**Key Highlights:**

- Builders FirstSource (BLDR, Financial) recently saw a 7.60% decline, marking the largest drop in the sector.

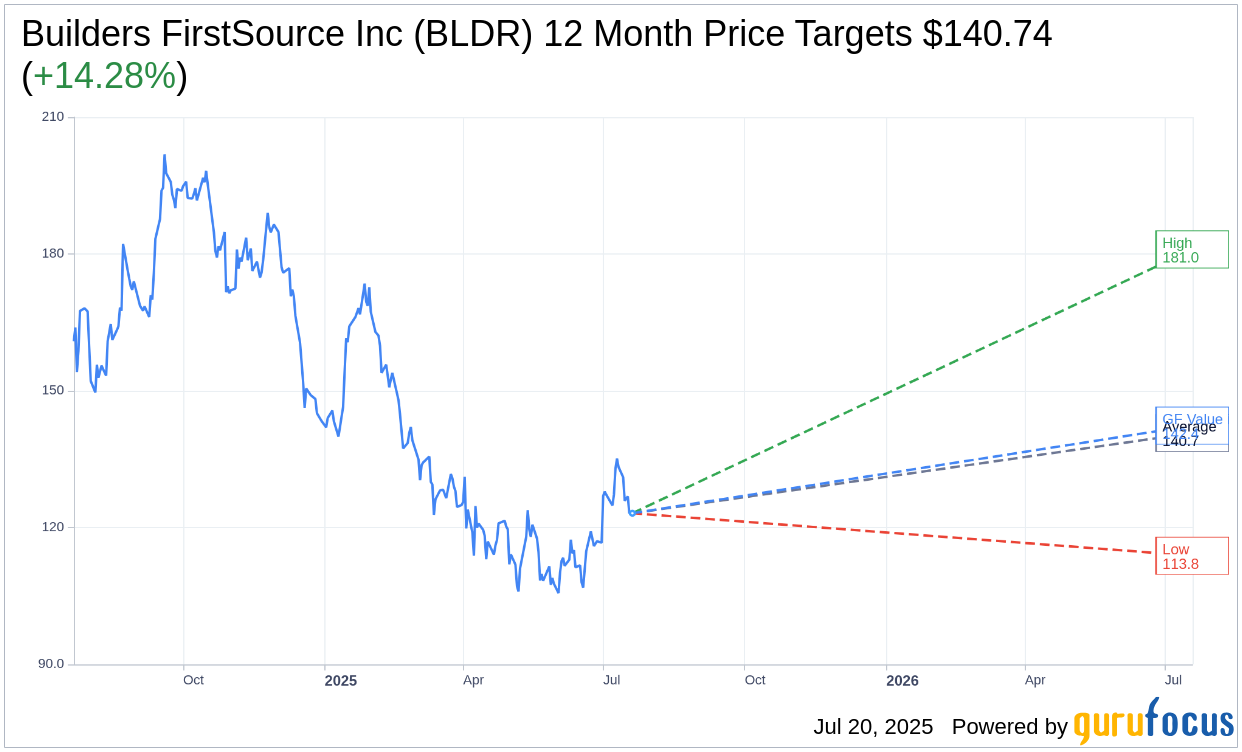

- Analysts project a potential 14.28% upside, with a price target average of $140.74.

- GuruFocus estimates indicate a 15.6% potential upside based on the GF Value model.

Recent Performance Insights

Builders FirstSource (BLDR) experienced a significant reversal this week, suffering a decrease of 7.60% in its stock value. Once among the top gainers, this decline now positions the company as the largest loser within its sector, attracting considerable attention from investors and analysts alike.

Analysts' Price Projections

Wall Street analysts have shared their one-year price targets for Builders FirstSource Inc (BLDR, Financial), with the average target set at $140.74. Projections range from a high of $181.00 to a low of $113.83, indicating a potential upside of 14.28% from the current price of $123.15. For further insights, visit the Builders FirstSource Inc (BLDR) Forecast page.

Brokerage Firm Recommendations

The consensus among 20 brokerage firms rates Builders FirstSource Inc (BLDR, Financial) at 2.1, suggesting an "Outperform" status. On the rating scale ranging from 1 (Strong Buy) to 5 (Sell), this positions the stock favorably in the eyes of market analysts.

Evaluating GF Value

According to GuruFocus estimates, the GF Value for Builders FirstSource Inc (BLDR, Financial) over the next year is pegged at $142.36. This estimation signifies a potential upside of 15.6% from the current price of $123.15. The GF Value is derived from historical trading multiples, past business growth, and future performance projections. More comprehensive data is available on the Builders FirstSource Inc (BLDR) Summary page.