Key Highlights:

- Hyperscale Data (GPUS, Financial) has initiated a strategic $125 million mixed shelf filing to boost financial agility.

- Wall Street experts predict an astronomical upside for GPUS, with some forecasts suggesting a nearly 4 million percent increase.

- GuruFocus estimates a notable 42.31% upside potential based on their GF Value analysis.

Hyperscale Data (GPUS) has strategically announced a $125 million mixed shelf filing. This financial maneuver is poised to enhance the company’s monetary flexibility, providing potential pathways for debt reduction or investment in emerging market opportunities.

Wall Street Analysts Forecast

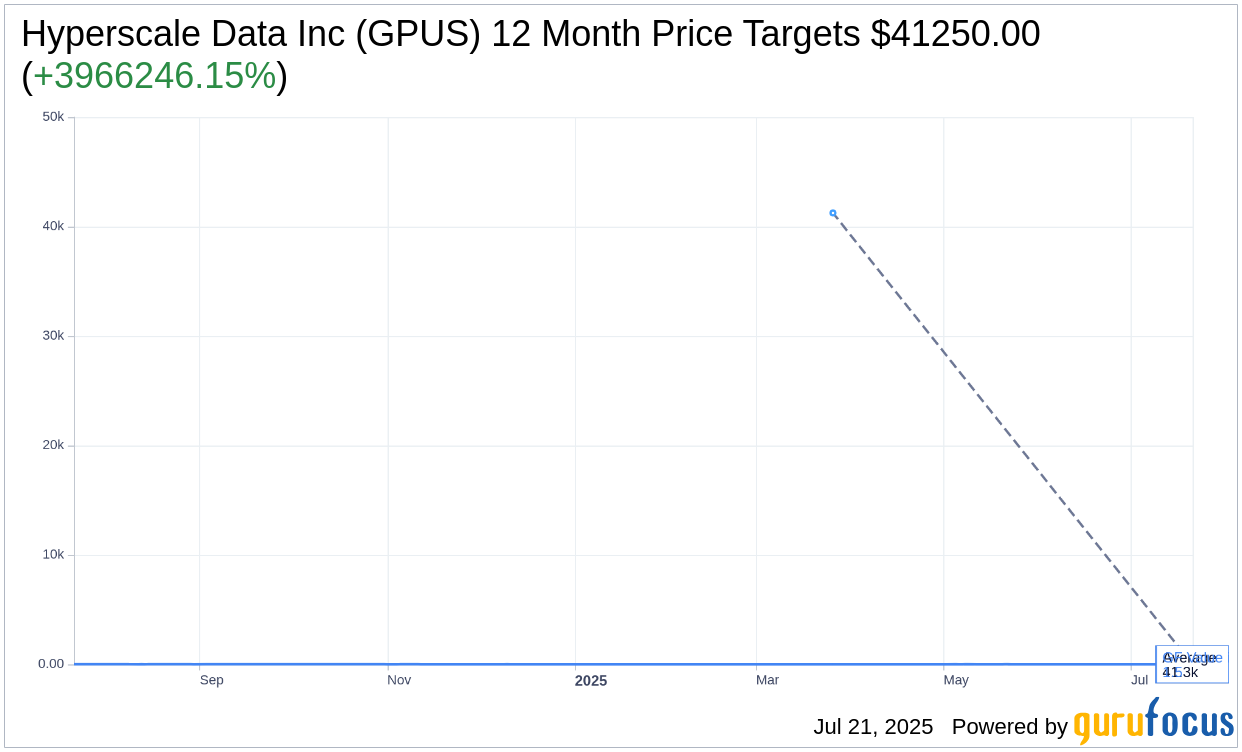

Financial analysts have offered their insights on Hyperscale Data Inc (GPUS, Financial), setting the one-year price target at a substantial $41,250.00. Notably, the high, low, and average estimates converge at this figure, forecasting an extraordinary upside of 3,966,246.15% from the current trading price of $1.04. Investors seeking further detailed projections can explore the Hyperscale Data Inc (GPUS) Forecast page.

From a consensus standpoint, 1 brokerage firm currently recommends Hyperscale Data Inc (GPUS, Financial) as an "Outperform," with an average brokerage rating of 2.0. This recommendation reflects the stock's promising potential, where a scale of 1 signifies "Strong Buy" and 5 denotes "Sell."

GuruFocus GF Value Analysis

According to GuruFocus evaluations, Hyperscale Data Inc (GPUS, Financial) is projected to have a GF Value of $1.48 in one year, indicating an impressive potential upside of 42.31% from its current price of $1.04. The GF Value represents the fair market value estimation based on historical trading multiples, past business growth trajectories, and forward-looking performance assessments. Investors keen on detailed insights can visit the Hyperscale Data Inc (GPUS) Summary page for comprehensive data.