Bank of America has revised its target price for Eversource (ES, Financial) upwards from $62 to $67, while maintaining a Neutral rating on the stock. The bank anticipates that Eversource will report second-quarter operating earnings per share (EPS) of 95 cents, which falls short of the market's consensus estimate of 97 cents per share.

Moreover, the firm has slightly increased its full-year EPS projection for the utility company to $4.74 from $4.72. Despite this upward adjustment, the estimate still trails the consensus expectation of $4.75. These updates reflect a cautious but optimistic outlook for Eversource amid varying market expectations.

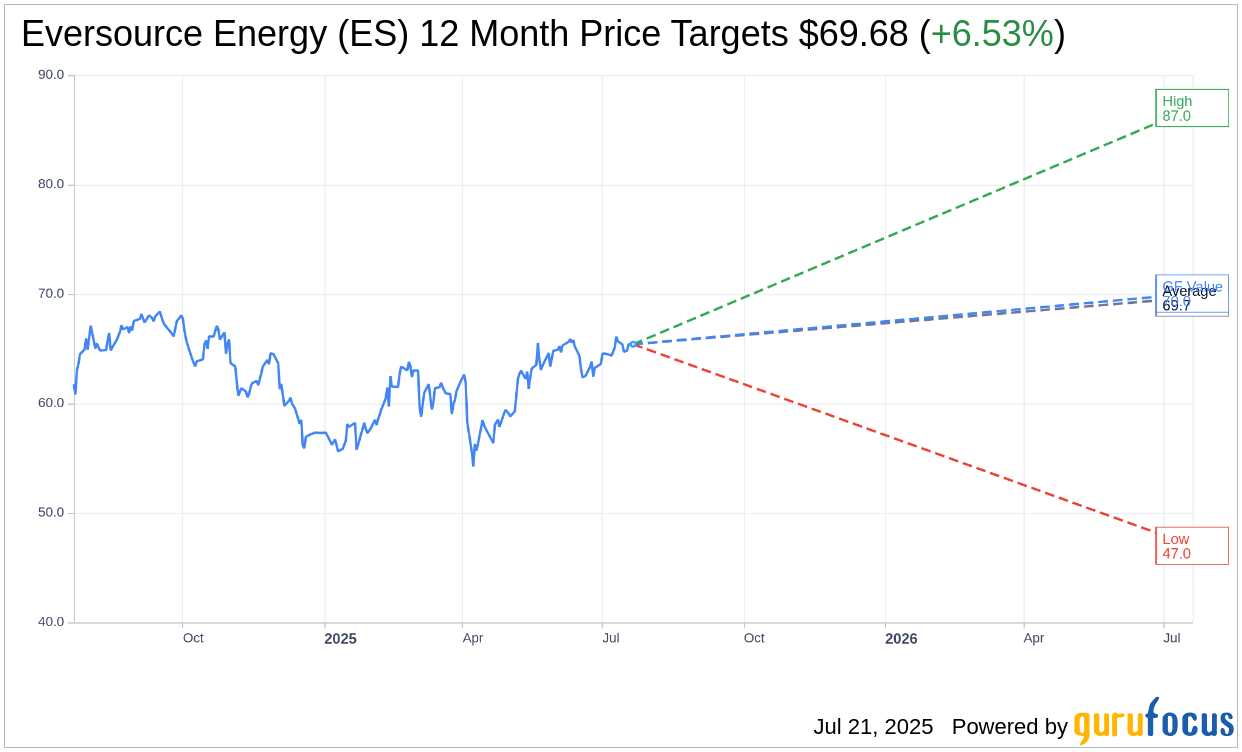

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Eversource Energy (ES, Financial) is $69.68 with a high estimate of $87.00 and a low estimate of $47.00. The average target implies an upside of 6.53% from the current price of $65.41. More detailed estimate data can be found on the Eversource Energy (ES) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Eversource Energy's (ES, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Eversource Energy (ES, Financial) in one year is $70.05, suggesting a upside of 7.09% from the current price of $65.41. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Eversource Energy (ES) Summary page.

ES Key Business Developments

Release Date: May 02, 2025

- GAAP and Recurring Earnings: $1.50 per share for Q1 2025, compared to $1.49 per share in Q1 2024.

- Transmission Earnings: Increased by $0.04 per share due to higher revenues from system investments.

- Electric Distribution Earnings: Increased by $0.03 per share, benefiting from grid modernization and rate mechanisms.

- Natural Gas Segment Earnings: Improved by $0.06 per share due to higher revenues from infrastructure investments.

- Parent Losses: Increased by $0.12 per share, primarily due to higher interest expenses.

- Five-Year Capital Plan: $24.2 billion, a 10% increase over the previous plan.

- Transmission Infrastructure Investments: Nearly $7 billion over the next five years.

- Electric Distribution Investments: Over $10 billion planned, with 60% in Massachusetts.

- 2025 EPS Guidance: Reaffirmed at $4.67 to $4.82 per share.

- Long-term EPS Growth Rate: 5% to 7% through 2029.

- FFO to Debt Ratio: Expected to improve significantly over 2024 levels.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Eversource Energy (ES, Financial) reaffirmed its 2025 EPS guidance and long-term EPS growth rate of 5% to 7% through 2029.

- The company projects an 8% rate base growth over the five-year forecast period, with additional opportunities beyond this period.

- Eversource Energy (ES) is making significant progress on its AMI project in Massachusetts, which is expected to empower customers with data-driven energy usage decisions.

- The acquisition of the Mystic site in Everett presents a strategic opportunity for multiuse energy resource interconnection in New England.

- Eversource Energy (ES) is actively collaborating with state leaders to address affordability and stabilize rates, including a 10% reduction in winter gas rates in Massachusetts.

Negative Points

- Higher utility earnings were offset by a decrease in parent and other earnings, impacting overall financial performance.

- The company faces challenges related to tariffs, which could potentially increase capital project costs by 3% to 6%.

- Eversource Energy (ES) is dealing with regulatory uncertainties in Connecticut, including pending rate proceedings and the composition of PURA.

- The company has increased interest expenses and the absence of capitalized interest from its former offshore wind investment, affecting financial results.

- There is ongoing uncertainty regarding the timing and impact of performance-based ratemaking plans in New Hampshire and Connecticut.