Rogers Communications (RCI, Financial) has announced an update on its cash purchase offers for certain outstanding senior notes. Initially, the company set a maximum purchase amount of C$400 million, but has now decided to increase this amount to cover all tendered 4.25% Senior Notes due in 2049, 2.90% Senior Notes due in 2030, and 3.30% Senior Notes due in 2029. Furthermore, the company plans to accept approximately C$300 million of the 3.25% Senior Notes due in 2029.

The TSX Trust Company, acting as the Tender Agent, reported that by the expiration deadline, C$2,168,414,000 combined principal of these notes had been validly tendered and were not withdrawn before the specified cut-off of 5:00 p.m. on July 18, 2025.

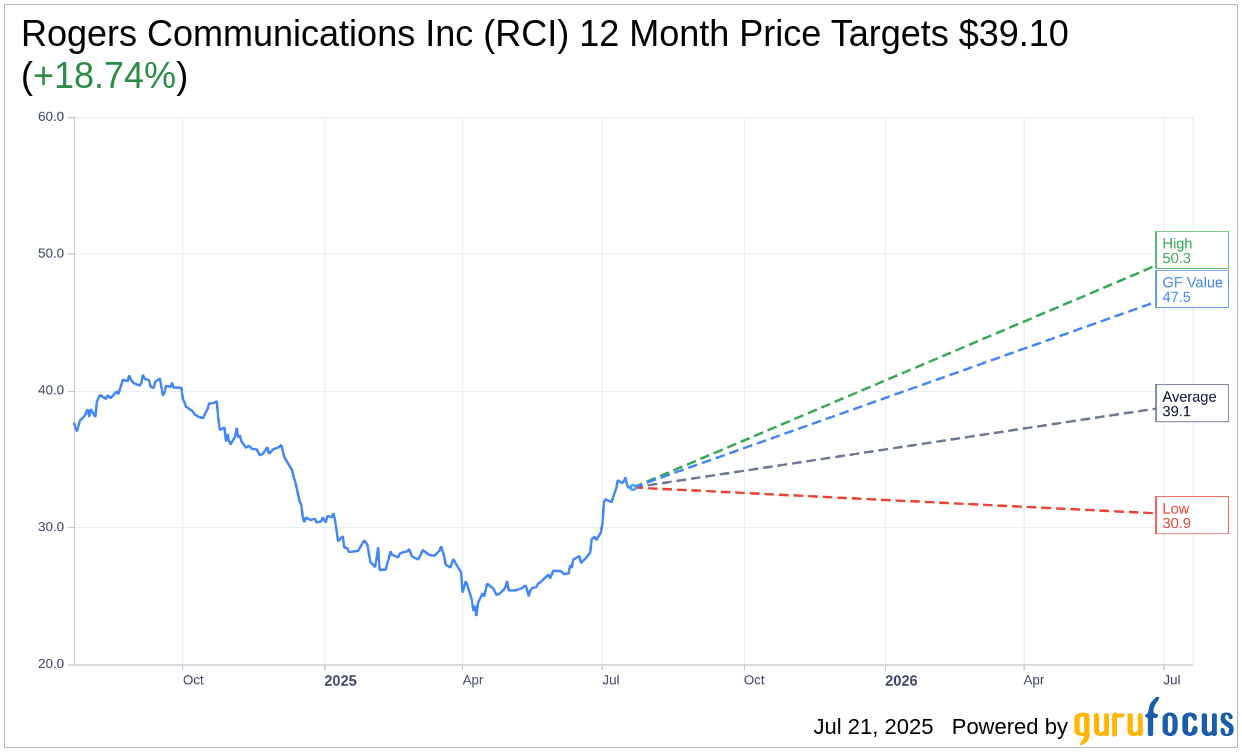

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Rogers Communications Inc (RCI, Financial) is $39.10 with a high estimate of $50.29 and a low estimate of $30.91. The average target implies an upside of 18.74% from the current price of $32.93. More detailed estimate data can be found on the Rogers Communications Inc (RCI) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Rogers Communications Inc's (RCI, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rogers Communications Inc (RCI, Financial) in one year is $47.45, suggesting a upside of 44.09% from the current price of $32.93. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rogers Communications Inc (RCI) Summary page.

RCI Key Business Developments

Release Date: April 23, 2025

- Service Revenue Growth: 2% year-over-year increase.

- Adjusted EBITDA Growth: 2% year-over-year increase.

- Wireless Margin: Increased by 40 basis points to just under 65%.

- Wireless Net Additions: 34,000 net new wireless subscribers.

- Postpaid Mobile Phone Churn: Decreased by 9 basis points to 1%.

- Blended Mobile Phone ARPU: Decreased by just under 2% to $57.

- Cable Service Revenue: Decreased by 1% year-over-year.

- Cable Adjusted EBITDA: Increased by 1% year-over-year.

- Internet Net Additions: 23,000 compared to 26,000 in the prior year.

- Cable Margin: Increased by 110 basis points to just over 57%.

- Sports and Media Revenue Growth: Increased by 24% year-over-year.

- Sports and Media EBITDA Improvement: $36 million year-over-year increase.

- Consolidated Operating Margins: Slight increase to just over 45%.

- Capital Expenditures: $978 million, down 8% from the previous year.

- Free Cash Flow: $586 million, unchanged from the prior year.

- Net Debt Leverage Ratio: Reduced to 4.3 times from 4.5 times at year-end 2024.

- Available Liquidity: $7.5 billion, including $2.7 billion in cash and $4.8 billion in credit facilities.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Rogers Communications Inc (RCI, Financial) reported a 2% growth in both service revenue and adjusted EBITDA, demonstrating resilience in a competitive market.

- The company achieved strong margin improvements year over year, maintaining industry-leading margins.

- Rogers Communications Inc (RCI) successfully executed its delevering plans, reducing leverage from 4.5 times to 3.6 times, positioning it as the lowest among major Canadian carriers.

- The company secured a $7 billion equity investment led by Blackstone, enhancing its balance sheet and financial stability.

- Rogers Communications Inc (RCI) was awarded the most reliable 5G wireless network in Canada for the seventh consecutive year, reinforcing its leadership in network reliability.

Negative Points

- The company experienced a decline in wireless subscriber additions, with 34,000 net new subscribers compared to 61,000 in the previous year, due to reduced immigration and market size.

- Blended mobile phone ARPU decreased by nearly 2% year over year, reflecting competitive intensity and lower roaming revenue.

- Cable service revenue declined by 1% in the quarter, impacted by competitive promotional activity and customer churn in satellite and video subscribers.

- The company faces challenges in maintaining price discipline in the wireless market, with ongoing competitive pressures and discounting.

- Rogers Communications Inc (RCI) is navigating a cautious economic environment with slower growth in its sector, driven by lower immigration and macroeconomic uncertainties.