Northland has begun covering ThredUP (TDUP, Financial) with an Outperform rating, setting a target price of $9. The digital resale platform is positioned at a significant turning point, according to the analysis. Key to this momentum is a sharpened focus on its core operations, which is resulting in faster growth. Despite a strong stock performance so far this year, the analyst suggests that there is room for further appreciation as confidence in this strategic inflection strengthens among investors.

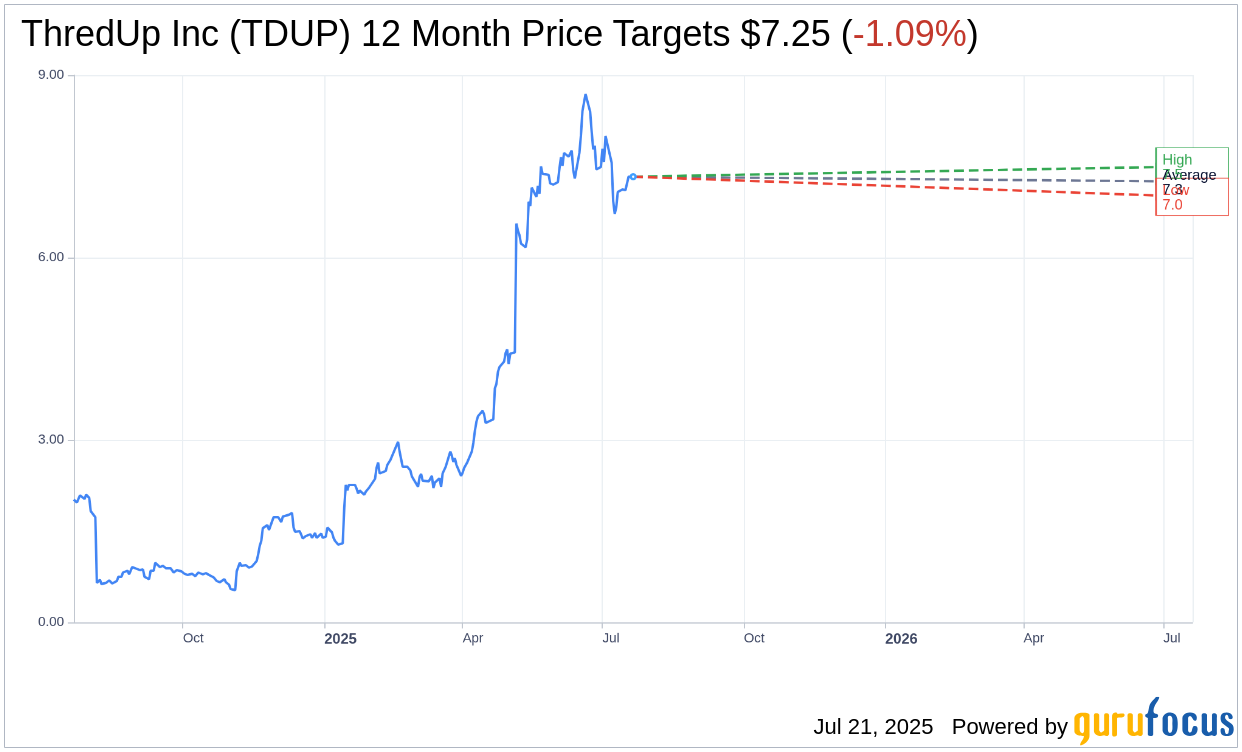

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for ThredUp Inc (TDUP, Financial) is $7.25 with a high estimate of $7.50 and a low estimate of $7.00. The average target implies an downside of 1.09% from the current price of $7.33. More detailed estimate data can be found on the ThredUp Inc (TDUP) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, ThredUp Inc's (TDUP, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ThredUp Inc (TDUP, Financial) in one year is $1.99, suggesting a downside of 72.85% from the current price of $7.33. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ThredUp Inc (TDUP) Summary page.

TDUP Key Business Developments

Release Date: May 05, 2025

- Revenue: $71.3 million, an increase of 10.5% year over year.

- Adjusted EBITDA: $3.8 million, or 5.3% of revenue.

- Gross Margin: 79.1%, a 100-basis-point decrease from the previous year.

- Active Buyers: 1.4 million, up 5.7% year over year.

- Orders: 1.4 million, up 16.1% year over year.

- Cash and Securities: Ended the quarter with $55.4 million, generating $2.6 million in cash.

- Free Cash Flow: $3.9 million for the quarter.

- New Buyers: Up 95% year over year.

- Q2 Revenue Guidance: $72.5 million to $74.5 million, representing 10% growth at the midpoint.

- Full Year 2025 Revenue Guidance: $281 million to $291 million, reflecting 10% growth at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ThredUp Inc (TDUP, Financial) achieved a 10.5% year-over-year revenue growth in Q1 2025, marking a significant acceleration in their US marketplace.

- The company reported a 95% increase in new buyers compared to Q1 2024, with April being the strongest month for new customer acquisition in its history.

- ThredUp Inc (TDUP) generated $2.6 million in cash and achieved an adjusted EBITDA of 5.3%, demonstrating strong financial performance.

- The company is leveraging AI-driven product experiences to enhance customer engagement, resulting in a 64% higher conversion rate for sessions using the updated 'shop similar' feature.

- ThredUp Inc (TDUP) is making substantial investments in the seller experience, with premium items contributing 60% higher margins than regular items.

Negative Points

- Gross margin decreased by 100 basis points to 79.1% due to higher incentives required for new buyer conversions.

- The company faces potential challenges from macroeconomic factors, such as tariffs and the closure of the de minimis loophole, which could impact pricing and competitiveness.

- Despite strong Q1 performance, ThredUp Inc (TDUP) remains cautious about the volatile and uncertain consumer environment for the remainder of 2025.

- The average revenue per order declined by about 5%, attributed to the mix of new buyers who typically have lower net revenue per order due to promotional offers.

- ThredUp Inc (TDUP) anticipates maintaining profitability expectations for the rest of the year, focusing on driving growth rather than immediate profit maximization.