On July 21, 2025, Roper Technologies Inc (ROP, Financial) released its 8-K filing for the second quarter ended June 30, 2025. The company reported a 13% increase in revenue to $1.94 billion, surpassing the analyst estimate of $1.92412 billion. The GAAP diluted earnings per share (EPS) rose by 12% to $3.49, exceeding the estimated EPS of $3.39. Roper Technologies is a holding company that focuses on acquiring, managing, and developing niche market-leading technology businesses, with a significant portion of its revenue derived from software products and recurring sources.

Performance Highlights and Challenges

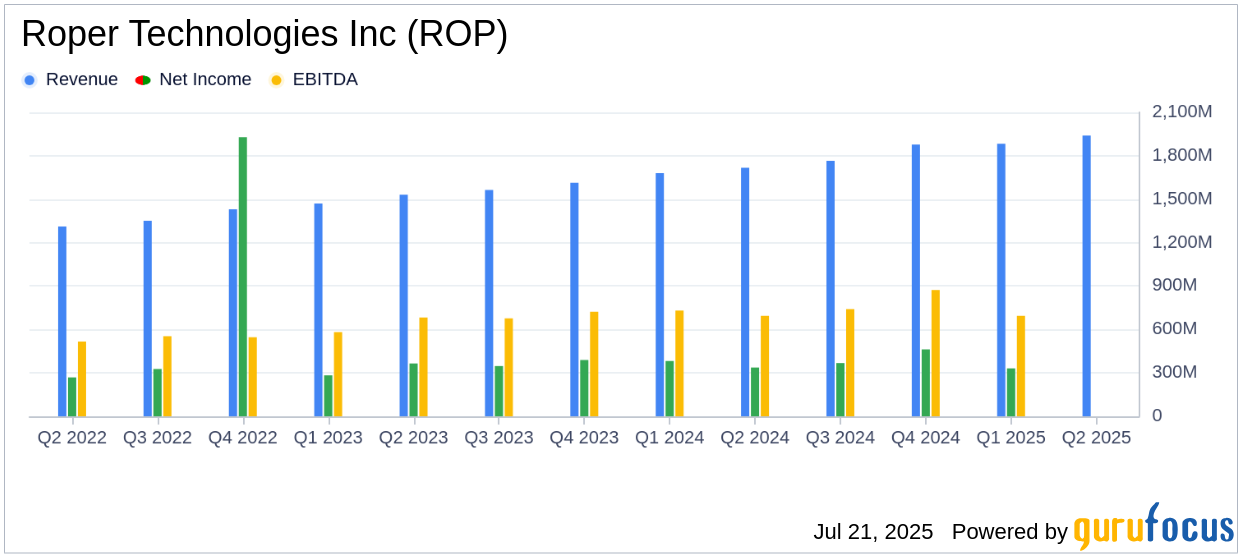

Roper Technologies Inc (ROP, Financial) demonstrated robust performance in the second quarter of 2025, with a 13% increase in total revenue and a 7% rise in organic revenue. The company's adjusted net earnings increased by 9% to $528 million, while adjusted EBITDA grew by 12% to $775 million. These results underscore the company's ability to execute its strategy effectively, leveraging its decentralized business model and focusing on high-quality acquisitions.

However, the company faces challenges such as maintaining its growth trajectory amidst potential economic uncertainties and integrating new acquisitions like Subsplash, which could impact its financial performance if not managed effectively.

Financial Achievements and Industry Significance

Roper Technologies Inc (ROP, Financial) achieved significant financial milestones, including a 5% increase in GAAP operating cash flow to $404 million and a 13% rise in adjusted operating cash flow to $434 million. These achievements are crucial for a company in the software industry, as they highlight the ability to generate substantial cash flow, which can be reinvested into further acquisitions and innovation.

Key Financial Metrics

The company's income statement reveals a GAAP net earnings increase of 12% to $378 million. The balance sheet and cash flow statement indicate strong cash generation capabilities, with adjusted free cash flow rising by 10% to $403 million. These metrics are vital for assessing the company's financial health and its capacity to sustain growth and shareholder value.

We delivered another strong quarter, highlighted by 13% total revenue growth, 7% organic revenue growth, and 10% free cash flow growth," said Neil Hunn, Roper Technologies' President and CEO.

| Metric | Q2 2024 | Q2 2025 | Change (%) |

|---|---|---|---|

| GAAP Revenue | $1.717 billion | $1.944 billion | 13% |

| Adjusted EBITDA | $695 million | $775 million | 12% |

| GAAP Net Earnings | $337 million | $378 million | 12% |

| Adjusted Net Earnings | $483 million | $528 million | 9% |

Analysis and Future Outlook

Roper Technologies Inc (ROP, Financial) continues to demonstrate its strength in generating revenue and earnings growth, driven by its strategic acquisitions and focus on recurring revenue streams. The company's acquisition of Subsplash, a provider of AI-enabled software solutions, aligns with its strategy to enhance shareholder value through high-quality acquisitions. The increased full-year guidance reflects confidence in sustaining growth momentum.

Overall, Roper Technologies Inc (ROP, Financial) is well-positioned to capitalize on its strong business model and acquisition strategy, which could lead to continued financial success and value creation for shareholders.

Explore the complete 8-K earnings release (here) from Roper Technologies Inc for further details.