed estimate data can be found on the DiaMedica Therapeutics Inc (DMAC) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, DiaMedica Therapeutics Inc's (DMAC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

DMAC Key Business Developments

Release Date: May 14, 2025

- Cash and Investments: $37.3 million as of March 31, 2025.

- Current Liabilities: $4.7 million as of March 31, 2025.

- Working Capital: $32.8 million as of March 31, 2025.

- Net Cash Used in Operating Activities: $7.1 million for Q1 2025.

- Research and Development Expenses: $5.7 million for the three months ended March 31, 2025.

- General and Administrative Expenses: $2.5 million for the three months ended March 31, 2025.

- Net Other Income: $443,000 for the three months ended March 31, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- DiaMedica Therapeutics Inc (DMAC, Financial) is making substantial progress in its clinical development programs, particularly in the preeclampsia and stroke areas.

- The company is close to identifying a target dose for its phase 2 preeclampsia trial, with preliminary top-line results expected between June and July.

- Enrollment in the stroke program is progressing steadily, with participant enrollment reaching between the 20th and 25th percentile mark.

- The company has engaged an experienced stroke neurologist to support site engagement and maintain enrollment momentum in the Remedy II trial.

- DiaMedica Therapeutics Inc (DMAC) has a strong financial position with a total combined cash and investments of $37.3 million as of March 31, 2025, providing a runway into Q3 of 2026.

Negative Points

- The company's net cash used in operating activities increased to $7.1 million for the first quarter of 2025, up from $6.7 million in the same period of 2024.

- Research and development expenses rose significantly to $5.7 million for the three months ended March 31, 2025, compared to $3.7 million for the same period in 2024.

- General and administrative expenses increased to $2.5 million for the three months ended March 31, 2025, from $2.1 million in the same period of 2024.

- The company anticipates that R&D expenses will moderately increase in future periods due to the continuation of the Remedy II trial and expansion of the DM 199 clinical development program.

- Interest income decreased, resulting in a net other income of $443,000 for the three months ended March 31, 2025, compared to $597,000 for the same period in 2024.