Hyperscale Data, trading under the ticker GPUS, has revealed an ambitious plan to expand its data center campus in Michigan, targeting a total capacity of 340 megawatts. Currently, the facility operates at around 30 MW, with goals to boost this capacity to 70 MW within the next 20 months. The full-scale development is expected to be completed in 44 months, contingent upon finalizing an agreement with the local utility provider and securing necessary funding.

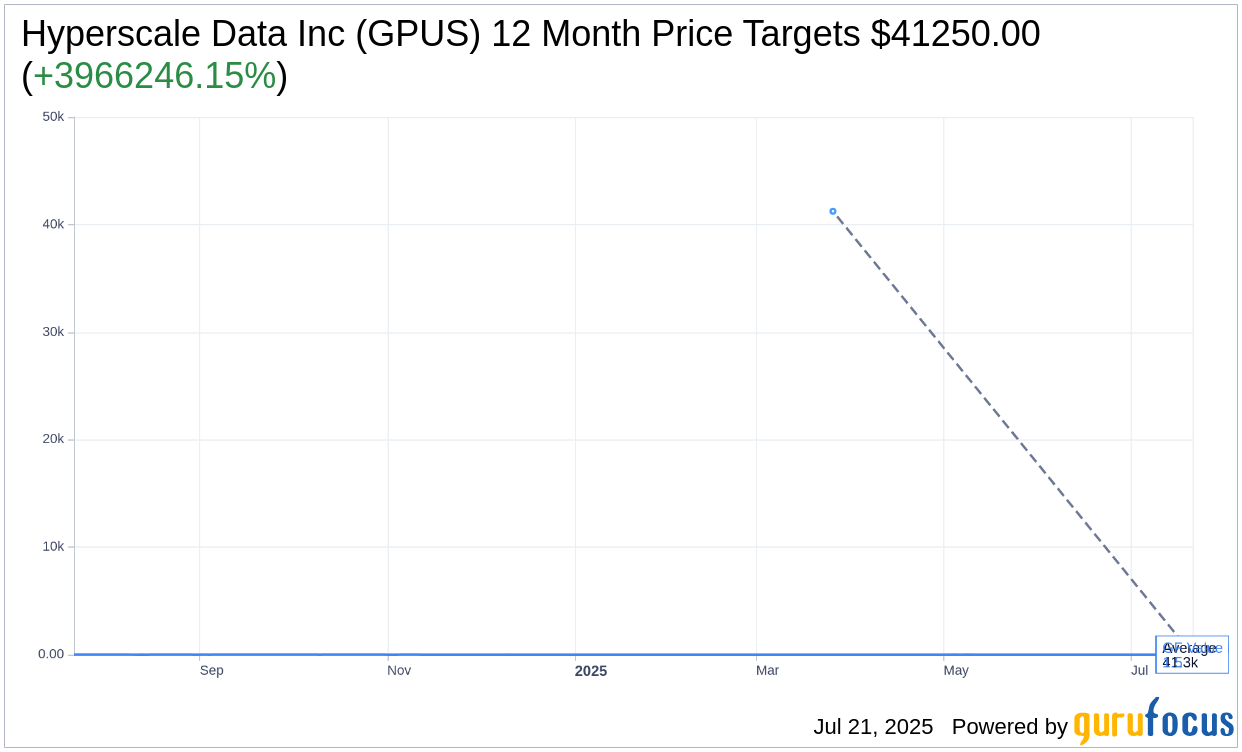

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Hyperscale Data Inc (GPUS, Financial) is $41,250.00 with a high estimate of $41,250.00 and a low estimate of $41,250.00. The average target implies an upside of 3,966,246.15% from the current price of $1.04. More detailed estimate data can be found on the Hyperscale Data Inc (GPUS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Hyperscale Data Inc's (GPUS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hyperscale Data Inc (GPUS, Financial) in one year is $1.48, suggesting a upside of 42.31% from the current price of $1.04. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hyperscale Data Inc (GPUS) Summary page.