Stifel analyst Simon Yarmak has revised his stance on Gaming and Leisure Properties (GLPI, Financial), moving it from a "Buy" to a "Hold" recommendation. The price target has been adjusted to $51.25, down from the previous $57.50. This change in rating reflects a more cautious approach to the investment potential of GLPI at this time.

Wall Street Analysts Forecast

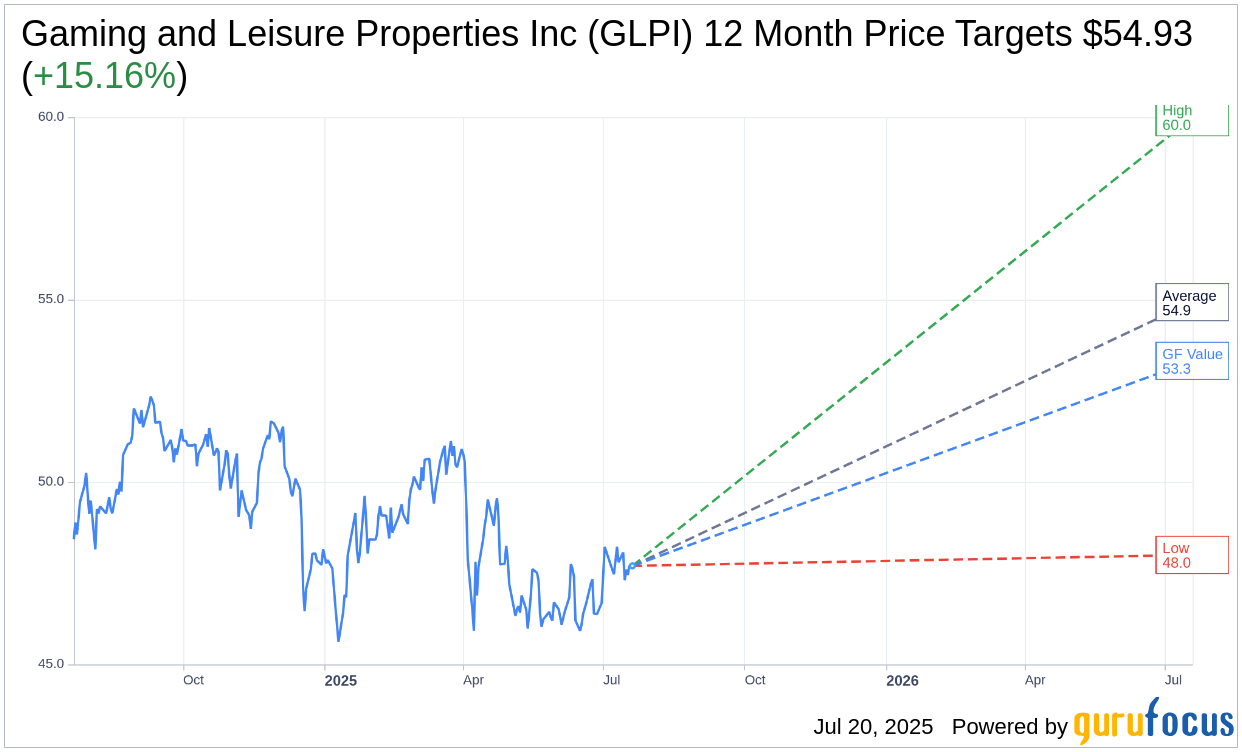

Based on the one-year price targets offered by 22 analysts, the average target price for Gaming and Leisure Properties Inc (GLPI, Financial) is $54.93 with a high estimate of $60.00 and a low estimate of $48.00. The average target implies an upside of 15.16% from the current price of $47.70. More detailed estimate data can be found on the Gaming and Leisure Properties Inc (GLPI) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Gaming and Leisure Properties Inc's (GLPI, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Gaming and Leisure Properties Inc (GLPI, Financial) in one year is $53.32, suggesting a upside of 11.78% from the current price of $47.7. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Gaming and Leisure Properties Inc (GLPI) Summary page.