In the second quarter, FUNC demonstrated a robust performance with an increase in its net interest margin, reaching 3.65% on a non-GAAP, fully tax-equivalent basis, compared to 3.49% the previous year. The tangible book value per share saw a significant rise to $27.64, up from $23.55 a year prior.

The company's CEO highlighted the strong performance, attributing it to effective management of funding costs and a favorable high-interest-rate environment that bolstered interest income from the loan portfolio. Loan production experienced growth during the quarter, and the pipeline remains promising. FUNC expanded its team in Morgantown during the first half of the year, indicating optimism about growth in that market. The company remains committed to recruiting talent and leveraging technology to enhance operational efficiency and improve the customer experience over the long term.

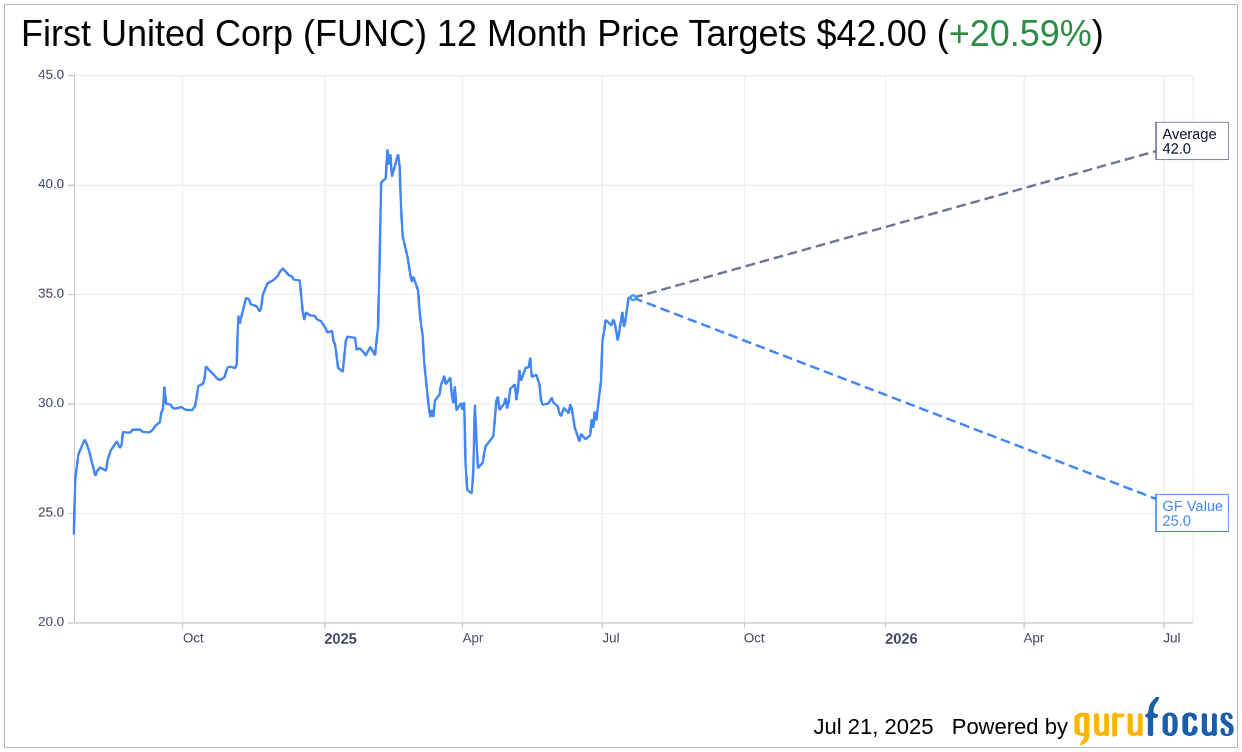

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for First United Corp (FUNC, Financial) is $42.00 with a high estimate of $42.00 and a low estimate of $42.00. The average target implies an upside of 20.59% from the current price of $34.83. More detailed estimate data can be found on the First United Corp (FUNC) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, First United Corp's (FUNC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First United Corp (FUNC, Financial) in one year is $25.00, suggesting a downside of 28.22% from the current price of $34.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First United Corp (FUNC) Summary page.