CIBC has elevated its price target for Stantec (STN, Financial) from C$156 to C$168, while maintaining its Outperformer rating on the company's shares. This adjustment suggests an optimistic outlook on STN's future performance. Investors may find this new target intriguing as they consider their portfolios and potential investment strategies.

Wall Street Analysts Forecast

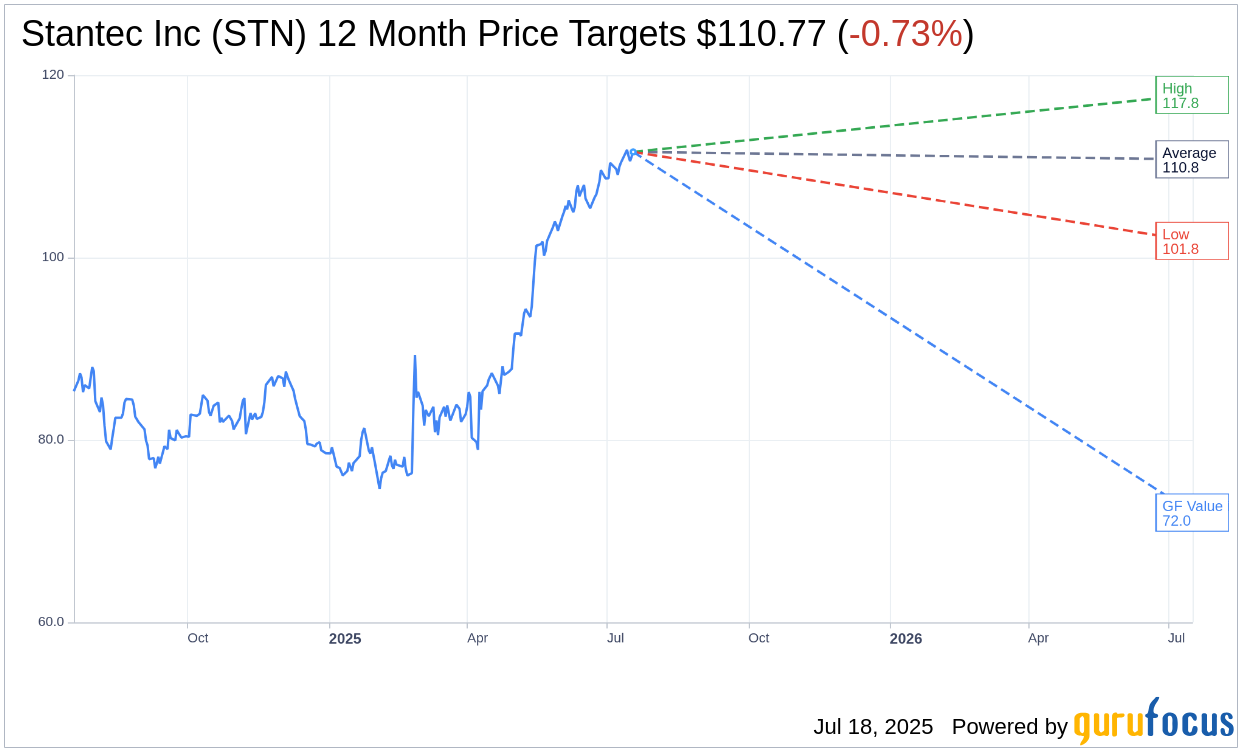

Based on the one-year price targets offered by 7 analysts, the average target price for Stantec Inc (STN, Financial) is $110.77 with a high estimate of $117.84 and a low estimate of $101.83. The average target implies an downside of 0.73% from the current price of $111.59. More detailed estimate data can be found on the Stantec Inc (STN) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Stantec Inc's (STN, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Stantec Inc (STN, Financial) in one year is $72.04, suggesting a downside of 35.44% from the current price of $111.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Stantec Inc (STN) Summary page.

STN Key Business Developments

Release Date: May 15, 2025

- Net Revenue: $1.6 billion, up 13.3% year over year.

- Organic Growth: 5.9% overall, with notable double-digit growth in Canada.

- Acquisition Growth: 3.2%.

- Adjusted EBITDA: Increased by over 19%, with a margin of 16.2%.

- Adjusted EPS: Growth of 29% compared to Q1 2024, reaching $1.16.

- Gross Revenue: $1.9 billion, up almost 12% year over year.

- Project Margins: 54.3%, a 10 basis point increase over last year.

- Operating Cash Flow: Increased almost 136% year over year, from $43 million to $101 million.

- Net Debt to Adjusted EBITDA Ratio: 1.1 times as of March 31.

- Backlog: Reached a record $7.9 billion, with 7.5% organic growth.

- US Net Revenue Growth: 9.7%, with 2.4% organic growth.

- Canada Net Revenue Growth: 15%, with 12.2% organic growth.

- Global Business Net Revenue Growth: 20.3%, with 7.5% organic growth.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Stantec Inc (STN, Financial) reported a strong start to 2025 with a 13.3% year-over-year increase in net revenue, reaching $1.6 billion.

- The company achieved a 19% growth in adjusted EBITDA, with an enhanced margin of 16.2%.

- Stantec Inc (STN) announced two strategic acquisitions, including Page, which will make it the second-largest architectural firm in North America.

- The company's backlog reached a record $7.9 billion, indicating strong demand and future work.

- Stantec Inc (STN) maintained a positive outlook for 2025, expecting net revenue growth of 7% to 10% and adjusted EPS growth of 16% to 19%.

Negative Points

- Organic growth in the US was slightly below expectations at 2.4%, attributed to project cycle timing and a tough comparison from the previous year.

- Despite strong performance, the company did not raise its guidance for 2025, citing the need to close acquisitions and assess Q2 results.

- There is some uncertainty in the US government business, with potential impacts on procurement cycles and contract renewals.

- The integration of ZETCON in Germany is progressing slower than usual due to language and accounting differences.

- The company faces heightened market uncertainty due to tariffs, policy shifts, and regulatory changes, which could impact future performance.