CIBC has increased its price target for RB Global (RBA, Financial) from $118 to $121, maintaining its Outperformer rating on the company's shares. Following the release of its Q1 earnings, the engineering and construction (E&C) firms under CIBC's coverage witnessed their stock prices surge by approximately 22%, aligning with similar gains seen in heavy equipment companies. This growth significantly outpaced the performance of the S&P/TSX index.

Despite variations in valuation, with some stocks nearing record highs and others trailing their historical averages, CIBC remains optimistic about the broader economic conditions. The firm suggests that these favorable conditions support higher valuation multiples, offering potential upside for stocks that have not yet caught up to the market's performance.

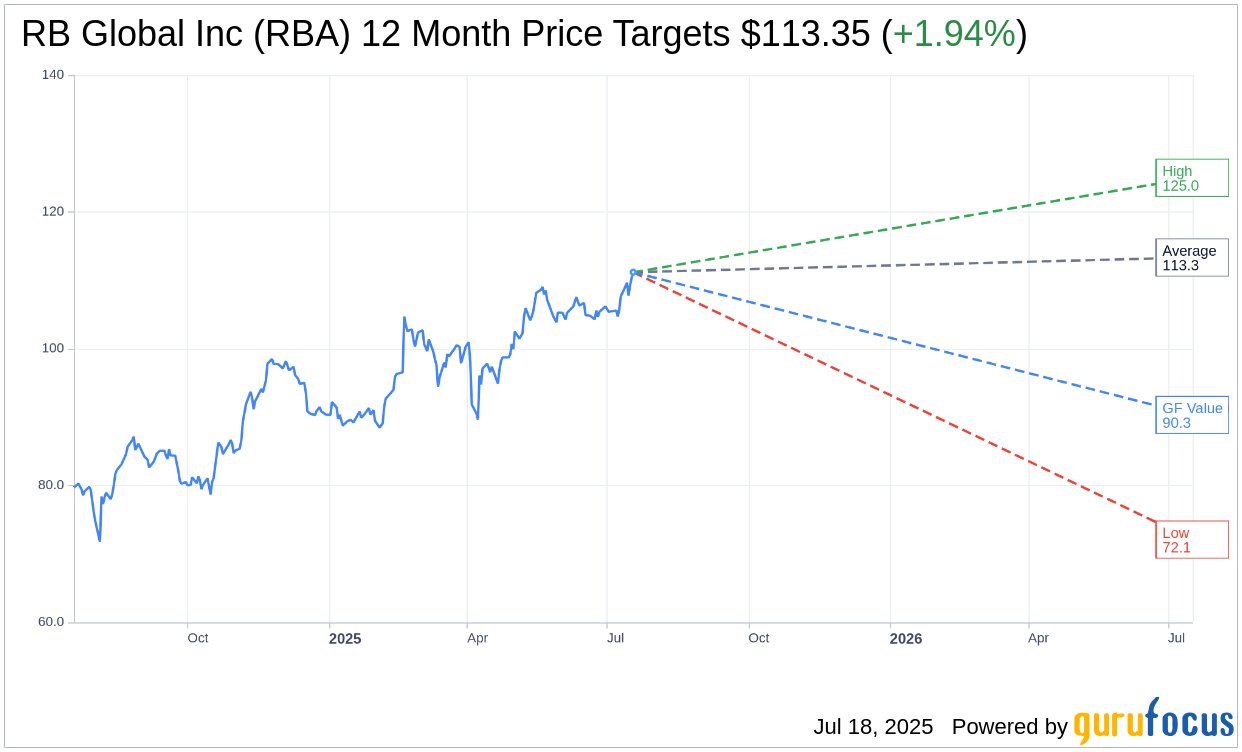

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for RB Global Inc (RBA, Financial) is $113.35 with a high estimate of $125.00 and a low estimate of $72.11. The average target implies an upside of 1.94% from the current price of $111.19. More detailed estimate data can be found on the RB Global Inc (RBA) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, RB Global Inc's (RBA, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for RB Global Inc (RBA, Financial) in one year is $90.33, suggesting a downside of 18.76% from the current price of $111.19. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the RB Global Inc (RBA) Summary page.

RBA Key Business Developments

Release Date: May 07, 2025

- Adjusted EBITDA: Declined 1% on a 6% decline in gross transactional value (GTV).

- Total GTV: Decreased by 6%.

- Automotive GTV: Increased by 2%, driven by a 7% increase in unit volumes.

- Commercial Construction and Transportation GTV: Decreased by 18%, with a 19% decline in lot volumes.

- Service Revenue Take Rate: Increased approximately 150 basis points year-over-year to 22.3%.

- Adjusted EBITDA as a Percentage of GTV: Increased to 8.6% compared to 8.1% in the prior year.

- Adjusted Earnings Per Share: Declined 1%, in line with the decline in adjusted EBITDA.

- Term Loan A and Revolver Repricing: Reduced bank spread by approximately 85 basis points and increased revolver capacity to $1.3 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- RB Global Inc (RBA, Financial) announced the acquisition of J.M. Wood for approximately $235 million, enhancing geographical coverage and bringing a talented team on board.

- The company increased the number of planned sales events in North America by approximately 15% to improve operational efficiency and customer experience.

- RB Global Inc (RBA) gained market share globally in the salvage sector, with a new multiyear contract with Direct Line Group in the UK.

- The IAA's 22nd Industry Leadership Summit shattered attendance records, reinforcing RB Global Inc (RBA)'s commitment to exceeding customer expectations.

- The company successfully repriced its Term Loan A and revolver, reducing bank spread and increasing financial flexibility.

Negative Points

- Adjusted EBITDA declined by 1% due to a 6% decrease in gross transactional value (GTV), reflecting challenges in the macroeconomic environment.

- GTV in the commercial construction and transportation sector decreased by 18%, driven by a 19% decline in lot volumes.

- US insurance average selling prices (ASPs) decreased by approximately 3% due to buyer hesitancy and year-over-year mix headwinds.

- The company is facing uncertainty due to recently announced tariffs, impacting customer and partner decision-making.

- There is hesitancy among customers in the commercial segment, with a wait-and-see approach due to macroeconomic uncertainties.