Key Highlights:

- ASML reports a significant 23% year-over-year revenue growth, projecting strong third-quarter sales.

- Analyst consensus suggests a 19.71% potential upside for ASML shares with an "Outperform" rating.

- GuruFocus estimates a 57.55% potential upside, reflecting ASML's positive long-term growth prospects.

ASML Holding NV (ASML, Financial) shares experienced a 7% decline even after announcing robust second-quarter earnings. The company reported a substantial 23% increase in revenue compared to last year and has projected third-quarter sales to land between €7.4 billion and €7.9 billion, along with a healthy gross margin ranging from 50% to 52%. Despite the recent dip in share price, ASML reaffirms its ambitious growth targets for 2025.

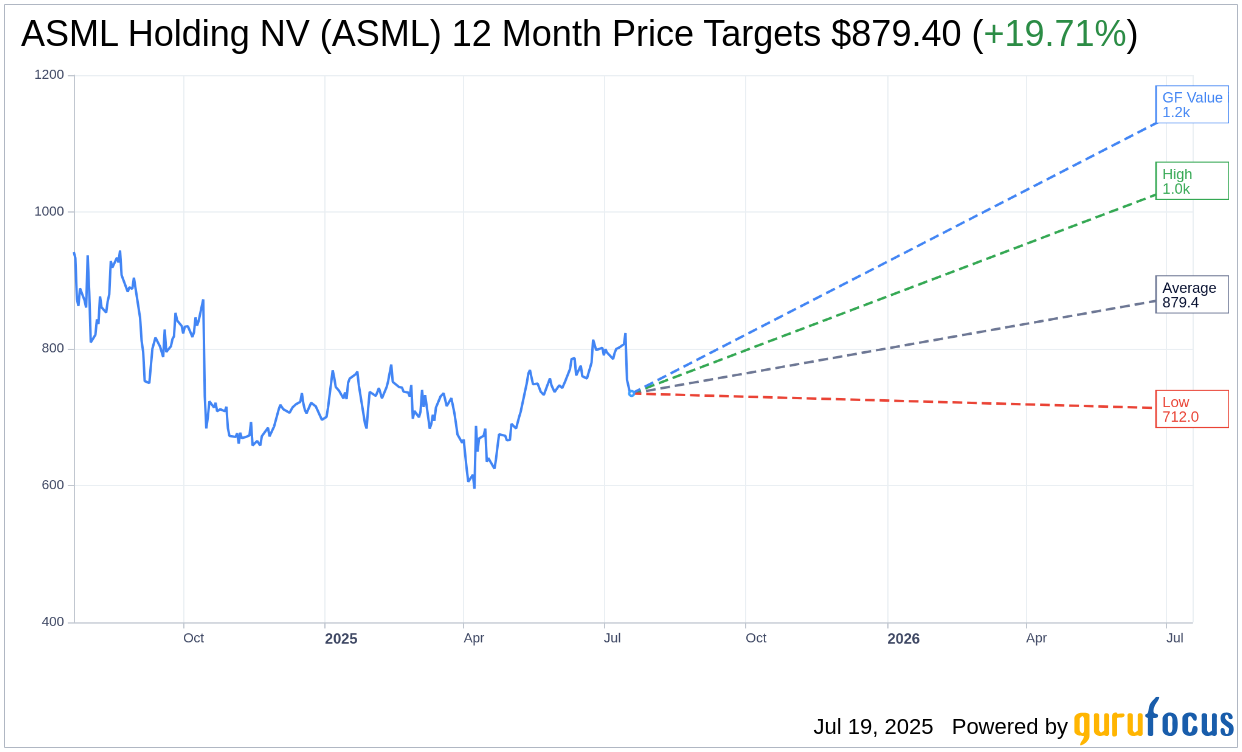

Wall Street Analysts Forecast

The average one-year price target set by 12 analysts for ASML Holding NV (ASML, Financial) stands at $879.40. This includes a high estimate of $1,045.62 and a low estimate of $712.02. Compared to the current stock price of $734.58, the average target suggests a promising upside potential of 19.71%. For a comprehensive view, visit the complete forecast data on the ASML Holding NV (ASML) Forecast page.

The consensus recommendation from 16 brokerage firms currently positions ASML Holding NV (ASML, Financial) with an average brokerage rating of 2.1, indicating an "Outperform" status. The rating scale ranges from 1, symbolizing a Strong Buy, to 5, which denotes a Sell recommendation.

GuruFocus GF Value Estimate

According to GuruFocus estimates, the one-year GF Value for ASML Holding NV (ASML, Financial) is projected at $1,157.31. This suggests a notable upside potential of 57.55% from the current price of $734.58. The GF Value is GuruFocus' calculated fair value, derived from the stock's historical trading multiples, past business growth, and future business performance estimates. To explore more detailed metrics, visit the ASML Holding NV (ASML) Summary page.