On July 21, 2025, analyst Meyer Shields from Keefe, Bruyette & Woods maintained an "Underperform" rating for Marsh & McLennan Cos (MMC, Financial). This decision comes despite a reduction in the company's price target.

The analyst has adjusted the price target for MMC from $214.00 to $210.00, marking a decrease of 1.87%. This adjustment indicates a cautious outlook for the company's financial performance in the near future.

Marsh & McLennan Cos (MMC, Financial), a leading global professional services firm, continues to face performance challenges as reflected in the "Underperform" rating. Investors and stakeholders should consider these insights when making decisions related to MMC shares.

Wall Street Analysts Forecast

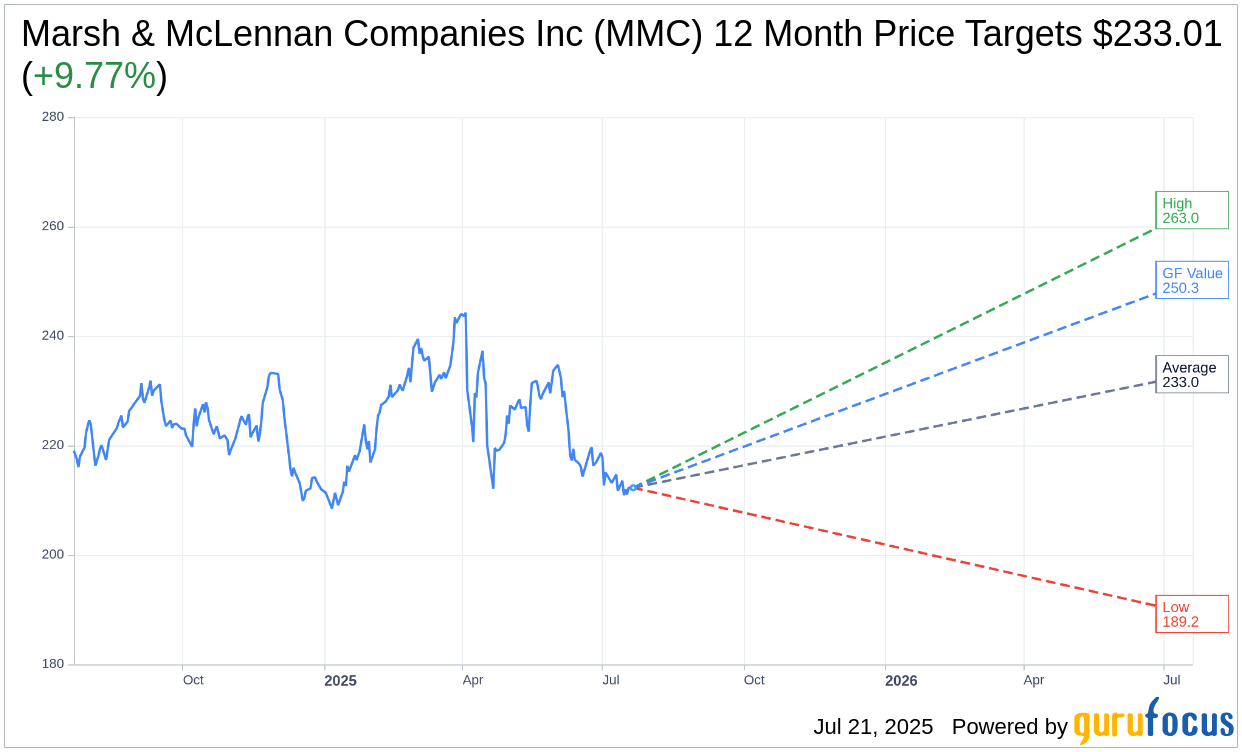

Based on the one-year price targets offered by 17 analysts, the average target price for Marsh & McLennan Companies Inc (MMC, Financial) is $233.01 with a high estimate of $263.00 and a low estimate of $189.21. The average target implies an upside of 9.77% from the current price of $212.28. More detailed estimate data can be found on the Marsh & McLennan Companies Inc (MMC) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Marsh & McLennan Companies Inc's (MMC, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Marsh & McLennan Companies Inc (MMC, Financial) in one year is $250.27, suggesting a upside of 17.9% from the current price of $212.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Marsh & McLennan Companies Inc (MMC) Summary page.