Roth Capital analyst Leo Mariani has reaffirmed a Buy rating for California Resources (CRC, Financial), maintaining a price target of $52. This comes in the wake of a Bloomberg report indicating that California Governor Gavin Newsom is proposing legislation aimed at simplifying the process for obtaining oil and gas permits in the state. According to the firm, this development is likely to positively impact California Resources, differentiating its performance favorably in comparison to its industry peers during Friday's trading session.

Wall Street Analysts Forecast

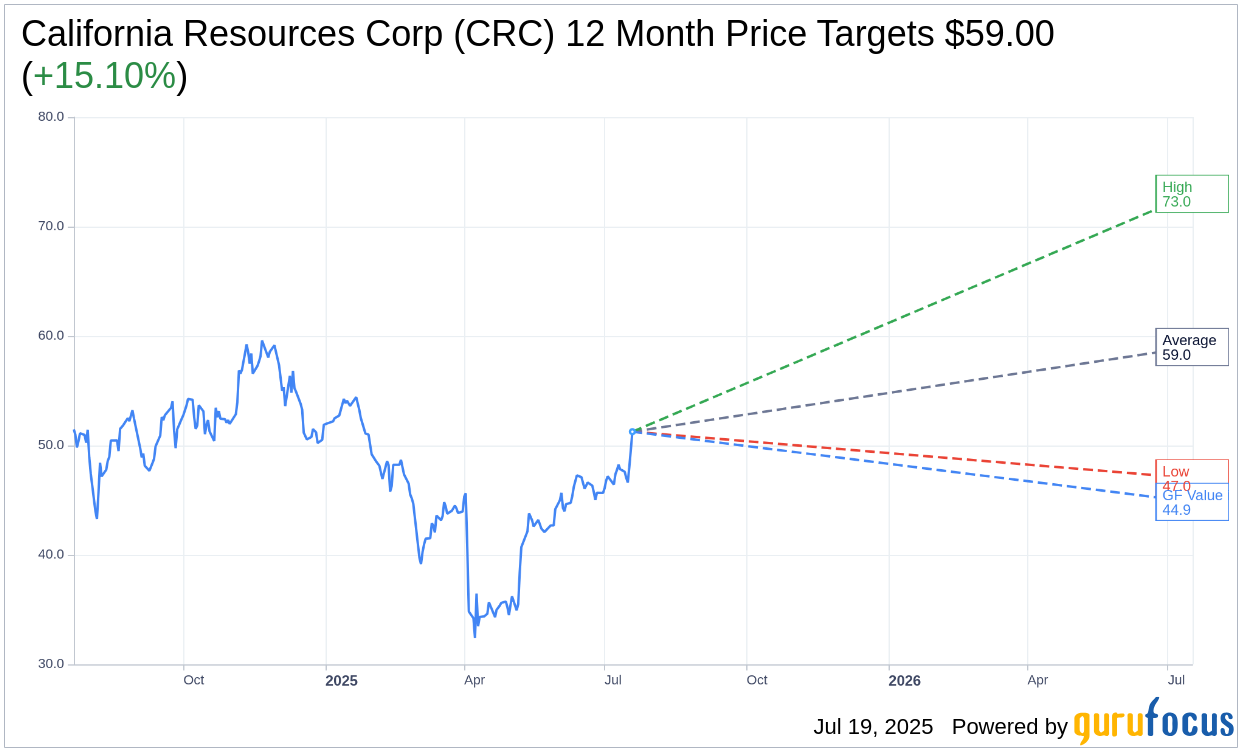

Based on the one-year price targets offered by 12 analysts, the average target price for California Resources Corp (CRC, Financial) is $59.00 with a high estimate of $73.00 and a low estimate of $47.00. The average target implies an upside of 15.10% from the current price of $51.26. More detailed estimate data can be found on the California Resources Corp (CRC) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, California Resources Corp's (CRC, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for California Resources Corp (CRC, Financial) in one year is $44.85, suggesting a downside of 12.5% from the current price of $51.26. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the California Resources Corp (CRC) Summary page.

CRC Key Business Developments

Release Date: May 07, 2025

- Net Production: 141,000 BOE per day, flat quarter-over-quarter.

- Realized Prices: 98% of Brent.

- Adjusted EBITDAX: $328 million.

- Net Cash Flow Before Changes in Working Capital: $252 million.

- Free Cash Flow: $131 million.

- Operating and G&A Costs: $388 million, approximately 5% better than guidance.

- Share Repurchases: $100 million, nearly double the historical average.

- Dividends Paid: $35 million.

- Total Cash Returned to Shareholders: $135 million, about 103% of Q1 free cash flow.

- Full Year Adjusted EBITDAX Guidance: $1.1 billion to $1.2 billion.

- Average Annual Production Target: 136,000 BOE per day.

- D&C Capital Investment: Between $165 million and $180 million.

- Leverage: Below 1x.

- Liquidity: More than $1 billion.

- Available Cash: Nearly $200 million.

- Debt Redemption: $123 million of 2026 notes redeemed at par.

- Aera-Related Synergies Realized: $173 million in annual run rate.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- California Resources Corp (CRC, Financial) delivered a solid quarter, exceeding the Street's expectations with an adjusted EBITDAX of $328 million and free cash flow of $131 million.

- The company has realized more than 70% of its $235 million in announced annual synergies from the Aera merger, with full target achievement expected by early 2026.

- CRC's strong hedge portfolio and diversified revenue stream provide visibility into near-term cash generation, supporting debt service and shareholder returns.

- The company returned a record $258 million to stakeholders in the first quarter through dividends, share buybacks, and debt redemption.

- CRC maintains a strong balance sheet with leverage below 1x, over $1 billion in liquidity, and nearly $200 million in available cash, providing flexibility for debt reduction and capital investment.

Negative Points

- Despite reaffirming full-year guidance, CRC faces challenges from a nearly 16% decline in oil prices.

- The company is navigating a complex regulatory environment in California, with ongoing litigation related to the Kern County EIR and the need for multiple permitting avenues.

- CRC's production guidance for the second quarter indicates a slight decline, attributed to operational adjustments and strategic decisions to optimize cash flow.

- The company is still in the early stages of its carbon management business, with significant reliance on future permitting and infrastructure development for CO2 pipelines.

- CRC's ability to achieve full synergy targets from the Aera merger is contingent on the timely completion of infrastructure consolidation projects, some of which extend into 2026.