- Medtronic's MiniMed 780G system now has CE mark approval in Europe for an expanded age group.

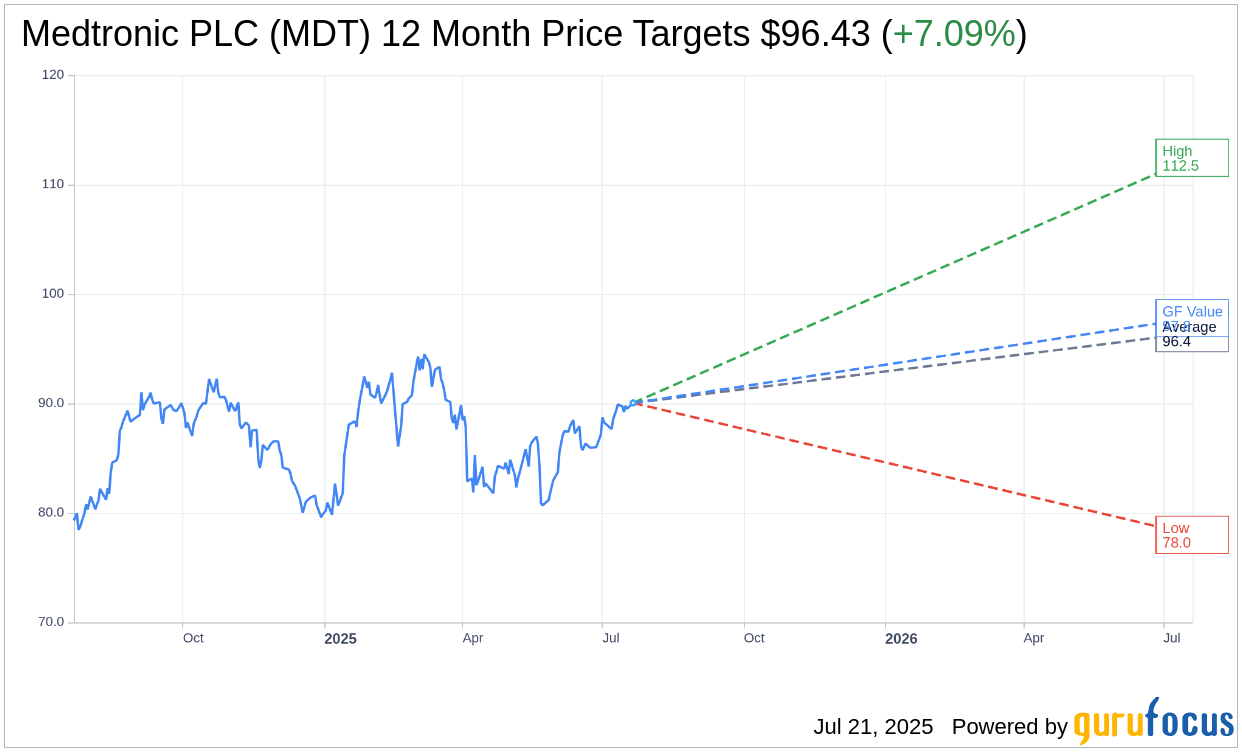

- Wall Street analysts forecast a potential upside of 7.09% for Medtronic PLC (MDT, Financial).

- GuruFocus estimates suggest an 8.61% upside from the current stock price.

Medtronic (MDT) is making significant strides in its diabetes care technology. The company has earned CE mark approval in Europe for its MiniMed 780G system, allowing broader access to this advanced insulin delivery technology. This approval is a pivotal expansion, making the system available to individuals aged 2 and up, including pregnant women and type 2 diabetes patients who require insulin. Consequently, young children with type 1 diabetes can now benefit from this sophisticated system.

Wall Street Analysts Forecast

Investors closely watching Medtronic PLC (MDT, Financial) will find insights from 27 analysts offering one-year price targets crucial. The average target price stands at $96.43, with the highest forecast at $112.45 and the lowest at $78.00. With these figures, Medtronic’s stock shows an implied upside potential of 7.09% from its current trading price of $90.05. For those seeking detailed forecast data, refer to the Medtronic PLC (MDT) Forecast page.

Additionally, a consensus recommendation from 35 brokerage firms places Medtronic PLC (MDT, Financial) in an "Outperform" category, with an average rating of 2.3 on a scale where 1 indicates a Strong Buy and 5 signifies a Sell.

From the perspective of GuruFocus estimates, the projected GF Value for Medtronic PLC (MDT, Financial) in one year is $97.80. This suggests a promising upside of 8.61% from the current price of $90.05. The GF Value represents the stock's fair trade value, calculated by examining historical trading multiples, business growth from the past, and future business performance projections. Further comprehensive data is available on the Medtronic PLC (MDT) Summary page.