CIBC has increased its price target for Thomson Reuters (TRI, Financial) from $174 to $201 while maintaining a Neutral stance on the stock. The firm appreciates the company's appealing revenue growth, especially when compared to industry peers. Thomson Reuters concluded the first quarter with a robust balance sheet, boasting a leverage ratio of 0.6-times. Additionally, the company stands to benefit from future mergers and acquisitions as well as its promising generative AI product initiatives. Despite these positives, CIBC remains cautious due to TRI's current valuation, which is trading near the upper range of its peer group.

Wall Street Analysts Forecast

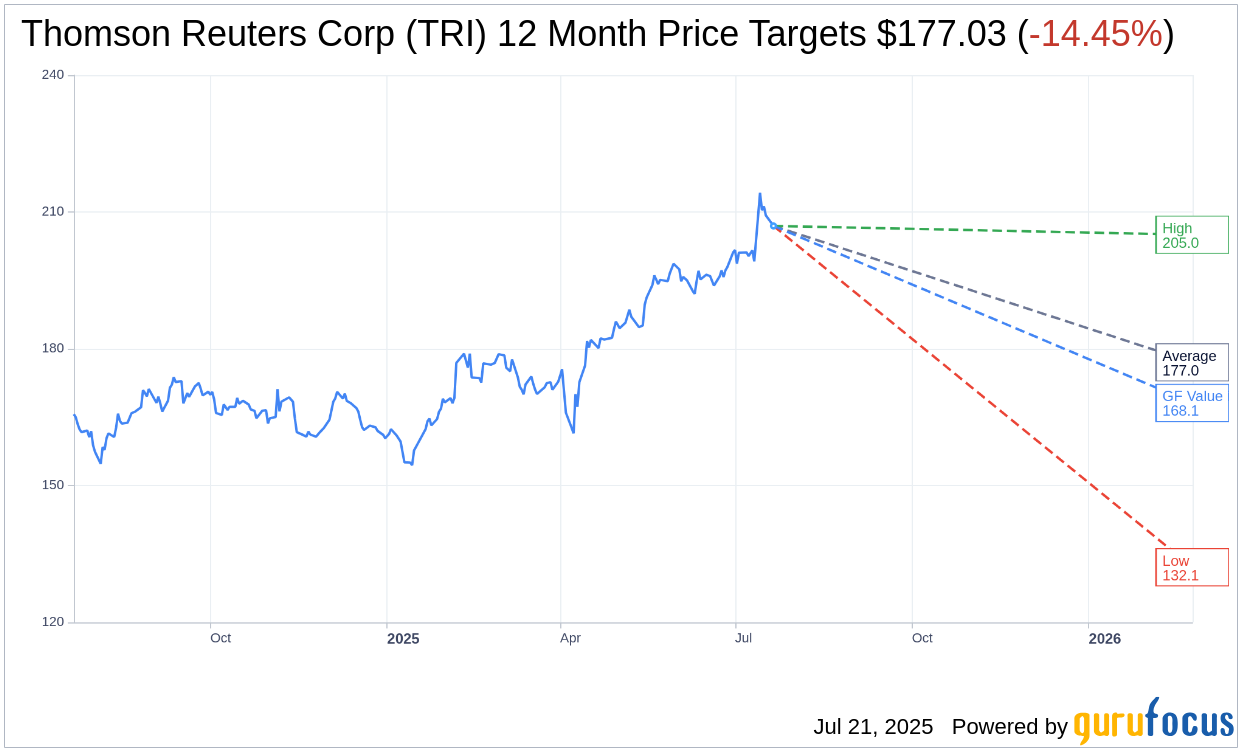

Based on the one-year price targets offered by 15 analysts, the average target price for Thomson Reuters Corp (TRI, Financial) is $177.03 with a high estimate of $205.00 and a low estimate of $132.08. The average target implies an downside of 14.45% from the current price of $206.94. More detailed estimate data can be found on the Thomson Reuters Corp (TRI) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Thomson Reuters Corp's (TRI, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Thomson Reuters Corp (TRI, Financial) in one year is $168.11, suggesting a downside of 18.76% from the current price of $206.935. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Thomson Reuters Corp (TRI) Summary page.

TRI Key Business Developments

Release Date: May 01, 2025

- Organic Revenue Growth: 6% overall, with the Big 3 segments growing by 9%.

- Adjusted EBITDA: $809 million, with a 40 basis point margin decline to 42.3%.

- Legal Professionals Organic Revenue Growth: 8%.

- Corporates Organic Revenue Growth: 9%.

- Tax & Accounting Organic Revenue Growth: 11%.

- Reuters News Organic Revenue Decline: 7%.

- Global Print Organic Revenue Decline: 5%.

- Adjusted EPS: $1.12, compared to $1.11 in the prior year period.

- Free Cash Flow: $277 million, up 3% from the prior year period.

- Dividend Increase: 10% to $2.38 per share.

- Acquisition: SafeSend for $600 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Thomson Reuters Corp (TRI, Financial) reported a strong start to 2025 with total company organic revenues rising 6%, and the Big 3 segments growing by 9%.

- The company reaffirmed its full-year 2025 outlook, expecting organic growth in the range of 7% to 7.5%, with margins projected to rise by 75 basis points to approximately 39%.

- Key products such as CoCounsel, SurePrep, and SafeSend showed double-digit growth, contributing to the company's positive performance.

- Thomson Reuters Corp (TRI) continues to invest heavily in innovation, launching new products like CoCounsel Tax, Audit and Accounting, and enhancing existing offerings with AI capabilities.

- The company completed the acquisition of SafeSend for $600 million, which is integrating smoothly and contributing positively to the business.

Negative Points

- Reuters News segment saw a 7% decline in organic revenues due to a difficult comparison with the previous year's AI-related transactional content licensing revenue.

- Global Print organic revenues declined by 5%, in line with expectations, reflecting ongoing challenges in this segment.

- Adjusted EBITDA was essentially unchanged year over year at $809 million, with a 40 basis point margin decline to 42.3%.

- The company faces potential challenges from economic uncertainties, including the impact of trade wars and tariff changes, which could affect customer spending patterns.

- Despite strong performance, there is a level of nervousness among customers regarding the economic backdrop for the rest of the year, which could impact future demand.