- Block (XYZ, Financial) surges 8.9% as it joins the prestigious S&P 500 Index, offering potential growth opportunities for investors.

- Analysts forecast a significant price increase, with average targets suggesting a possible upside of over 28%.

- GuruFocus metrics indicate a favorable outlook, with Block positioned as "Outperform" by key brokerage firms.

Shares of Block (XYZ) soared by 8.9% in early trading following the announcement that the company will be included in the S&P 500 Index, replacing Hess (HES). Set to take effect on July 23, 2025, this notable change underscores Block's robust market positioning, bolstered by successful platforms like Cash App and Square.

Wall Street Analysts' Forecasts for Block

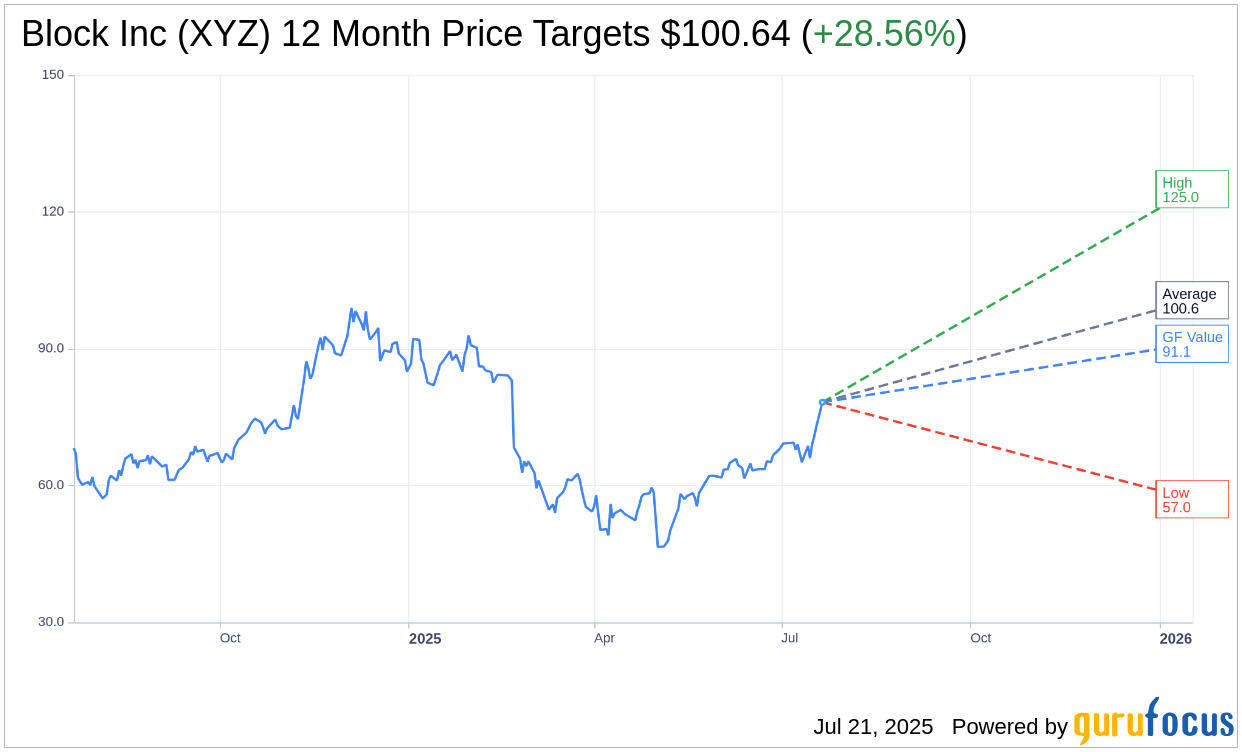

Based on insights from 40 analysts, the average one-year price target for Block Inc (XYZ) stands at $100.64, with projections ranging from a high of $125.00 to a low of $57.00. This average target hints at a potential upside of 28.56% from the current price of $78.28. Investors can access more detailed estimate data on the Block Inc (XYZ, Financial) Forecast page.

The consensus recommendation from 45 brokerage firms places Block Inc's (XYZ) average brokerage recommendation at 2.0, signaling an "Outperform" status. This rating scale spans from 1 (Strong Buy) to 5 (Sell), showcasing a favorable sentiment among analysts.

GuruFocus Valuation Estimates

According to GuruFocus estimates, the projected GF Value for Block Inc (XYZ) in one year is $91.10. This suggests a potential upside of 16.38% from the current price of $78.28. The GF Value reflects GuruFocus' assessment of the fair market value of the stock, derived from historical trading multiples, previous business growth, and future performance forecasts. For more comprehensive data, visit the Block Inc (XYZ, Financial) Summary page.