Ellington Financial Inc. (EFC, Financial) has announced an anticipated book value per share ranging from $13.47 to $13.51 for the second quarter of 2025. This projection underscores a positive trend in the company's financials, highlighting an expected rise in both net income and Adjusted Distributable Earnings for the quarter ended June 30, 2025, compared to the previous quarter ending March 31, 2025. This reflects an overall improvement in the company's earnings performance, aligning with its strategic financial objectives.

Wall Street Analysts Forecast

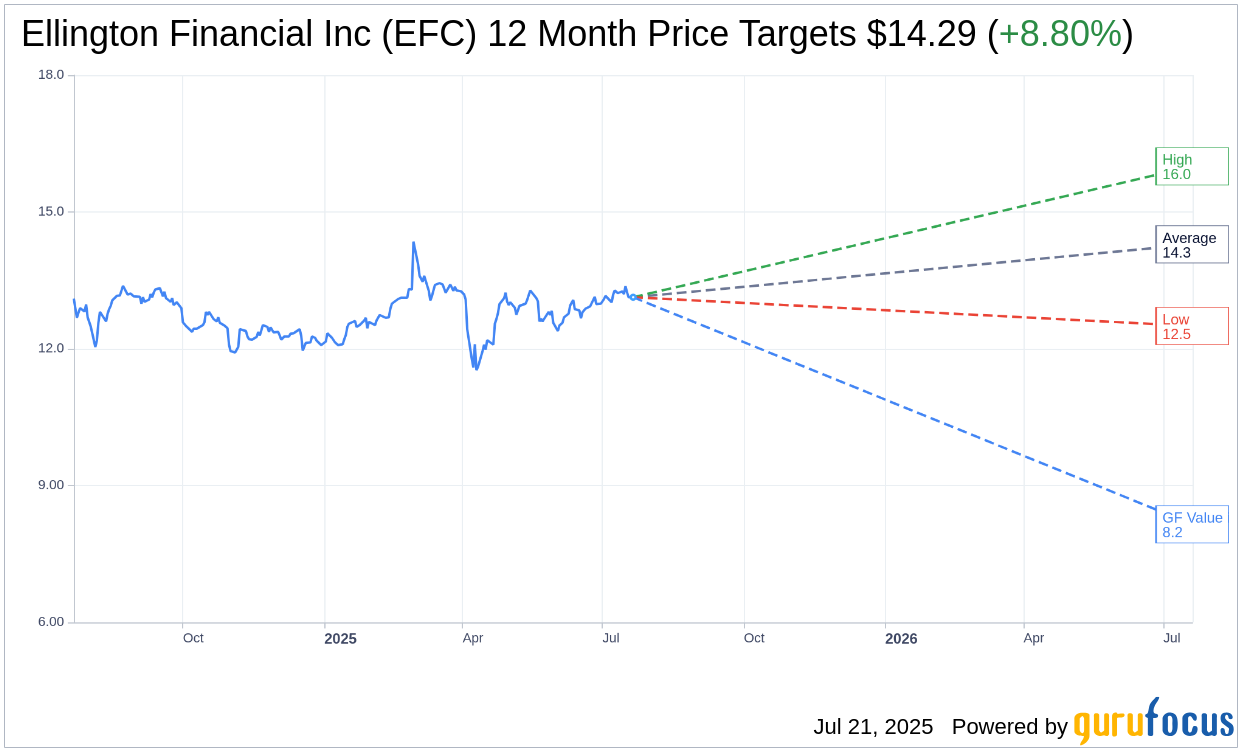

Based on the one-year price targets offered by 7 analysts, the average target price for Ellington Financial Inc (EFC, Financial) is $14.29 with a high estimate of $16.00 and a low estimate of $12.50. The average target implies an upside of 8.80% from the current price of $13.13. More detailed estimate data can be found on the Ellington Financial Inc (EFC) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Ellington Financial Inc's (EFC, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ellington Financial Inc (EFC, Financial) in one year is $8.15, suggesting a downside of 37.93% from the current price of $13.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ellington Financial Inc (EFC) Summary page.

EFC Key Business Developments

Release Date: May 08, 2025

- GAAP Net Income: $0.35 per share.

- Adjusted Distributable Earnings (ADE): $0.39 per share.

- Recourse Leverage: 1.7:1, down from 1.8:1 at year-end.

- Book Value per Common Share: $13.44.

- Total Economic Return: 9.5% annualized for the first quarter.

- Adjusted Long Credit Portfolio: Decreased by 4% to $3.3 billion.

- Total Long Agency RMBS Portfolio: Declined by 14% to $256 million.

- Longbridge Portfolio: Increased by 31% to $549 million.

- Weighted-Average Borrowing Rate on Recourse Borrowings: Decreased by 12 basis points to 6.09%.

- Cash and Unencumbered Assets: Increased to approximately $853 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ellington Financial Inc (EFC, Financial) reported GAAP net income of $0.35 per share and adjusted distributable earnings (ADE) of $0.39 per share, covering their dividends.

- The company successfully priced five new securitization deals in the first quarter, securing long-term, non mark-to-market financing at attractive terms.

- Ellington Financial Inc (EFC) added two more loan financing facilities during the first quarter, enhancing their liquidity and capital flexibility.

- The company's non-QM originator affiliates, including LendSure and American Heritage, continued to provide a strong flow of products and profitability.

- Ellington Financial Inc (EFC) made significant progress in resolving delinquent commercial mortgage loans, freeing up capital for redeployment.

Negative Points

- The Longbridge segment reported a slight net loss overall due to interest rate hedges, despite positive contributions from servicing and originations.

- Securitization debt spreads widened late in the quarter and surged in early April, causing Ellington Financial Inc (EFC) to refrain from pricing more securitizations until spreads recovered.

- The company's total long Agency RMBS portfolio declined by 14% to $256 million as they rotated capital into higher-yielding opportunities.

- Ellington Financial Inc (EFC) experienced net realized and unrealized losses on consumer loans, CLOs, non-QM loans, and residential transition loans.

- The company's recourse leverage remained low at 1.7:1, which could limit potential growth opportunities if not managed carefully.