Investment Highlights:

- Analysts predict a notable 9.1% rise in EPS for Medpace’s upcoming earnings report.

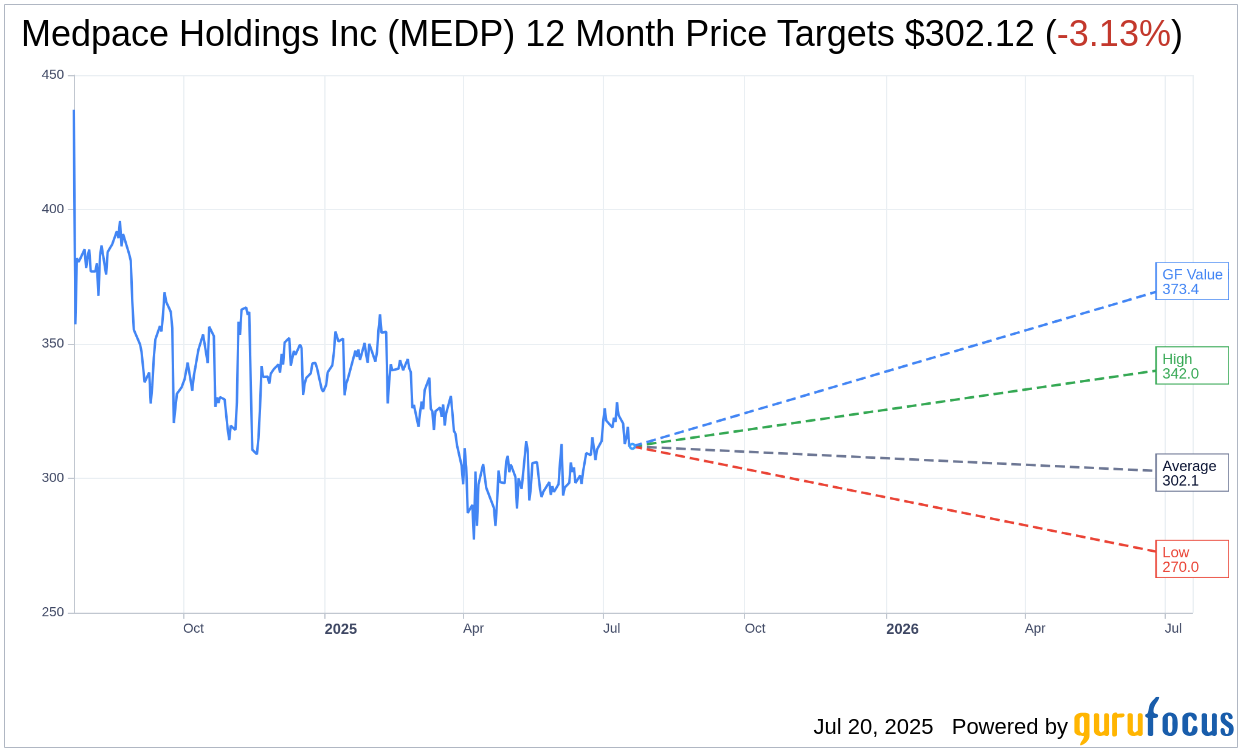

- The current average target price suggests a slight downside from the current stock value.

- GuruFocus's GF Value projects a potential 19.72% upside for Medpace.

Medpace's Anticipated Earnings Report

Medpace Holdings Inc. (NASDAQ: MEDP) is set to announce its second-quarter earnings results after the market closes on July 21. The financial community is looking forward to an earnings per share (EPS) of $3.00, reflecting a 9.1% increase compared to the same period last year. Revenue expectations stand at $538.78 million, marking a 2.0% growth. Historically, Medpace has exceeded EPS expectations 75% of the time, and it has outperformed revenue forecasts 63% of the time. However, recent trends show one upward and three downward EPS revisions, while revenue projections have seen seven upward and two downward adjustments.

Wall Street Analysts’ Predictions

Eleven analysts have set one-year price targets for Medpace Holdings, with an average target of $302.12. The forecasts range from a high of $342.00 to a low of $270.00. Presently, this average implies a slight downside of 3.13% from Medpace's current price of $311.87. For a comprehensive overview of the estimates, visit the Medpace Holdings Inc (MEDP, Financial) Forecast page.

Analyst Recommendations and Valuation

The consensus among 12 brokerage firms gives Medpace Holdings a "Hold" rating, reflected in an average recommendation score of 2.8 (on a scale where 1 indicates Strong Buy and 5 indicates Sell).

From a valuation perspective, GuruFocus's projected GF Value for Medpace Holdings suggests that the stock should trade at $373.37 within a year, which points to a potential upside of 19.72% from the current stock price of $311.87. This valuation takes into account historical trading multiples, past business growth, and future performance estimates. For more detailed insights, please visit the Medpace Holdings Inc (MEDP, Financial) Summary page.