- Franklin Resources' Q2 share buyback shows significant shifts among different funds.

- Analysts provide a one-year price target range for Franklin Resources with potential downside risks.

- Franklin Resources currently holds a "Hold" status among brokerage firms, with a notable GF Value downside.

Franklin Resources Inc, prominently known as Franklin Templeton, has recently disclosed its share buyback activity for the second quarter. Here's a closer look at the details for various trusts and funds:

Q2 Share Buyback Insights

Putnam Managed Municipal Income Trust reported repurchasing 280,433 shares. This figure marks a significant reduction from its first-quarter buyback, which saw 837,971 shares repurchased. In contrast, Putnam Municipal Opportunities Trust increased its buyback activity to 690,423 shares. Meanwhile, Templeton Emerging Markets Fund reduced its repurchase volume to 52,676 shares, a decline from 139,103 shares in Q1.

Wall Street Analysts' Forecast for Franklin Resources

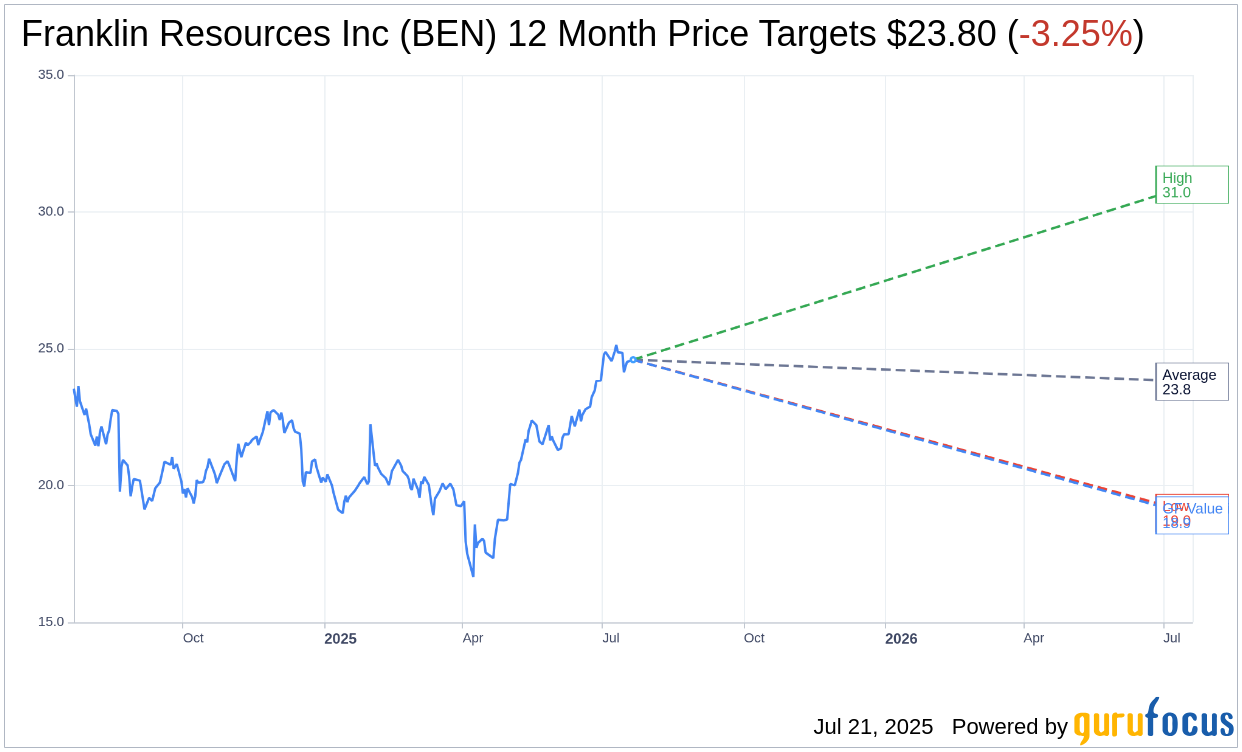

According to projections from 10 analysts, the average one-year price target for Franklin Resources Inc (BEN, Financial) stands at $23.80. The forecast spans a high estimate of $31.00 and a low estimate of $19.00. This average target price suggests a potential downside of 3.25% from the current trading price of $24.60. Investors can find more detailed estimates on the Franklin Resources Inc (BEN) Forecast page.

Brokerage Recommendations and GF Value Analysis

The average brokerage recommendation for Franklin Resources Inc (BEN, Financial), sourced from 12 firms, holds at 3.2, which indicates a "Hold" position. The brokerage rating scale ranges from 1, indicating a Strong Buy, to 5, denoting a Sell.

On another front, GuruFocus estimates suggest the GF Value for Franklin Resources Inc (BEN, Financial) for the coming year is $18.91. This represents a potential downside of 23.13% from the current price of $24.6. The GF Value is crafted based on historical trading multiples, past business growth, and anticipated future performance metrics. For an in-depth analysis, visit the Franklin Resources Inc (BEN) Summary page.