- SS&C Technologies sets sights on acquiring Calastone, enhancing its growth trajectory.

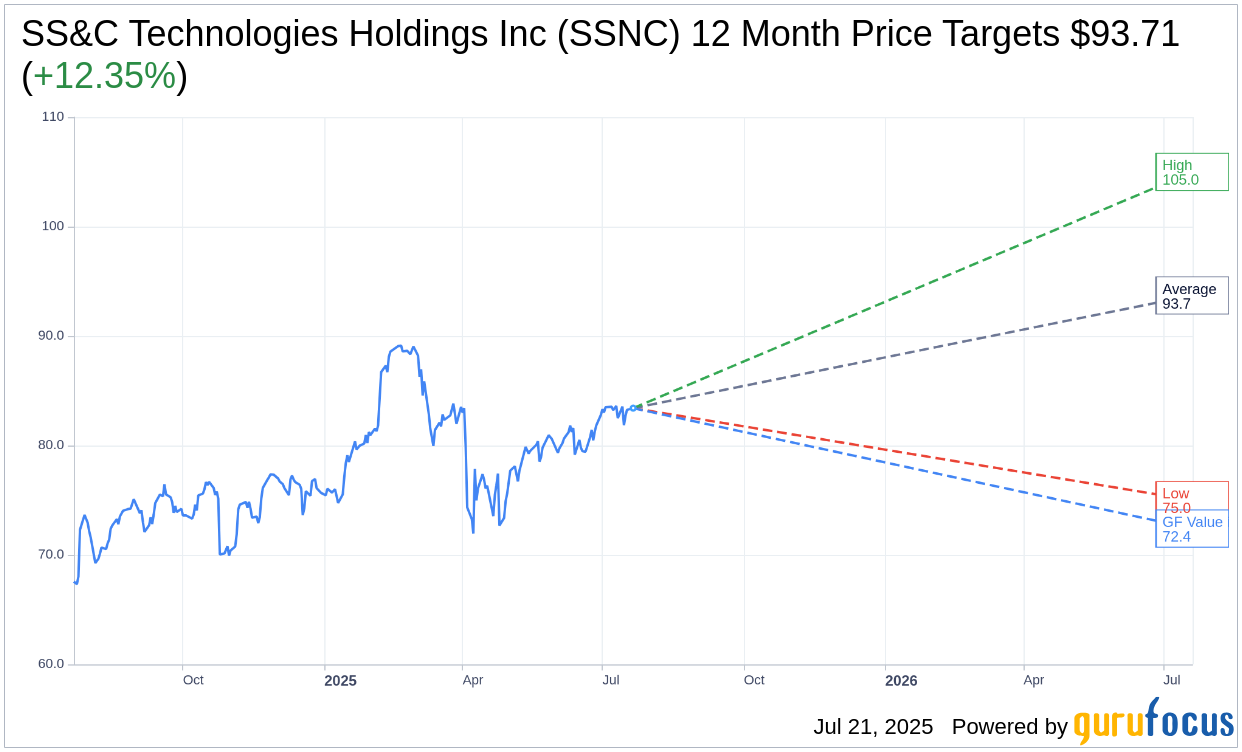

- Analysts project a 12.35% upside for SS&C Technologies stock.

- GuruFocus estimates a potential downside of 13.19% based on GF Value metrics.

SS&C Technologies Targets Strategic Growth with Calastone Acquisition

SS&C Technologies Holdings Inc. (NASDAQ: SSNC) has strategically announced its intention to purchase Calastone, a prominent British funds network currently under the ownership of Carlyle, for a substantial $1.03 billion. This acquisition, anticipated to finalize by the fourth quarter of 2025, remains pending regulatory approval and will be financed through a combination of cash and debt.

Wall Street Analysts Project Market Movement

As per insights from nine analysts, SS&C Technologies is forecasted to reach an average price target of $93.71 over the next year, with estimates fluctuating between a high of $105.00 and a low of $75.00. This projection suggests a potential upside of approximately 12.35% from the current trading price of $83.41. For a more in-depth exploration of these projections, visit the SS&C Technologies Holdings Inc (SSNC, Financial) Forecast page.

Brokerage Recommendations Favor Performance

The collective insight from 11 brokerage firms places SS&C Technologies in an "Outperform" standing, with an average recommendation of 1.8 on a 1 to 5 scale—where 1 is a Strong Buy and 5 is a Sell.

Understanding GuruFocus's GF Value Assessment

According to GuruFocus's valuation metrics, the estimated GF Value for SS&C Technologies in the coming year is $72.41. This estimation points to a potential downside of 13.19% from the current market price of $83.41. The GF Value is computed using historical trading multiples alongside past business growth and future performance forecasts. For comprehensive data, please refer to the SS&C Technologies Holdings Inc (SSNC, Financial) Summary page.