Linde (LIN, Financial) is making significant strides in the U.S. space industry through new investments aimed at supplying essential gases for rocket launches. The company has secured two key long-term agreements to provide bulk industrial gases, solidifying its influence in this burgeoning sector. As part of these plans, Linde will enhance its industrial gas operations in Mims, Florida, offering critical supplies like liquid oxygen and nitrogen to support nearby launch sites. This expansion is poised to commence in early 2027, building on previous growth phases in 2020 and 2024 due to high regional demand.

Additionally, Linde will establish a new air separation unit in Brownsville, Texas, under a separate deal. Scheduled for completion by the first quarter of 2026, this facility will produce liquid oxygen, nitrogen, and argon, meeting the needs of space industry operations in the area. This expansion not only bolsters Linde's role in space exploration but also enhances its extensive industrial gas infrastructure, increasing its merchant capacity across Texas.

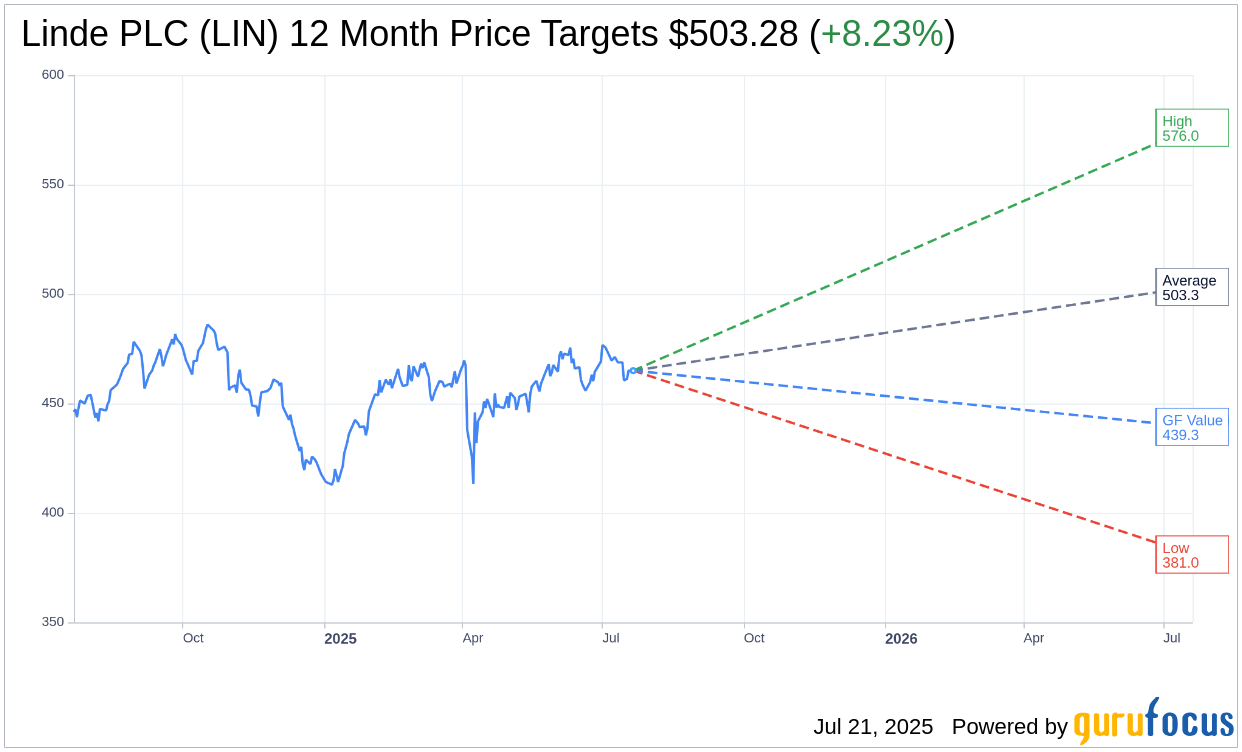

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for Linde PLC (LIN, Financial) is $503.28 with a high estimate of $576.00 and a low estimate of $381.00. The average target implies an upside of 8.23% from the current price of $465.01. More detailed estimate data can be found on the Linde PLC (LIN) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Linde PLC's (LIN, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Linde PLC (LIN, Financial) in one year is $439.34, suggesting a downside of 5.52% from the current price of $465.01. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Linde PLC (LIN) Summary page.

LIN Key Business Developments

Release Date: May 01, 2025

- Revenue: $8.1 billion, flat compared to the prior year and down 2% sequentially.

- Operating Margin: Expanded by 120 basis points to 30.1%.

- Return on Capital (ROC): Maintained at 25.7%.

- Earnings Per Share (EPS): $3.95, a 5% increase over the prior year, or 8% excluding currency effects.

- Capital Expenditure (CapEx): $1.3 billion, split equally between base CapEx and project backlog.

- Operating Cash Flow: $2.2 billion, an 11% increase from the previous year.

- Dividend Growth: Annual dividend increased by 8%, marking 32 consecutive years of growth.

- Stock Repurchase: $1.1 billion worth of stock repurchased during the quarter.

- Project Backlog: $10 billion, with more than $7 billion in sale of gas projects.

- Second Quarter EPS Guidance: $3.95 to $4.05, representing 3% to 5% growth.

- Full Year EPS Guidance: $16.20 to $16.50, maintaining the original guidance midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Linde PLC (LIN, Financial) achieved an 8% growth in APS XFX and expanded operating margins by 120 basis points to 30.1%.

- The company maintained an industry-leading return on capital (ROC) at 25.7%.

- Linde PLC (LIN) has a strong backlog of $10 billion, with over $7 billion in sale of gas projects underpinned by long-term contracts.

- The company raised its annual dividend by 8%, marking 32 consecutive years of dividend growth.

- Linde PLC (LIN) continues to see attractive acquisition opportunities, contributing 1% to sales growth through packaged gas tuck-ins in North America.

Negative Points

- Linde PLC (LIN) experienced a 1% decline in volumes, primarily driven by seasonal factors and weaker trends in certain packaged gas markets.

- The company faces challenges from lower helium and rare gas prices, particularly impacting the APAC region.

- Industrial activity remains sluggish in most geographies, dragging down base volumes.

- The American segment is experiencing mixed results, with weakness in Canada and US package gases due to manufacturing uncertainty.

- Linde PLC (LIN) anticipates more volatility in end market trends due to rapid changes in global trade policy.