Quick Summary:

- Thomson Reuters (TRI, Financial) to join the Nasdaq-100 Index by July 28, 2025.

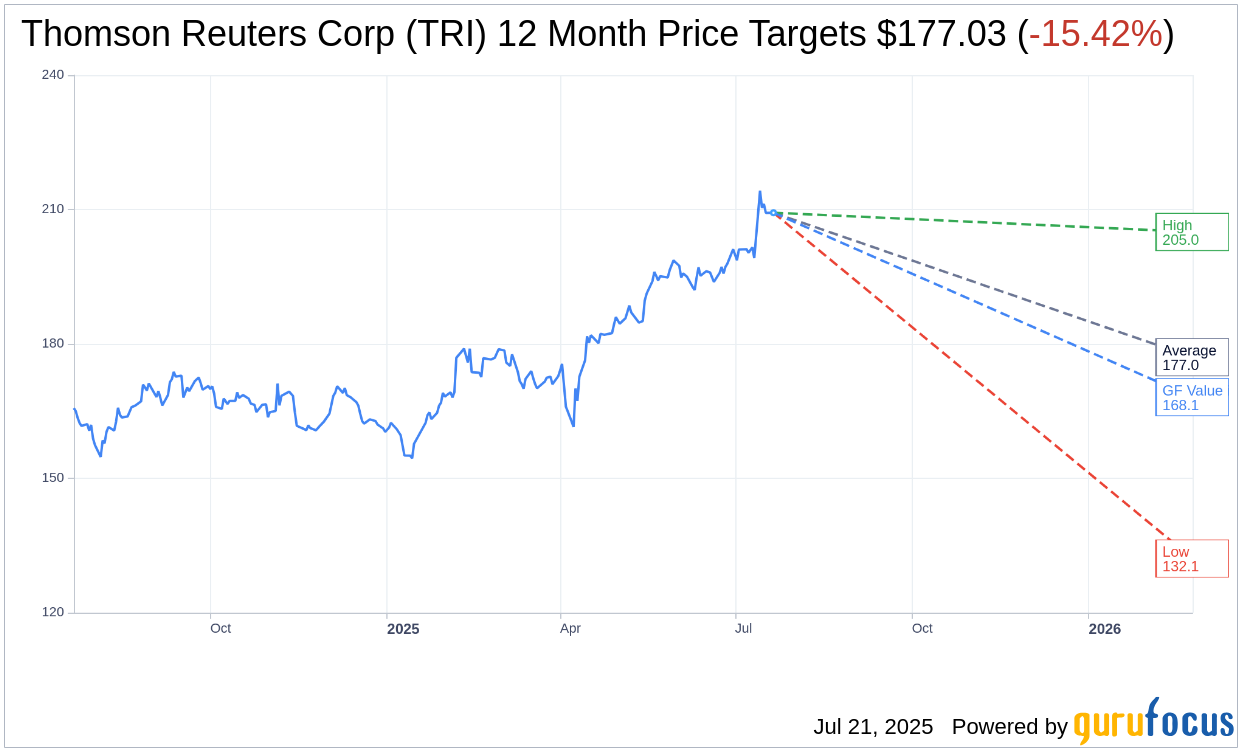

- Analysts suggest an average price target of $177.03, implying a potential downside.

- Current analyst consensus rating is "Hold" with a GF Value indicating potential overvaluation.

Thomson Reuters (TRI) is poised for a significant milestone as it is set to be added to the Nasdaq-100 Index, alongside other related indexes, before the market opens on July 28, 2025. This strategic move comes on the heels of Synopsys’ (SNPS) $35 billion acquisition of ANSYS (ANSS), which will consequently lead to ANSYS’ removal from several Nasdaq indices.

Wall Street Analysts' Outlook

Investors following Thomson Reuters Corp (TRI, Financial) can glean insights from the latest analyst forecasts. According to projections from 15 financial analysts, the average one-year price target for TRI is pegged at $177.03. This target encompasses a high of $205.00 and a low of $132.08. Notably, this average price target implies a potential downside of 15.42% from the current trading price of $209.29. For more detailed analysis, visit the Thomson Reuters Corp (TRI) Forecast page.

Further reflecting on Thomson Reuters Corp's market stance, a consensus recommendation derived from 17 brokerage firms positions the stock at an average rating of 2.8. This figure signifies a "Hold" recommendation on the ratings scale, which ranges from 1 (Strong Buy) to 5 (Sell).

GuruFocus Valuation Insight

From the perspective of GuruFocus analytics, the estimated GF Value for Thomson Reuters in the next year is set at $168.11, indicating a notable downside of 19.68% from its current share price of $209.29. The GF Value represents GuruFocus’ estimation of the fair trading value for the stock, determined through historical trading multiples, past business growth, and future performance projections. For a comprehensive overview, please refer to the Thomson Reuters Corp (TRI, Financial) Summary page.