- Parsons introduces the innovative BlueFly sensor to boost emergency response capabilities.

- Analysts predict a potential price increase for Parsons Corp (PSN, Financial), with an average target price of $82.15.

- Current consensus indicates an "Outperform" rating, suggesting growth potential for investors.

Parsons (PSN) has launched BlueFly, an innovative search and rescue sensor aimed at dramatically enhancing the efficiency of emergency response teams in tough and remote areas. This cutting-edge development is poised to improve mission success rates in challenging environments, making it a significant addition to Parsons' technological advancements.

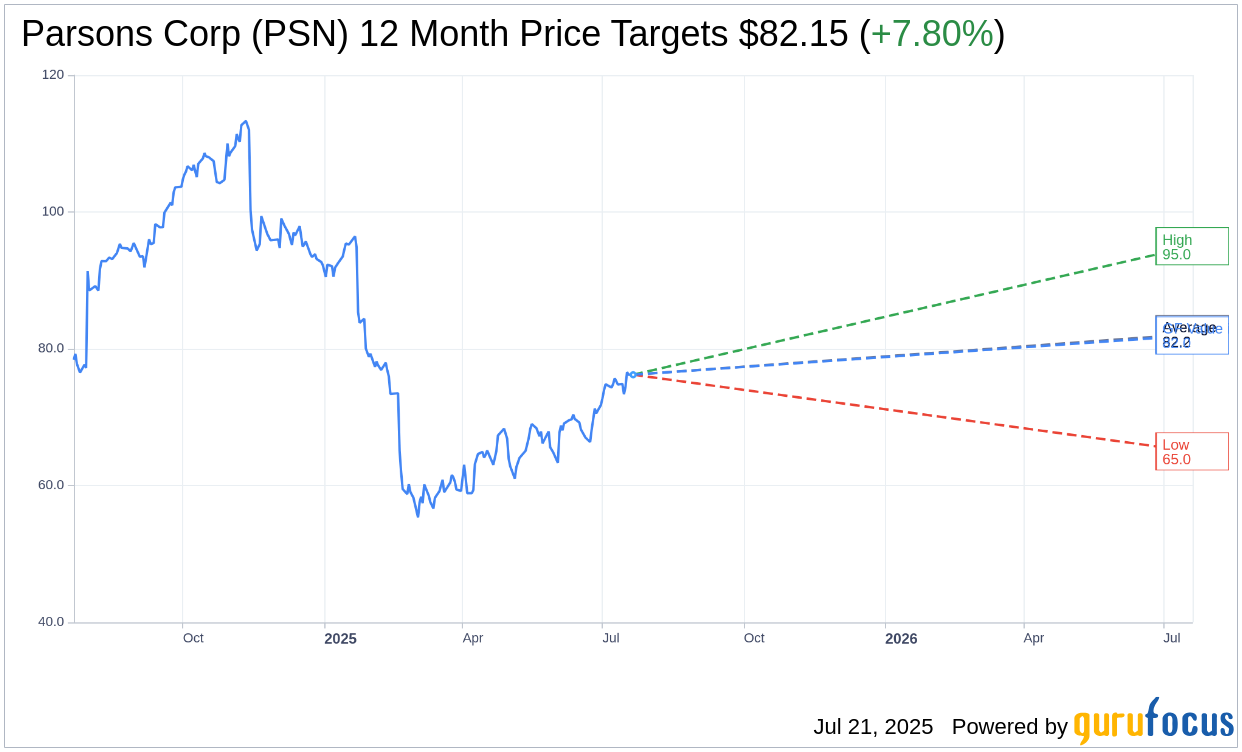

Wall Street Analysts Forecast

Analysts from 10 financial institutions have set their sights on Parsons Corp (PSN, Financial), offering a one-year average target price of $82.15. The projections range from a high of $95.00 to a low of $65.00, indicating a potential upside of 7.80% from its current market price of $76.21. Investors seeking more detailed estimations can explore the Parsons Corp (PSN) Forecast page for comprehensive insights.

According to consensus from 12 brokerage firms, Parsons Corp (PSN, Financial) carries an average brokerage recommendation of 2.3, denoting an "Outperform" status. This rating rests on a scale where 1 is Strong Buy and 5 is Sell, hinting at investors' positive sentiment towards the stock's future performance.

GuruFocus offers further insights with its estimated GF Value for Parsons Corp (PSN, Financial), positing a fair value of $81.95 in one year. This estimate suggests a potential upside of 7.53% from the current trading price of $76.21. The GF Value is calcualted based on historical trading multiples, previous business growth, and future performance projections. For additional data, visit the Parsons Corp (PSN) Summary page, where investors can dive deeper into the financial metrics.