Stifel's analyst, Nathan Jones, has revised the price target for Valmont (VMI, Financial), elevating it from $345 to $382 while maintaining a Buy rating on the stock. Discussions with Valmont’s management and observations from the firm's channel checks suggest a robust and steady demand. This outlook is expected to encourage several companies to consider raising their guidance in the upcoming Q2 earnings reports, according to the analyst's preview for the Diversified Industrials sector.

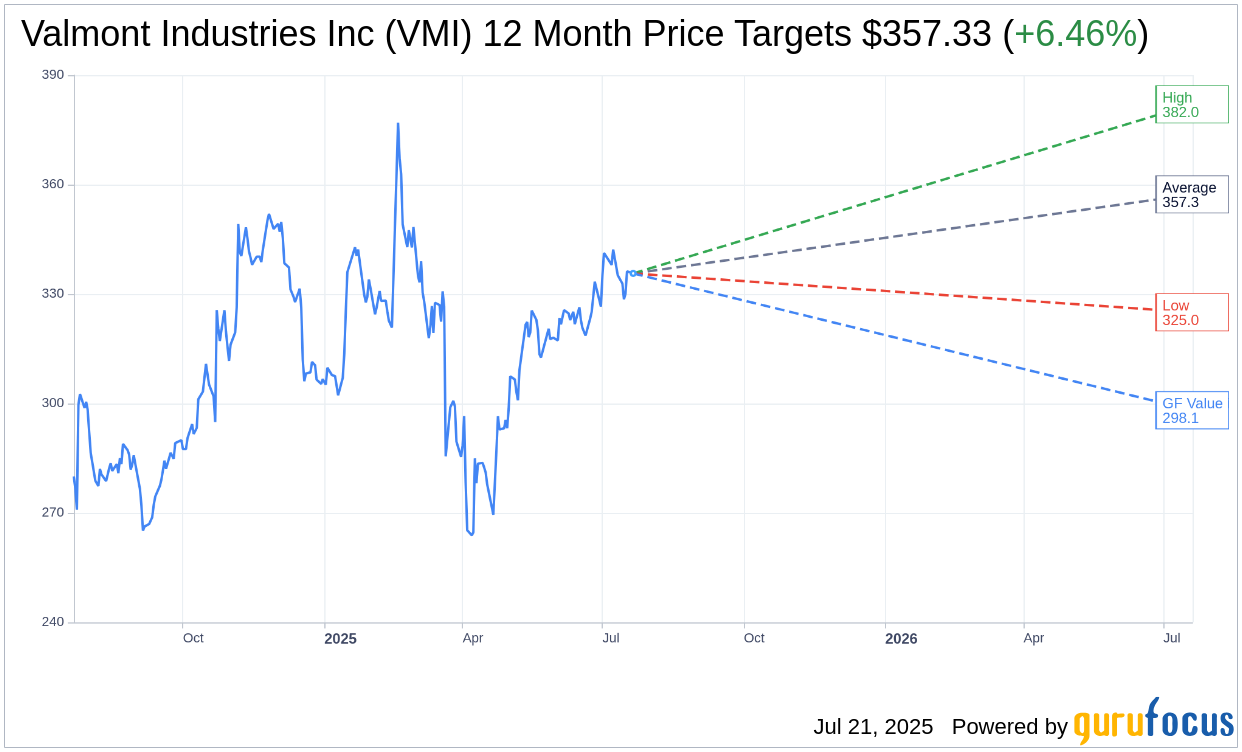

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Valmont Industries Inc (VMI, Financial) is $357.33 with a high estimate of $382.00 and a low estimate of $325.00. The average target implies an upside of 6.46% from the current price of $335.65. More detailed estimate data can be found on the Valmont Industries Inc (VMI) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Valmont Industries Inc's (VMI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Valmont Industries Inc (VMI, Financial) in one year is $298.14, suggesting a downside of 11.18% from the current price of $335.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Valmont Industries Inc (VMI) Summary page.

VMI Key Business Developments

Release Date: April 22, 2025

- Net Sales: $969.3 million, a decrease of 0.9% year-over-year.

- Gross Margin: 30%, a decrease of 130 basis points from the prior year.

- Operating Income: $128.3 million, or 13.2% of sales.

- Diluted Earnings Per Share: $4.32, in line with the prior year period.

- Infrastructure Sales: Decreased 2.4%; telecom and utility growth offset by lower solar and lighting sales.

- Utility Sales: Increased 2.4%, driven by higher volumes and selling prices.

- Telecommunications Sales: Nearly 30% growth due to favorable carrier spending.

- Agriculture Sales: Increased 3.3%, approximately 6% on a constant currency basis.

- Operating Cash Flow: $65.1 million, driven by earnings and lower inventory.

- Capital Expenditures: $30.3 million, primarily for capacity expansion in the Infrastructure segment.

- Dividend Increase: 13% increase announced during the quarter.

- Stock Repurchase Program: $59 million of shares repurchased in the second quarter at an average price of $269 per share.

- 2025 Outlook: Net sales projected between $4.0 billion to $4.2 billion; EPS expected between $17.20 to $18.80.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Valmont Industries Inc (VMI, Financial) reported a strong backlog of $1.5 billion, indicating healthy order activity and volume growth.

- The company is actively mitigating tariff risks with a local for local supply chain strategy, reducing exposure to international tariffs.

- Valmont Industries Inc (VMI) is investing in capacity expansion, with $30 million in CapEx directed towards increasing utility production.

- The telecommunications segment saw a robust 30% growth, driven by carrier spending on 5G upgrades and modernization.

- Valmont Industries Inc (VMI) is implementing cost optimization initiatives, which could result in $15 million to $20 million in savings once fully implemented.

Negative Points

- Consolidated net sales decreased by 0.9% year-over-year, with a decline in gross margin due to a higher mix of lower-margin international projects.

- The agriculture segment is facing challenges due to lower crop prices and pressured farm income, impacting North American market conditions.

- Solar sales declined by more than 50%, reflecting lower volumes and the strategic decision to exit low-margin projects.

- The lighting markets have been soft, with international sales exposure facing challenges, particularly in the Asia-Pacific region.

- Tariffs resulted in a $3 million cost in the first quarter, although the company expects to be cost-neutral by the end of the year.