UBS analyst Brian Meredith has adjusted the price target for Marsh McLennan (MMC, Financial), reducing it from $261 to $258. Despite this revision, the analyst maintains a Buy rating on the company's shares, suggesting continued confidence in its performance. The adjustment reflects the latest analysis and outlook on the firm's financial trajectory.

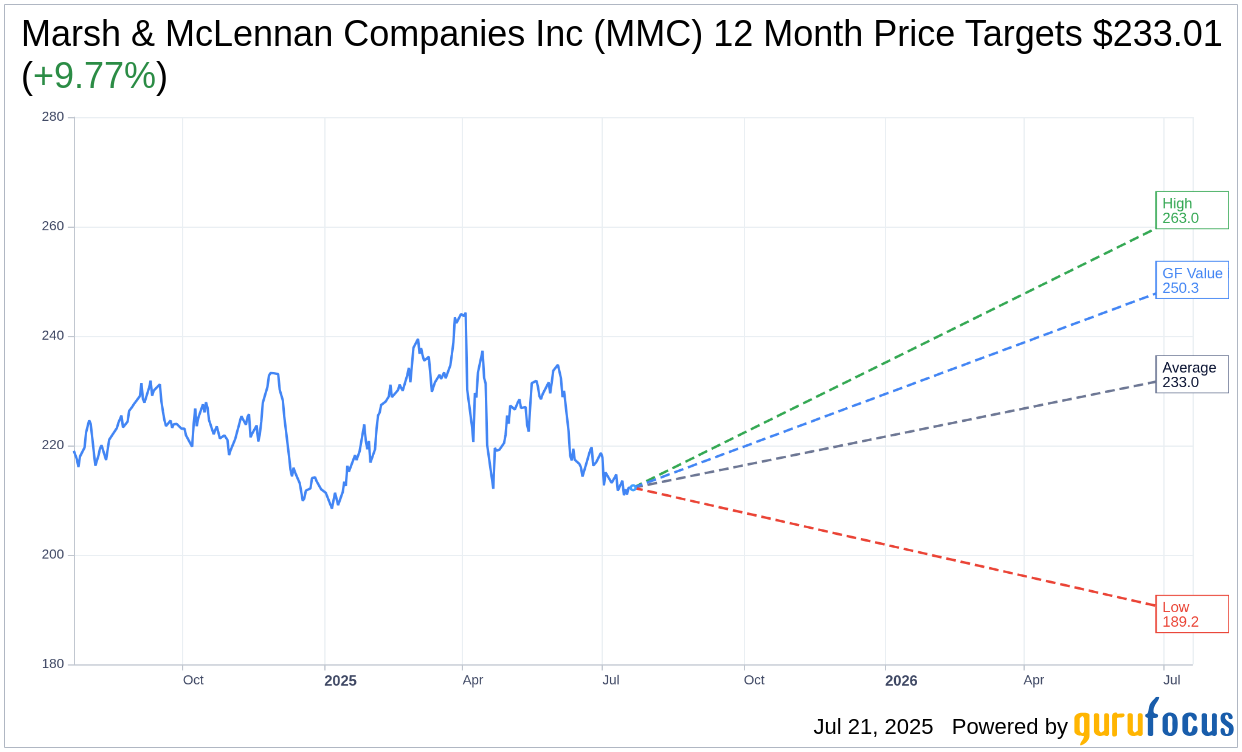

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Marsh & McLennan Companies Inc (MMC, Financial) is $233.01 with a high estimate of $263.00 and a low estimate of $189.21. The average target implies an upside of 9.77% from the current price of $212.28. More detailed estimate data can be found on the Marsh & McLennan Companies Inc (MMC) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Marsh & McLennan Companies Inc's (MMC, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Marsh & McLennan Companies Inc (MMC, Financial) in one year is $250.27, suggesting a upside of 17.9% from the current price of $212.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Marsh & McLennan Companies Inc (MMC) Summary page.

MMC Key Business Developments

Release Date: July 17, 2025

- Revenue: Increased 12% to $7 billion; underlying growth of 4%.

- Adjusted Operating Income: Increased 14% to $2.1 billion.

- Adjusted Operating Margin: Increased 50 basis points to 29.5%.

- Adjusted EPS: Grew 11% to $2.72.

- Quarterly Dividend: Increased 10% to $0.90.

- Share Repurchases: Completed $300 million during the quarter.

- Risk and Insurance Services Revenue: $4.6 billion, up 15% or 4% on an underlying basis.

- Consulting Revenue: $2.4 billion, up 7% or 3% on an underlying basis.

- Mercer Revenue: $1.5 billion, up 9% or 3% on an underlying basis.

- Oliver Wyman Revenue: $873 million, up 5% or 3% on an underlying basis.

- Assets Under Management: $670 billion, up 36% year-over-year.

- Interest Expense: $243 million, up from $156 million in the previous year.

- Cash Position: $1.7 billion at the end of the second quarter.

- Total Debt: $19.7 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Marsh & McLennan Companies Inc (MMC, Financial) reported a 12% increase in consolidated revenue for the second quarter, reflecting strong business momentum and successful acquisitions.

- Adjusted operating income grew by 14%, and adjusted EPS increased by 11%, indicating effective cost management and operational efficiency.

- The company announced a 10% increase in its quarterly dividend, demonstrating confidence in its financial stability and future outlook.

- International growth was robust, with EMEA up 8%, Asia Pacific up 4%, and Latin America up 3%, showcasing strong global market presence.

- Marsh & McLennan Companies Inc (MMC) is leveraging AI and advanced analytics to enhance client offerings and improve operational efficiencies, positioning itself well for future technological advancements.

Negative Points

- The macroeconomic environment remains uncertain, with geopolitical instability, trade wars, and extreme weather impacting client operations and market conditions.

- The US litigation environment is causing a surge in liability insurance costs, posing challenges for clients and potentially impacting future business growth.

- Declining P&C pricing and lower fiduciary interest income are creating headwinds for revenue growth in certain segments.

- The career segment experienced a 5% contraction due to reduced demand for project work in the US, reflecting economic uncertainty and client caution.

- Interest expense increased significantly due to higher levels of debt associated with the McGriff transaction, impacting overall financial performance.