Biogen (BIIB, Financial) plans to enhance its manufacturing capabilities with a substantial $2 billion investment in North Carolina's Research Triangle Park (RTP). This new funding adds to the company's considerable existing investment in the region, amounting to around $10 billion so far, with over $3 billion spent in recent years alone.

The latest financial commitment aims to propel Biogen's late-stage clinical developments forward. Over the coming years, Biogen will focus on expanding various facilities and technology across its RTP locations. Notably, the company will enhance its antisense oligonucleotide capabilities, establish clinical and commercial multi-platform fill-finish operations, and further modernize its manufacturing processes through advanced automation and artificial intelligence. This strategic move underscores Biogen's commitment to maintaining a leading edge in biotechnology and pharmaceuticals.

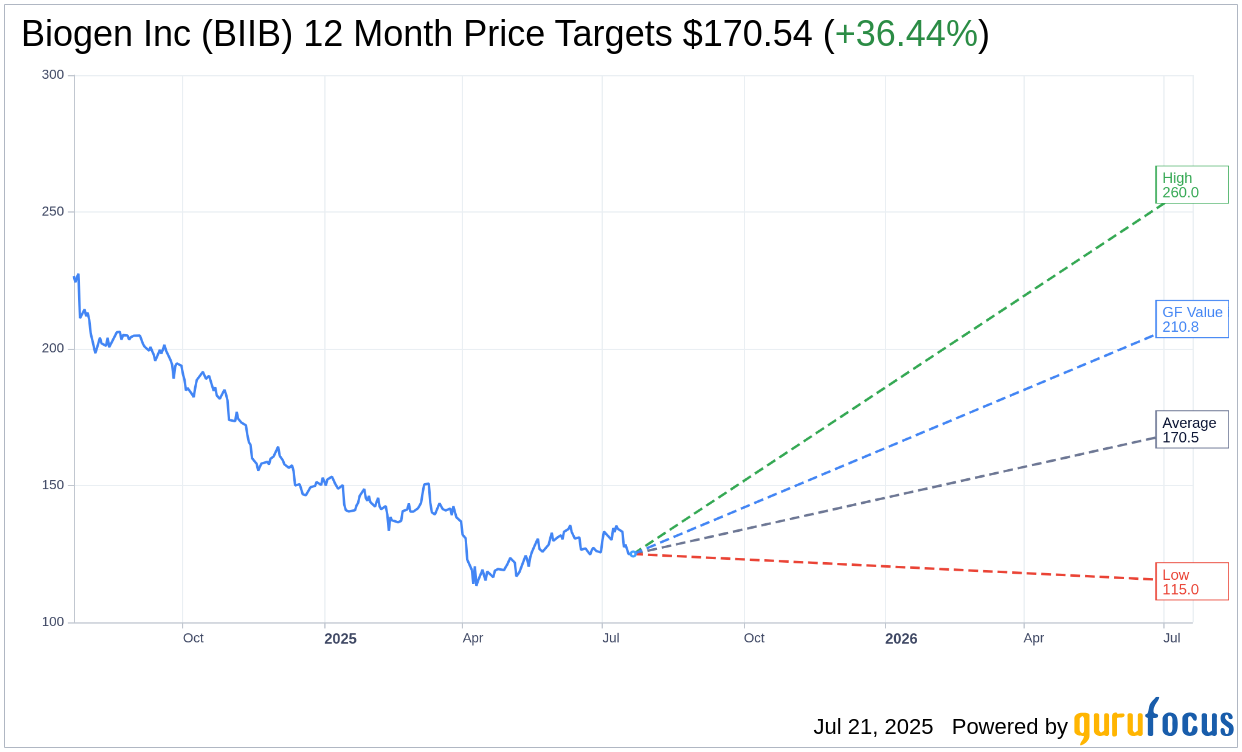

Wall Street Analysts Forecast

Based on the one-year price targets offered by 29 analysts, the average target price for Biogen Inc (BIIB, Financial) is $170.54 with a high estimate of $260.00 and a low estimate of $115.00. The average target implies an upside of 36.44% from the current price of $124.99. More detailed estimate data can be found on the Biogen Inc (BIIB) Forecast page.

Based on the consensus recommendation from 37 brokerage firms, Biogen Inc's (BIIB, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Biogen Inc (BIIB, Financial) in one year is $210.85, suggesting a upside of 68.69% from the current price of $124.99. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Biogen Inc (BIIB) Summary page.

BIIB Key Business Developments

Release Date: May 01, 2025

- Total Revenue: $2.4 billion, up 6% year-over-year.

- Non-GAAP Diluted EPS: $3.02, down 18% year-over-year; adjusted EPS would have been $3.97, up 8% year-over-year excluding a $165 million charge.

- Free Cash Flow: $222 million, including a $165 million upfront payment to Stoke.

- Cash Position: $2.6 billion at the end of the quarter.

- MS Franchise Revenue Decline: 11% year-over-year, primarily due to competition.

- LEQEMBI Sales: $96 million, up approximately 11% sequentially.

- SKYCLARYS Revenue: $124 million, up 59% year-over-year and 21% quarter-on-quarter.

- ZURZUVAE Sales: $28 million in Q1.

- VUMERITY Demand Increase: Remains the number 1 branded oral therapy.

- Guidance for 2025: Non-GAAP diluted EPS expected between $14.50 and $15.50; total revenue expected to decline by a mid-single-digit percentage.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Biogen Inc (BIIB, Financial) reported a strong start to the year with a significant increase in revenue from new product launches, contributing to 45% of product revenue.

- The company received FDA Fast Track designation for its ASO targeting BIIB080, indicating confidence in its potential for Alzheimer's treatment.

- LEQEMBI received marketing authorization in the EU, marking a significant regulatory endorsement for its efficacy and safety profile.

- Biogen Inc (BIIB) has a robust pipeline with five Phase III studies initiating this year, indicating a maturation of its pipeline.

- The company maintains a strong balance sheet, allowing for continued investment in internal and external growth opportunities.

Negative Points

- Biogen Inc (BIIB) faces declining revenue in its MS franchise due to competition from biosimilars and generics.

- The launch of LEQEMBI has been challenging due to the workload it imposes on treating physicians.

- The company anticipates a mid-single-digit percentage decline in total revenue for 2025, primarily driven by a decline in the MS business.

- Biogen Inc (BIIB) is experiencing impacts from the Medicare tax, affecting net sales growth.

- The tariff landscape remains uncertain, posing potential risks to the company's financial outlook.