Key Highlights:

- American Express shares saw a 2.6% decline due to falling short of Wall Street's NNPR expectations.

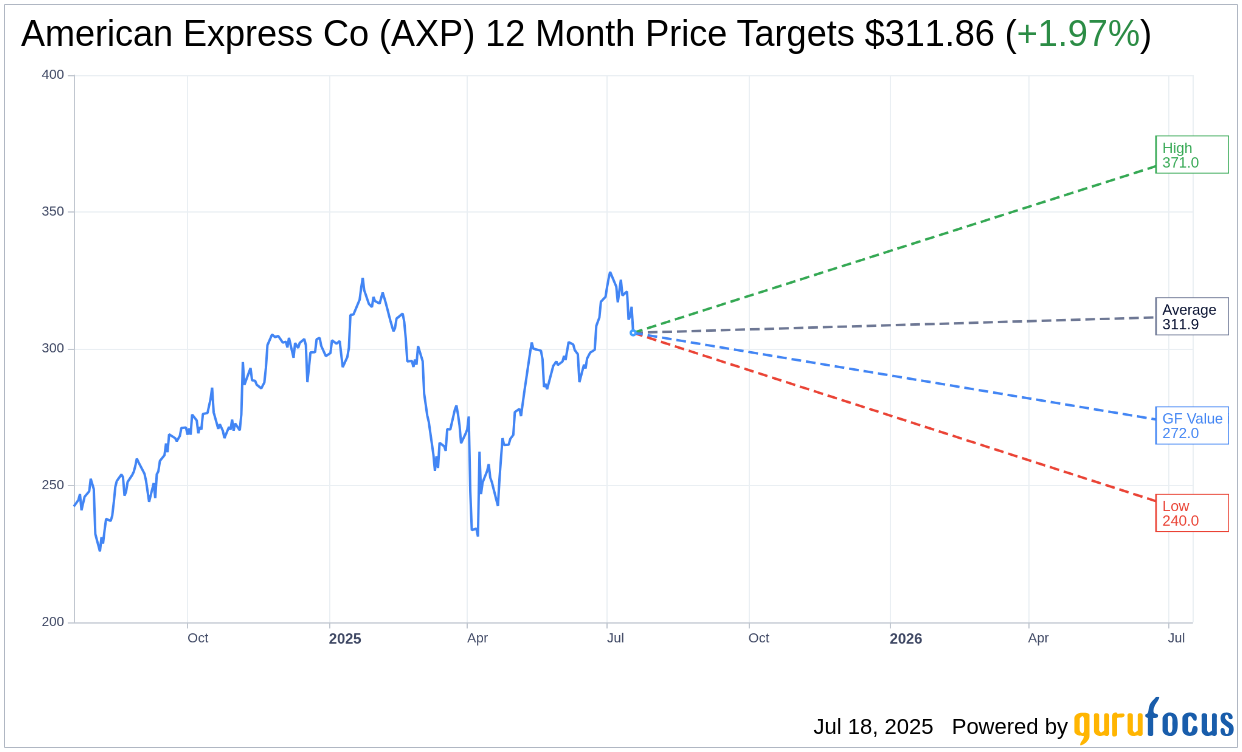

- Analysts have set a one-year price target of $311.86, implying a modest upside.

- GuruFocus estimates suggest a potential 11.07% downside relative to the current stock price.

American Express (AXP, Financial) shares found themselves under pressure, dipping 2.6% during midday trading on Friday. The decline followed the release of results that saw the company's core pre-provision net revenue (NNPR) trailing behind Wall Street's forecasts. This setback in new card acquisition growth contributed to the stock's downturn, despite an early boost in premarket activity fueled by earnings and revenue figures that exceeded expectations.

Wall Street Analyst Forecasts

Wall Street analysts have offered a range of one-year price targets for American Express Co (AXP, Financial). The average target is $311.86, with estimates ranging from a high of $371.00 to a low of $240.00. This average target indicates a potential upside of 1.97% from the current share price of $305.83. Investors can delve into more comprehensive estimate data by visiting the American Express Co (AXP) Forecast page.

Currently, the consensus recommendation from 31 brokerage firms positions American Express Co (AXP, Financial) at an average brokerage recommendation of 2.6, which equates to a "Hold" status. This recommendation scale spans from 1, indicating a Strong Buy, to 5, signifying a Sell.

Evaluating GuruFocus Metrics

According to GuruFocus estimates, the projected GF Value for American Express Co (AXP, Financial) in one year is set at $271.96. This presents a potential downside of 11.07% from the current price of $305.83. The GF Value is a meticulously calculated measure of what the stock should be valued at, drawing from historical trading multiples, past business growth, and anticipated future performance. For those seeking further data, a visit to the American Express Co (AXP) Summary page is advised.