Key Takeaways:

- Wolters Kluwer is streamlining its operations by selling its Finance, Risk, and Regulatory Reporting unit.

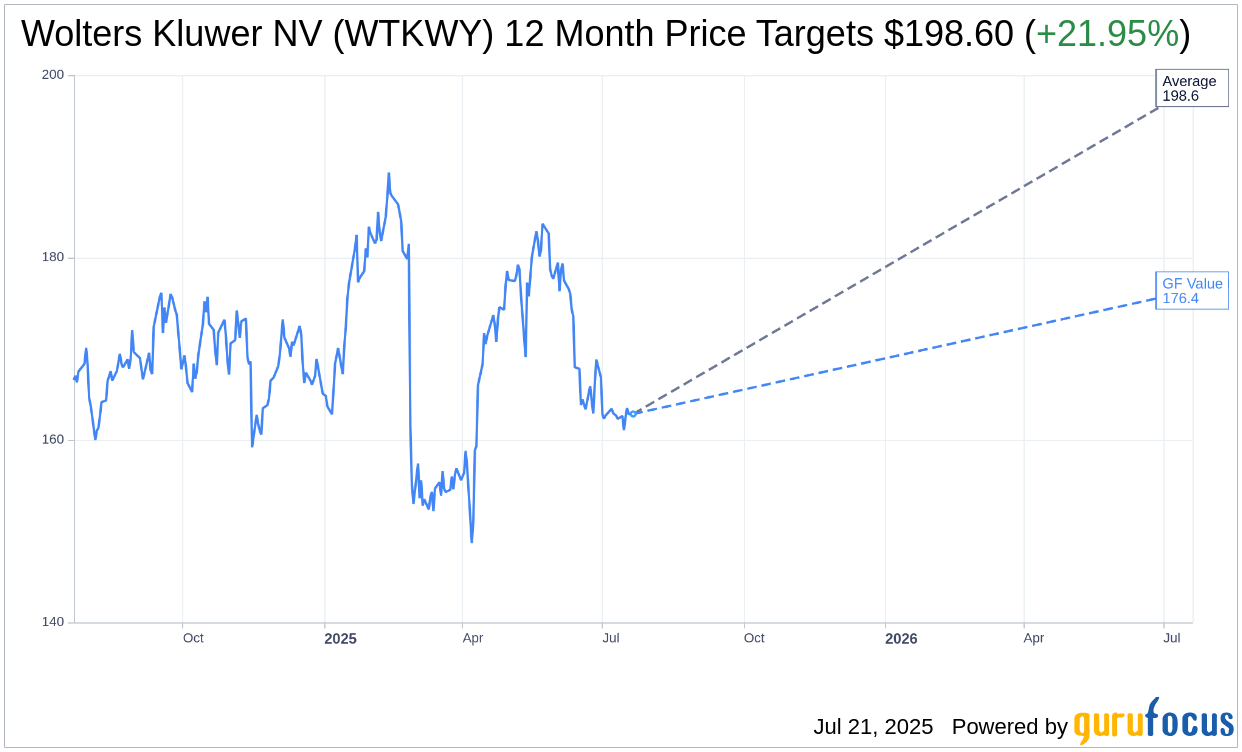

- Analysts suggest a potential upside of 21.95% based on current price targets.

- GuruFocus estimates an 8.31% upside, highlighting a favorable investment opportunity.

Wolters Kluwer's Strategic Shift

Wolters Kluwer (WTKWY, Financial) has entered into a binding agreement to divest its Finance, Risk, and Regulatory Reporting unit to Regnology Group GmbH for approximately €450 million. This strategic decision is targeted at reinforcing the company's focus on the U.S. banking compliance and corporate legal services sectors. By streamlining its operations, Wolters Kluwer aims to enhance its core competencies and drive growth in these key areas.

Analyst Price Targets and Recommendations

Wall Street analysts have provided a one-year average price target for Wolters Kluwer NV (WTKWY, Financial) at $198.60, with both the high and low estimates aligning at this level. This target suggests a potential upside of 21.95% from the current trading price of $162.85. For a more comprehensive analysis, please visit the Wolters Kluwer NV (WTKWY) Forecast page.

Consensus from one brokerage firm rates Wolters Kluwer NV's (WTKWY, Financial) stock as a "Buy" with an average recommendation of 1.0 on a scale where 1 indicates Strong Buy and 5 indicates Sell. This reflects positive sentiment from analysts regarding the stock's potential performance.

Understanding GF Value and Growth Estimates

According to GuruFocus, the estimated GF Value for Wolters Kluwer NV (WTKWY, Financial) in one year stands at $176.39. This indicates an upside of 8.31% from the current price of $162.85. The GF Value is GuruFocus' calculation of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. To dive deeper into these estimates, visit the Wolters Kluwer NV (WTKWY) Summary page.

These estimates and judgments serve as a valuable resource for investors considering WTKWY, offering a comprehensive insight into its potential as a strategic investment.