Key Takeaways:

- Qualcomm maintains a steady dividend, offering a forward yield of 2.33%.

- Analysts predict a potential upside of 14.92% in Qualcomm's stock price.

- Qualcomm's "Outperform" rating reflects investor confidence.

Qualcomm Inc. (QCOM, Financial) continues to secure its reputation as a dividend staple by declaring a quarterly dividend of $0.89 per share. This payout remains consistent with previous distributions, resulting in a commendable forward yield of 2.33%. Mark your calendars, as this dividend is payable on September 25, with important dates set: the record and ex-dividend date is September 4.

Brokerage Insights and Analyst Forecasts

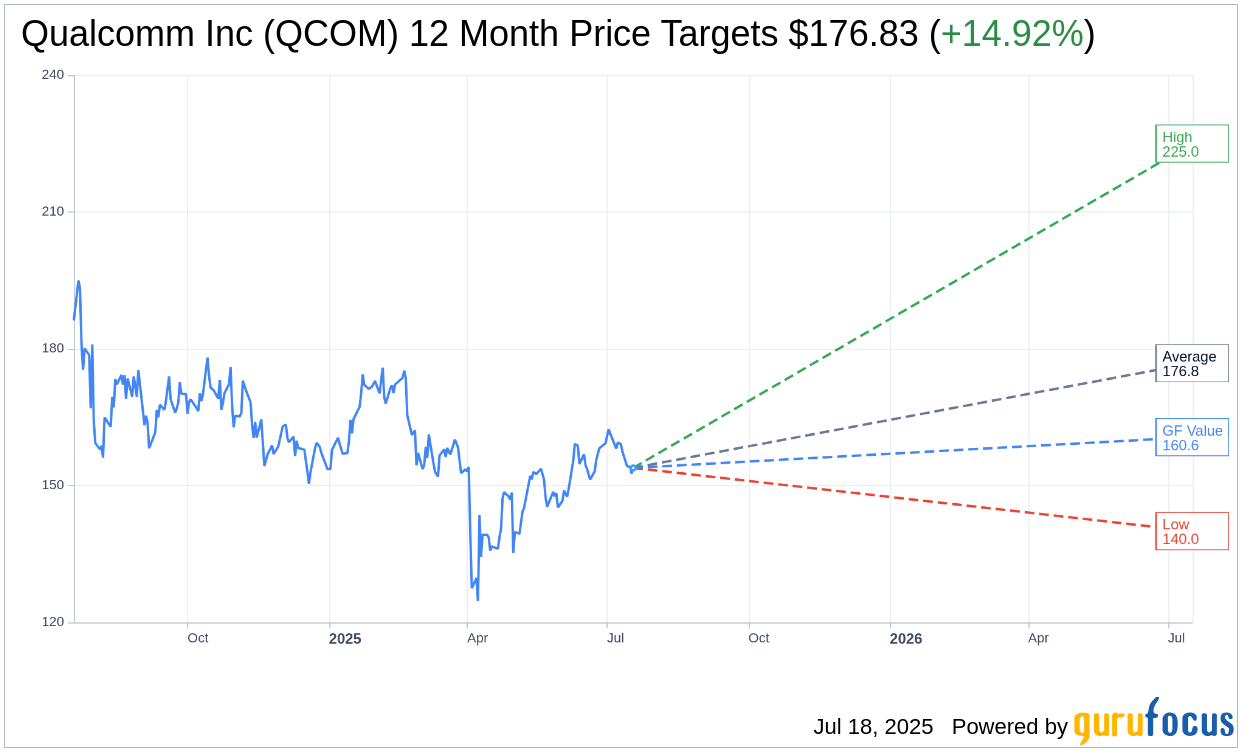

Delving into analyst perspectives, the one-year price targets, aggregated from 30 financial experts, suggest an average target price for Qualcomm Inc. (QCOM, Financial) at $176.83. Projections span from a high of $225.00 to a low of $140.00, indicating a forecasted upside potential of 14.92% from the prevailing price point of $153.88. For a more granular breakdown, please visit the Qualcomm Inc (QCOM) Forecast page.

Investment Ratings and Recommendations

Amidst the diverse opinions from 42 brokerage entities, Qualcomm Inc.’s (QCOM, Financial) stock gathers a consensus recommendation standing at 2.4. This denotes an "Outperform" status, under a rating scale stretching from 1 (Strong Buy) to 5 (Sell), reflecting a favorable outlook among analysts.

Evaluating Fair Value with GF Value Metric

According to GuruFocus estimates, Qualcomm Inc. (QCOM, Financial) holds an estimated GF Value of $160.62 in the coming year. This valuation signifies an anticipated upside of 4.38% from its current trading price of $153.875. The GF Value is a proprietary metric by GuruFocus, providing insights into what the stock's fair value should be based on historical trading multiples, past business growth, and future performance projections. For additional detailed data, explore the Qualcomm Inc (QCOM) Summary page.

Also check out: (Free Trial)