On July 18, 2025, WaFd Inc (WAFD, Financial) released its 8-K filing for the third quarter ended June 30, 2025. The company reported a diluted earnings per share (EPS) of $0.73, surpassing the analyst estimate of $0.68. WaFd Inc, a provider of lending, depository, insurance, and other banking services, operates through WaFd Bank across several states including Washington, Oregon, and California.

Financial Performance and Strategic Initiatives

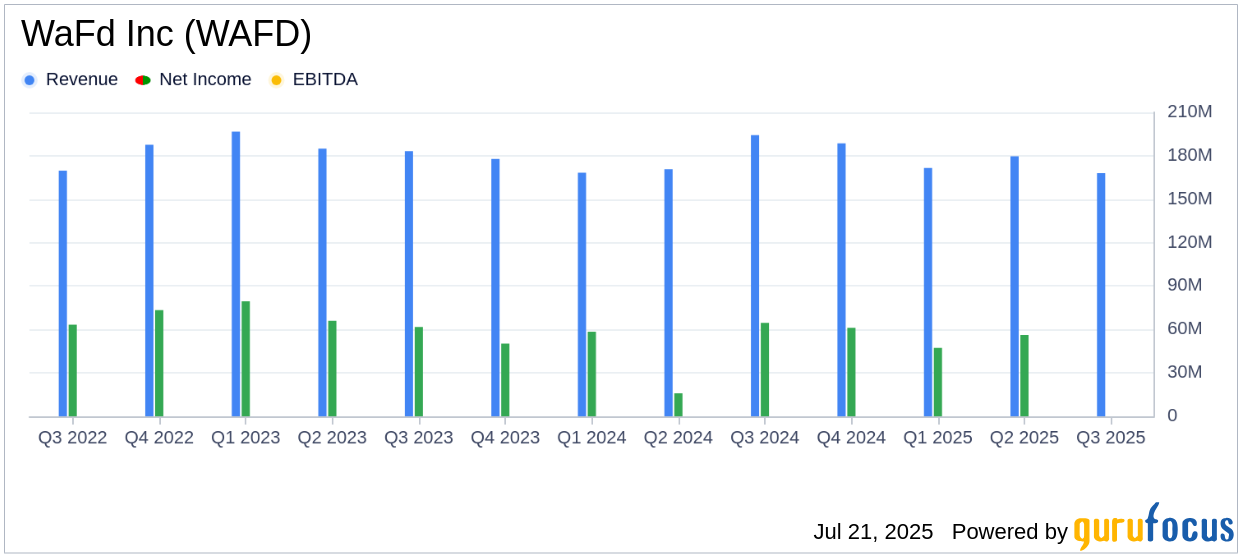

WaFd Inc reported a net income of $61.95 million for the third quarter, marking a 10% increase from the previous quarter's $56.25 million. However, this represents a 4% decrease from the $64.56 million reported in the same quarter last year. The company's strategic decision to repurchase 1,662,508 shares at a weighted average price of $29.08 per share contributed to a 12% increase in EPS compared to the previous quarter.

Brent Beardall, President and CEO of WaFd Bank, stated, "The third quarter delivered strong core earnings driven by improved margin and resultant net interest income. Our cost of funds in dollars decreased 6.5% on a linked quarter basis, benefiting from lower rates on deposits and reduced borrowings as we chose to shrink the balance sheet."

Key Financial Metrics and Achievements

Net interest income for the quarter was $168 million, exceeding the estimated revenue of $166.63 million, with a net interest margin of 2.69% compared to 2.55% in Q2. The company's efficiency ratio improved to 56.01% from 58.31% in the prior quarter, reflecting increased net interest income and stable non-interest expenses.

WaFd Inc's balance sheet showed a decrease in total assets to $26.7 billion, primarily due to a reduction in loans receivable and cash used to reduce borrowings and purchase investments. The company's total deposits remained stable at $21.4 billion, with a slight increase in transaction accounts.

| Metric | Q3 2025 | Q2 2025 | Q3 2024 |

|---|---|---|---|

| Net Income ($ million) | 61.95 | 56.25 | 64.56 |

| Diluted EPS ($) | 0.73 | 0.65 | 0.75 |

| Net Interest Margin (%) | 2.69 | 2.55 | 2.56 |

| Efficiency Ratio (%) | 56.01 | 58.31 | 56.61 |

Challenges and Market Conditions

Despite the positive earnings, WaFd Inc faces challenges with tepid loan demand as borrowers await more certainty before initiating new projects. The company has responded by focusing on share repurchases and maintaining strong credit quality. Non-performing assets increased to 0.36% of total assets, up from 0.26% in the previous quarter, indicating a need for continued vigilance in credit management.

Conclusion

WaFd Inc's third-quarter performance demonstrates its ability to navigate a challenging economic environment through strategic initiatives and effective cost management. The company's focus on improving net interest income and maintaining a strong balance sheet positions it well for future growth. Investors and stakeholders will be keen to see how WaFd Inc continues to adapt to market conditions and leverage its strengths in the banking sector.

Explore the complete 8-K earnings release (here) from WaFd Inc for further details.