Key Highlights:

- PepsiCo's organic revenue surpasses forecasts with a 2.1% growth.

- Analysts predict a moderate upside for PepsiCo's stock price.

- GuruFocus estimates suggest a significant valuation increase.

PepsiCo Inc. (PEP, Financial) recently experienced a notable 5.90% increase in its stock price, driven by a robust international performance. The company's organic revenue rose by 2.1% for the quarter ending June 14, outpacing market expectations of 1.2% growth. This achievement underscores PepsiCo's strong global market presence and strategic initiatives.

Wall Street Analysts Forecast

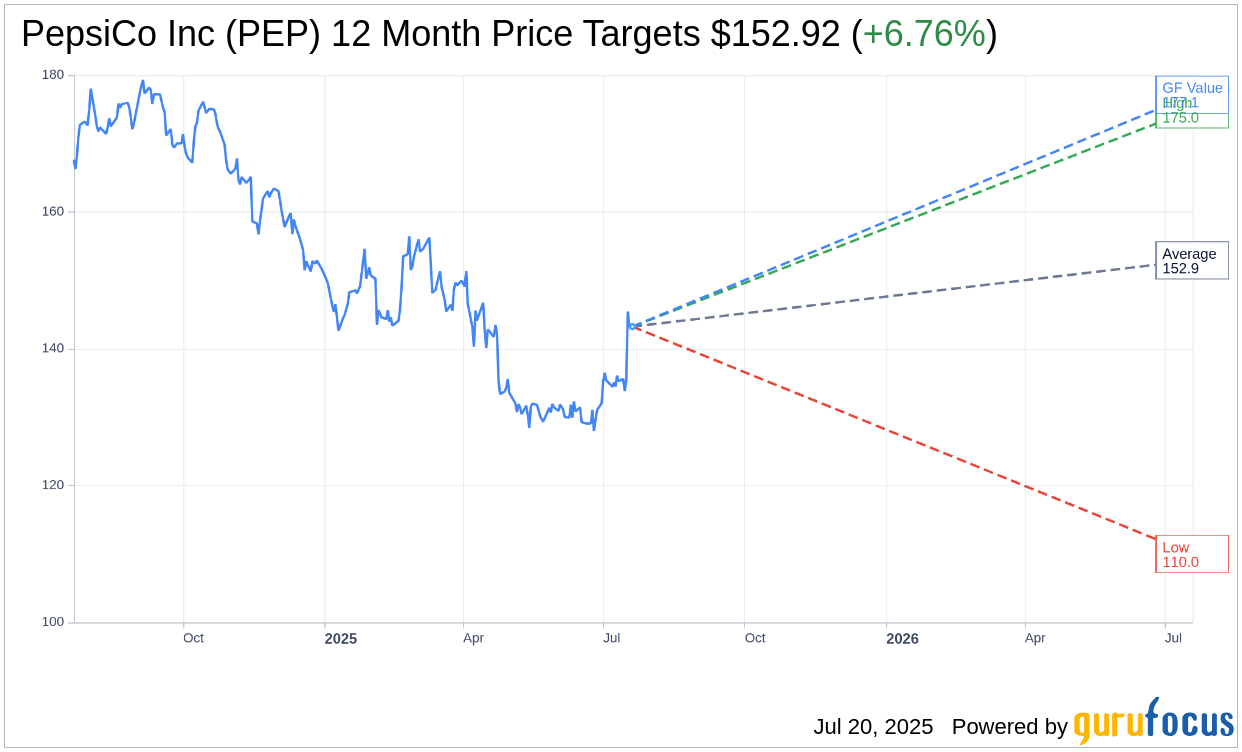

According to insights from 21 analysts, the average one-year price target for PepsiCo Inc. (PEP, Financial) stands at $152.92. Price projections range from a high of $175.00 to a low of $110.00, suggesting a potential upside of 6.76% from the current stock price of $143.24. For a more detailed analysis, visit the PepsiCo Inc (PEP) Forecast page.

The average brokerage recommendation, based on evaluations from 24 firms, positions PepsiCo Inc. (PEP, Financial) at 2.8, aligning with a "Hold" rating. This rating is based on a scale from 1 (Strong Buy) to 5 (Sell).

GF Value Estimate

GuruFocus estimates that PepsiCo Inc.'s (PEP, Financial) GF Value in one year is projected to be $177.14, indicating a potential upside of 23.67% from its current price of $143.24. The GF Value is calculated by assessing the historical trading multiples, past business growth, and future performance estimates of the company. For further details, explore the PepsiCo Inc (PEP) Summary page.