- Nvidia-backed AI startup Perplexity has achieved an impressive $18 billion valuation, posing a challenge to Google's search leadership.

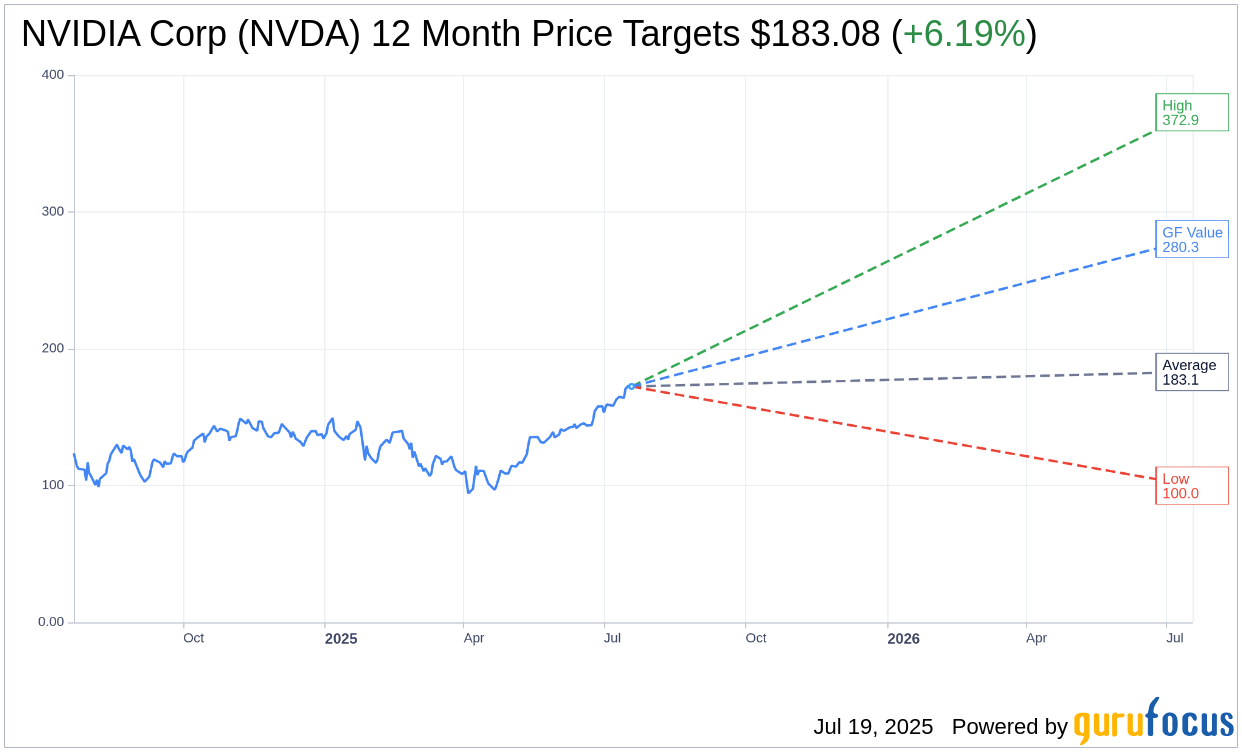

- NVIDIA Corp's (NVDA, Financial) one-year average price target stands at $183.08, with analysts forecasting a potential upside of 6.19%.

- GuruFocus estimates suggest NVIDIA's stock could see an upside of 62.58% based on its projected GF Value.

AI startup Perplexity, supported by tech giant Nvidia (NVDA), has reached a remarkable valuation of $18 billion, setting its sights on disrupting Google's stronghold in the search industry. This surge represents a staggering increase from $520 million in early 2024 to $14 billion by mid-2025, propelled by substantial investments, including a recent $100 million raise.

Wall Street Analysts Forecast

Nvidia's financial outlook has caught the attention of analysts, with 53 experts providing a one-year average price target for NVIDIA Corp (NVDA, Financial) at $183.08. Their predictions range from a high of $372.87 to a low of $100.00, indicating a potential upside of 6.19% from the current price of $172.41. For a deeper dive into these estimates, visit the NVIDIA Corp (NVDA) Forecast page.

Adding to Nvidea's bullish sentiment, consensus from 66 brokerage firms rates NVIDIA Corp (NVDA, Financial) with an average recommendation of 1.8, suggesting an "Outperform" status. This rating scale, where 1 signifies Strong Buy and 5 denotes Sell, reinforces the positive outlook for Nvidia among market analysts.

GuruFocus Fair Value Analysis

According to GuruFocus estimates, the projected GF Value for NVIDIA Corp (NVDA, Financial) in one year is $280.31. This suggests a significant upside of 62.58% from the current price of $172.41. The GF Value is derived from historical trading multiples, past business growth, and future performance estimates, offering investors a thorough assessment of fair stock value. Additional information is available on the NVIDIA Corp (NVDA) Summary page.